Project Finance Modeling and its Use Cases

Project Finance Modeling and its Use Cases

Understanding Project Finance Modeling and its Use Cases

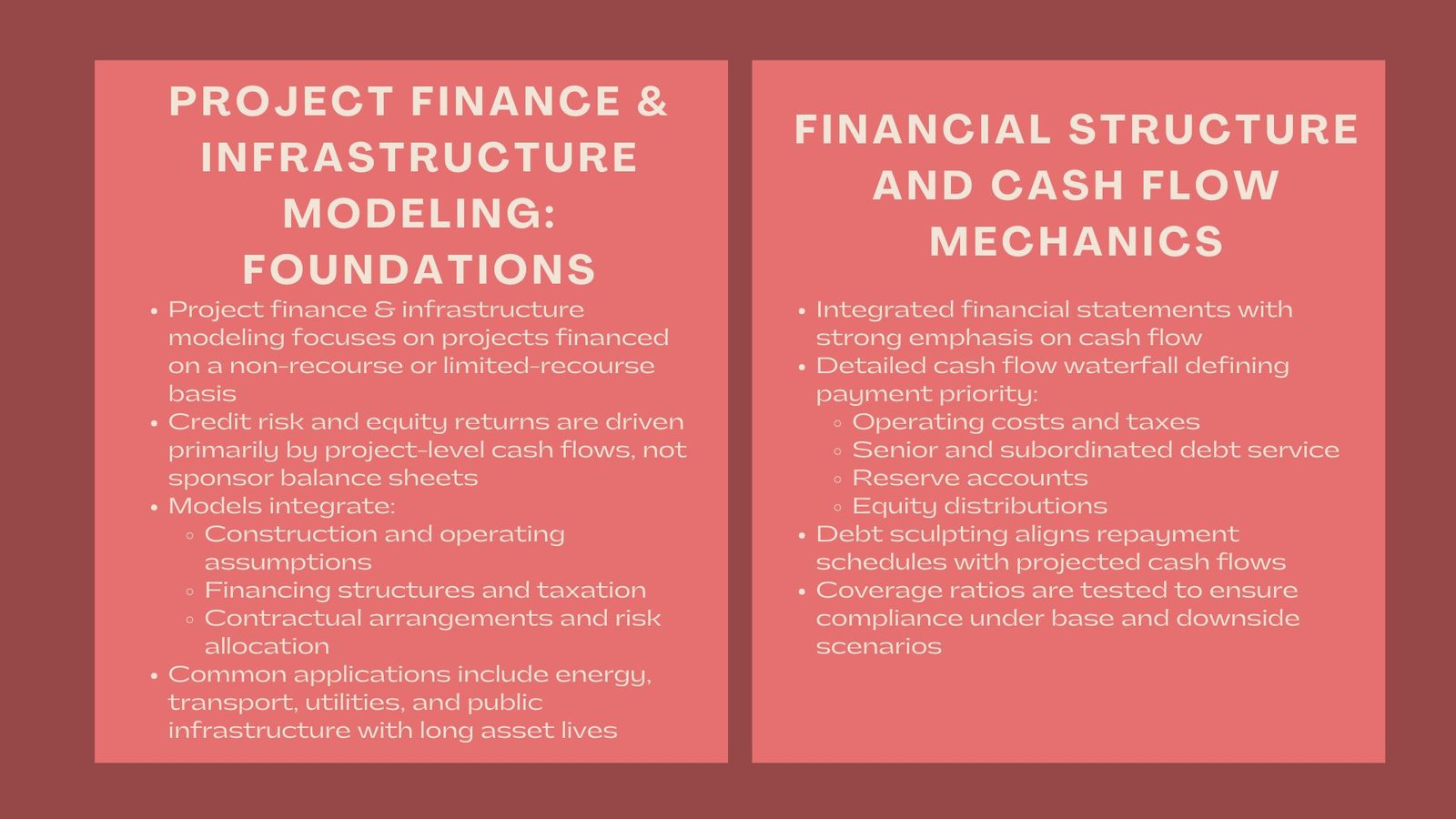

Project finance is the most important source of finance to finance large infrastructure, energy and industrial projects. Project finance also differs with Corporate finances where a balance sheet strength would be used to judge in regard to funding whereas project finances revolve around impact on viability of that project and the cash flows involved in the projects. Under it, a structure is developed where the revenues obtained in the project are utilized by extinguishing the debt and returning money to investors.

In this framework, project finance modeling comes out as a very important tool that can be used in determining the viability of such projects, risks, as well as the anticipated returns. Keeping in mind the financial and technical issues of a project is definitely the understanding that would enable the modeling of project finance since it is a rare skill to have in the financial world.

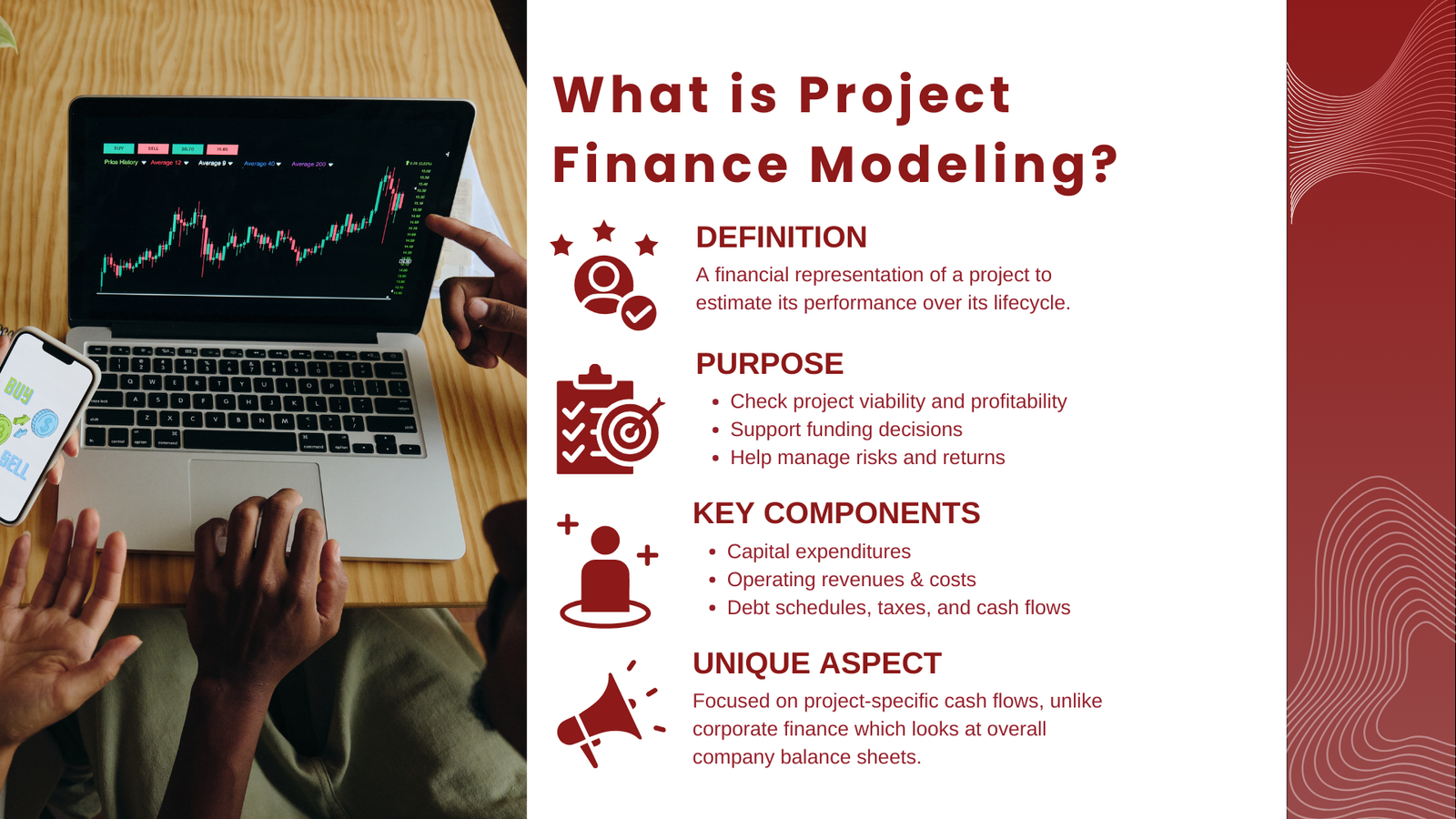

At its simplest definition, project finance modeling is the means of producing a financial representation of a project (which is usually done by use of a spreadsheet editor like excel) to estimate the predicted financial performance of a project over its life cycle. This model factors in the capital expenditure, operating revenues and costs, the schedule of paying debts, taxes, and other expenses which influences cash flows.

The objective is to establish whether the project is economically viable or otherwise and in case it is, what will be the terms and conditions. They entail planning a logical and transparent framework which the stakeholders could employ to experiment different situations, evaluate risks and make the right decisions when it comes to making investments.

Defining Project Finance Modeling

Project finance model Project finance model can be defined as a prospective analysis instrument that combines the presumptions regarding the ventures operation, financing forms, and the market environment to create forecasts of revenue, expenses, and cash flows. In essence, it will facilitate the answer of a basic question: whether the project will have sufficient cash flow to cover its debt and deliver the anticipated level of return on equity. To respond to this, the model addresses all the technical, contractual and financial aspects of the project.

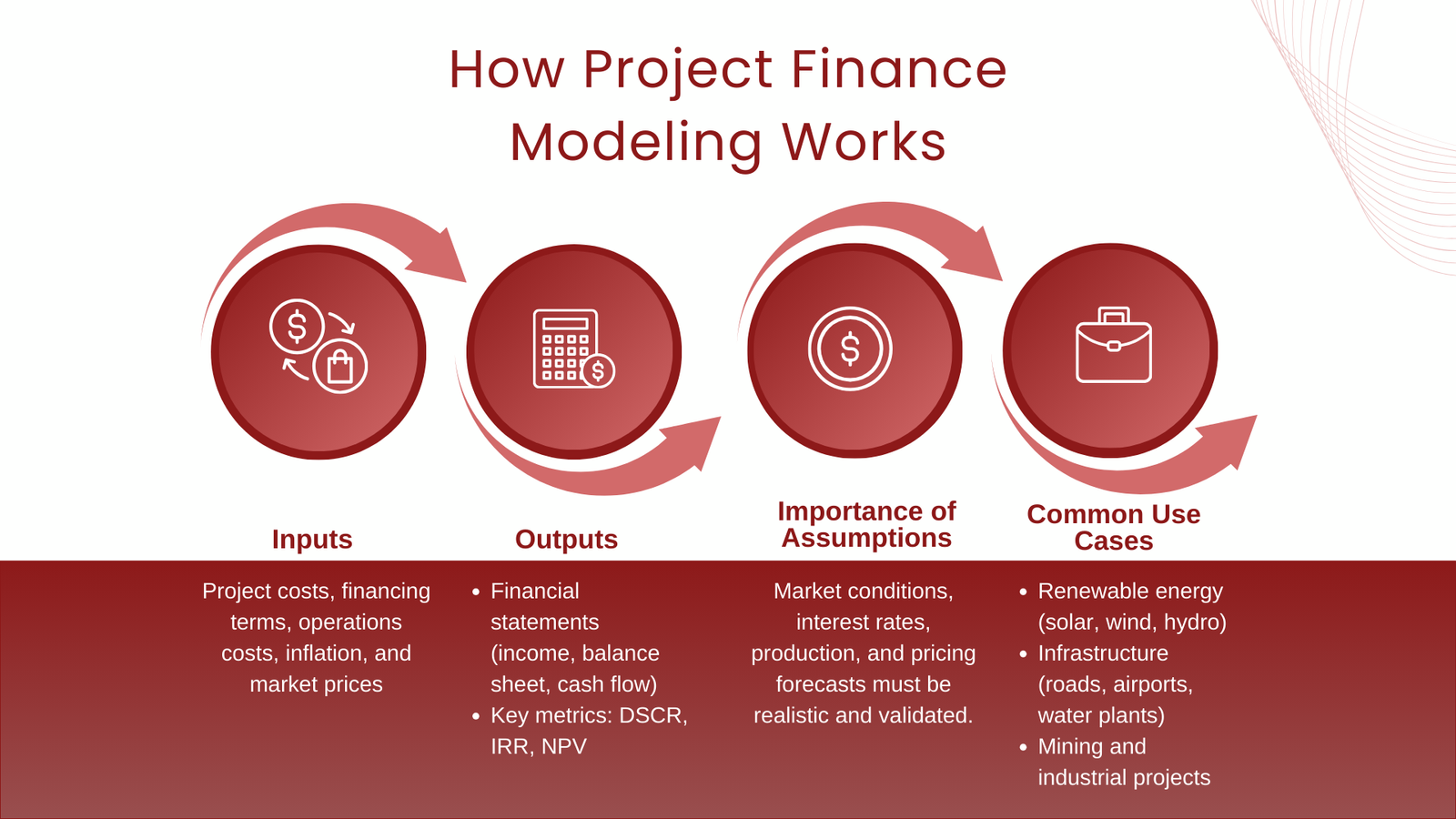

A model of project finance does tend to have a logical format. It starts with well-defined inputs like the cost of building the project, the financing terms, the cost of operating the project, and inflation rates as well as the price of goods or services produced by the project in the market. It then uses a set of calculations to process all these inputs which represent the operating and financial dynamics of a project.

The result is a series of financial statements, a set of at least an income statement, balance sheet and cash flow statement to be able to evaluate critical metrics like debt service coverage ratio (DSCR), internal rate of return (IRR) and net present value (NPV). Lenders, investors and project sponsors base their actions on these produced outputs.

How Project Finance Modeling Differs from Corporate Finance Modeling

Whereas the approach to corporate finance and project finance modeling tries to predict a financial position, their direction is different and is quite substantial. Models of corporate finance are anchored on the financial soundness of an entire company. They have several sources of revenues, functional departments, and a generic debt, and equity pool of corporate financing. In contrast, project finance models are autonomous. They only concentrate on the revenues and costs of one project and presuppose that the financing is specialized on that project.

This difference implies that the finance models of the projects can typically contain very detailed schedules of operation, including schedule of construction, production projection and obligation to make payment under contract. Finance is normally non-recourse or limited recourse, that is, lenders may only enforce the assets and cash flows of the project when the project performs below par-not the corporation-wide balance sheet. In this structure, much value is put in the accuracy and reliability of the project finance model since it is the main source upon which financing decision is based.

The Role of Assumptions in Project Finance Modeling

There are assumptions which lie at the core of any calculations of a project finance model. Assumptions can be as much as the price of raw materials and workforce to an estimated production of a power plant or toll road, amongst others. The financial assumptions could include interest rates, loan tenors, equity contributions and tax rates. Market connections might include the expectations of the demand, pricing systems, and inflationary expectations.

These assumptions will make the outputs of the model reliable depending on their quality. Too bullish revenue estimate or inadequate estimation of operating cost may cause erroneous assumptions concerning the viability of a project. This is the reason why a good experience project financier would invest as much time confirming assumptions as he will in the actual development of the model. They can discuss with engineers, market analysts and legal counselors in order to make the assumptions realistic and grounded on reliable data.

The Importance of Transparency and Structure

An effective project finance model does not only give the right answer; it is also transparent. Transparency has the meaning that any user be it an investor, a lender, or an analyst, be able to what is a figure back to the source assumption or calculation. Such clarity is realised by means of a well-organised design, clear labeling, and logical sequence of calculations. This translates to logistically isolating inputs, calculations and outputs into separate parts, with similar formatting and not having excessively complicated or obfuscated formulas.

The flexibility should also be facilitated by the structure of a model. Transactions in project finance are done at the negotiation table of various stakeholders who might like to explore various scenarios. A decent model is flexible to changes in assumptions and does not necessitate the model to be rebuilt. This ability is of specific interest in sensitivity analysis, where a variation of one or more assumptions is ran through to determine the effect on important financial measures.

Use Cases of Project Finance Modeling

Project finance modeling is practiced across the lifecycle of a project including pre-investment feasibility studies and during the project performance monitoring procedures. During the preliminary phase, the model will be involved in determining the viability of the project idea on a financial basis. This will include estimating cost of construction, profits of the operation and structure of co-financing so that one can ascertain whether the anticipated returns outweighs the investments.

The model is a key element in a number of negotiations during the financing stage between the project sponsors and its possible lenders or investors. The model will be reviewed to determine that the project can service its debt on the basis of realistic assumptions by the lenders. Depending on the outputs of the model, they might ask to carry out adjustments in the financing structure e.g. by increasing the loan tenors or by increasing the reserve accounts.

The model is used as the monitoring tool once the project is up and running. It is also possible to compare actual performance data with those projected in the model to determine the variances and analyze whether correcting measures are necessary. During other instances, the model can be revised in the event that the market conditions or operational performance change, and the stakeholders will always have a current picture of the financial standing of the project.

Real-World Applications

In the energy industry, renewable energy projects (wind farms, solar power plants and hydroelectric facilities) are one of the most common projects that utilize project finance modeling. These are projects that are normally characterized by a high initial capital investment requirement and long operating periods thus requiring proper financial projections. The model is useful in deciding the tariff rates necessary to target a certain rate of return, the most effective debt to equity ratio, and the effect of various capacity aspects affecting cash flows.

The other significant extension is in the development of infrastructure, i.e., toll roads, water treatment plants and airports. In such instances, the model should incorporate elements, such as volume forecasts, traffic composition of traffic, regulatory frameworks and maintenance cost over decades. Outputs of the model inform the decision-making regarding the concession agreements, the financing type, and risk distribution between the stakeholders which are in the public and the private sector.

Project finance modelling applies in the mining industry, where it is used to analyze the chances of developing new mines or extending the capacity of the existing ones. These models include the price forecast and the cost of extraction and also the environmental compliance costs. Considering that the market prices of commodities are highly volatile, sensitivity and scenario analysis are very important in determining how profitable a mining project can be in the face of various market conditions.

Risk Analysis in Project Finance Modeling

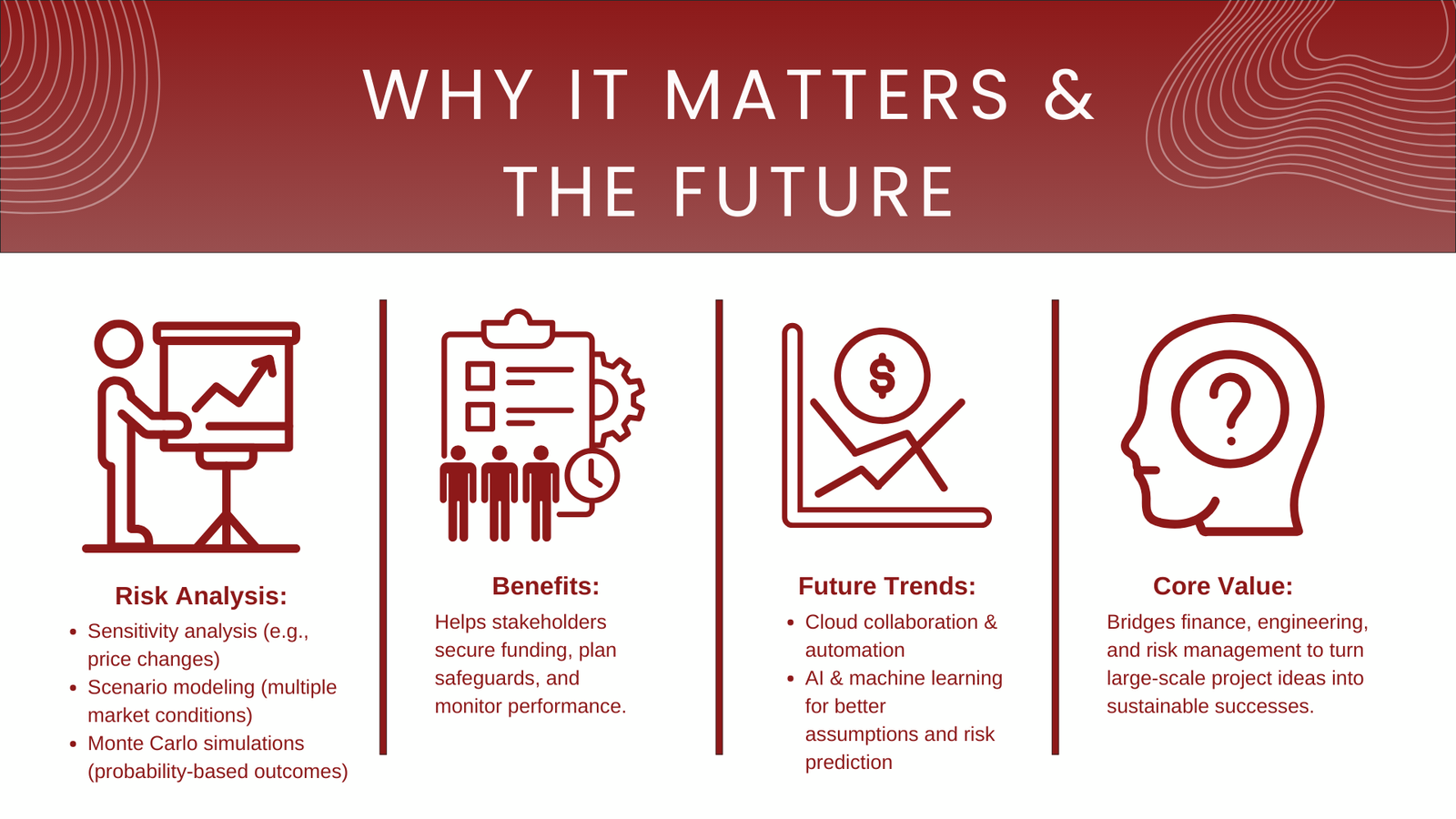

Project finance models entail risk analysis. Since several projects financed through project finance may require substantial capital investment and may have lengthy commitments, key stakeholders must appreciate the risks that may affect the project cash flows. Such risks may entail construction delays, overruns, shifts in demand in the market, shifts in input prices and changes in regulation.

Another form of risk analysis widely employed is sensitivity analysis, which involves varying one of the assumptions in an analysis, say, price of electricity in a power project, to determine its impact on such financial indicators as DSCR and IRR. Scenario analysis goes a step further and leaves the process of continuing with more than one assumption at a changed level in order to model various market or operational situations. A more complex Monte Carlo simulation modeling uses statistics to produce a probability distribution of outcomes based on the variance in multiple inputs.

The use of risk analysis as a part of the project finance model helps the stakeholders to define the most significant risk factors and plan the way to eliminate them. This may take the form of contractual safeguards, including set price building contracts or long-run buy-offs and financial measures such as hedges or keeping reserve accounts balance.For professionals, project finance modeling training for better risk management provides the essential skills to evaluate these risks effectively and apply the right strategies.

The Future of Project Finance Modeling

Technology developments are defining how in future the project finance modeling will take shape. Cloud-based services and collaborative tools are also enabling teams dispersed in various locations to co-work on the same model at the same time. Some aspects of the modeling process are being automated through development of specialized software to link operational data to financial projections or to undertake a large-scale scenario analysis.

Machine learning and artificial intelligence have the potential to enhance the aptness of project finance operations too. The technologies may be applied by analyzing large datasets of the previous projects, refining assumptions, and interpreting patterns that human analysts may overlook. Nevertheless, good principles of modeling, clarity, transparency, and sanity of assumptions, are not changed by technology; to the contrary, they might be increased by technology.

These innovations are becoming especially relevant for professionals focused on Mastering project finance modelling in Asia, where rapid economic growth and infrastructure development demand advanced, tech-driven financial modeling approaches.

Conclusion

A project finance modeling is a mixture of finance, engineering and risk management in a special field. It offers an organized system to assess the financial feasibility of huge size projects, procure funding and track performance in the long run. With the comprehensive set of assumptions, open calculations and strict analysis of risks, the models of project finance provide the stakeholders with the assurance that they can allocate large amounts of resources to a long-term project.

Project finance modeling is as diverse as the projects on which it is applied: renewable energy plants to sizable infrastructure projects and mining operations. With increasing worldwide demand in infrastructure and sustainable energy will also come the supporting value of accurate and reliable project finance modeling. The technical aspect of financial modeling is not the only step towards mastering this skill, but it also needs to possess a thorough study of the industries and markets where such projects will be involved. To those working in the field of finance, it is still one of the most powerful resources to transform ambitious ideas about the project into successful and generating resources.