How Financial Due Diligence Validates Cashflow Assumptions

How Financial Due Diligence Validates Cashflow Assumptions

Introduction to Financial Due Diligence

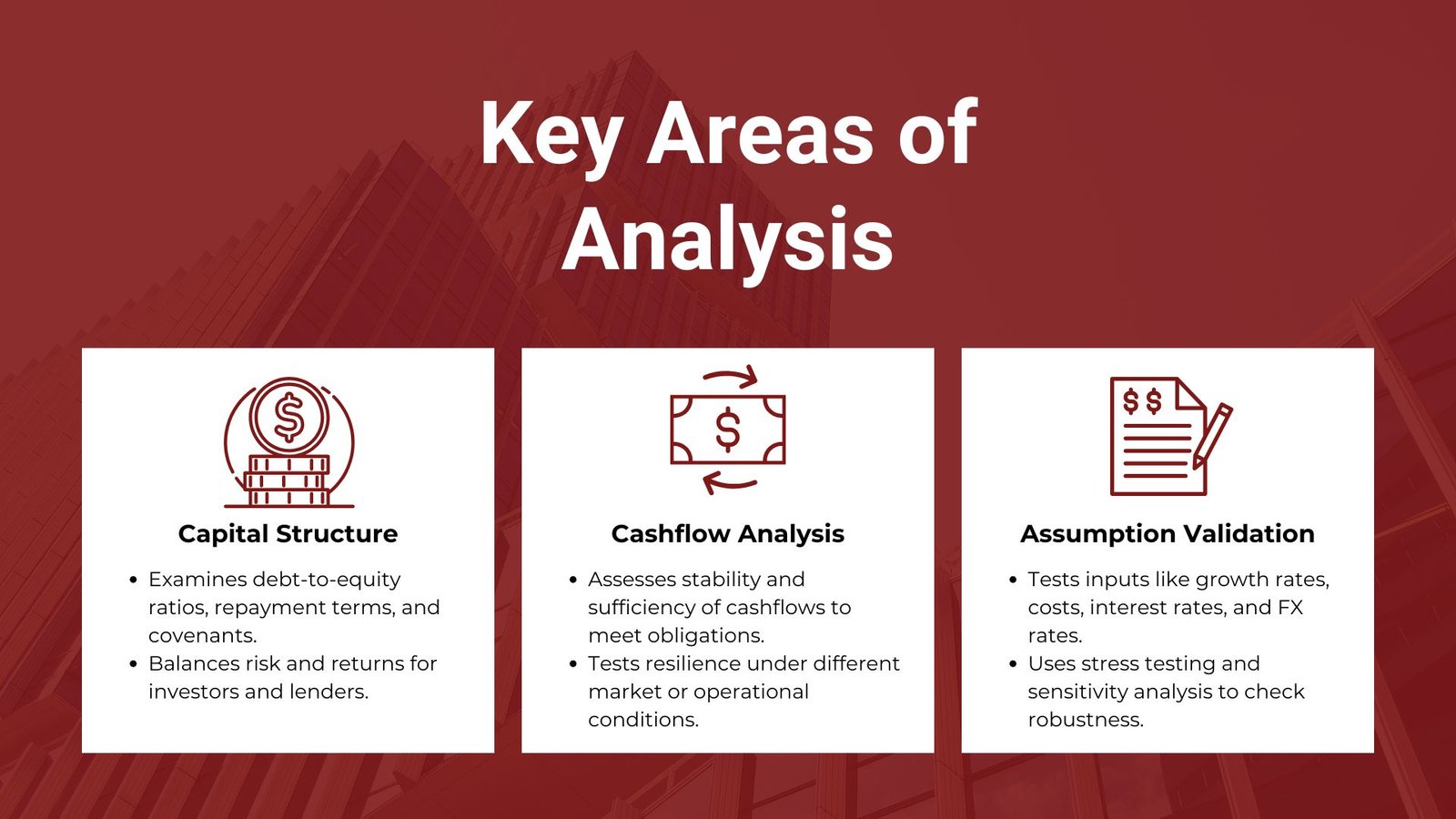

One of the most important aspects of investment decisions, mergers and acquisition and project financing is financial due diligence. It generates an organized assessment of the financial robustness of a business or project and its capacity to produce sustainable profits to the investors, lenders and stakeholders. Through its analysis of important factors like capital structure, stability in the cashflow and assumptions used in financial models, due diligence prepares investment decisions to be as clear as possible, and with less risk exposure. Six due diligence areas in mergers and acquisitions are often referenced in relation to these assessments, with financial due diligence standing as one of the most critical components.

Practically, financial due diligence is much more than going over balance sheets and profit statements. It digs on the way a company is funded, what the business does in terms of generating cash flows and what can be believed about the financial projections made. When the viability of the project itself forms the key security on repayment (i.e. project finance), due diligence is even more imperative. Neglected flaws of the financial modelling might lead to unforeseen losses, late repayments or permanent financial sustainability.

This article discusses three key items of financial due diligence: capital structure, cashflow analysis and assumptions underlying financial forecasts. Both of them have different functions when determining the viability and sustainability of investments.

Understanding Capital Structure in Financial Due Diligence

Business/Projects capital structure represents the balance of capital source to finance the business/projects worldwide. Thinking about this structure is a capital step towards financial due diligence since it shows both the exposure to risk and financial workout.

A firm that is highly geared on debt financing can afford to pay higher returns to its equity holders yet it is financially risky especially when there are fluctuations in the cashflows. In contrast, a firm that enjoys greater equity funding might be steady in performance but it might water down the shareholders. The decision on capital structure is even more important in project finance where credit providers test the capability of the revenues associated with the project to service the debt without the need of any external funds.

Some of the major areas of capital structure covered in the due diligence are, the debt-to-equity ratios, repayment terms, the interest cover-up ratios, and covenants on loan agreements. Investors and lenders are interested in finding balanced structures that guarantee the project to survive stress situations and at the same time pay sufficient returns. An example would be the fact that a renewable energy project with long-term power purchase agreements might be able to support a higher level of debt, but infrastructure projects with changing demand needs OR may necessitate a more reserved combination of finance.

Finally, the capital structure evaluation gives an idea about the strength of a company or a project in terms of the pressure it faces during the financial crunch. In the absence of this clarity the stakeholders will run the risk of over investing in ventures that are not able to support its own funding mechanism.

Cashflow Analysis: The Core of Financial Due Diligence

Business/Projects capital structure represents the balance of capital source to finance the business/projects worldwide. Thinking about this structure is a capital step towards financial due diligence since it shows both the exposure to risk and financial workout, similar to insights gained from a Cash flow and working capital management course Singapore.

A firm that is highly geared on debt financing can afford to pay higher returns to its equity holders yet it is financially risky especially when there are fluctuations in the cashflows. In contrast, a firm that enjoys greater equity funding might be steady in performance but it might water down the shareholders. The decision on capital structure is even more important in project finance where credit providers test the capability of the revenues associated with the project to service the debt without the need of any external funds.

Some of the major areas of capital structure covered in the due diligence are, the debt-to-equity ratios, repayment terms, the interest cover-up ratios, and covenants on loan agreements. Investors and lenders are interested in finding balanced structures that guarantee the project to survive stress situations and at the same time pay sufficient returns. An example would be the fact that a renewable energy project with long-term power purchase agreements might be able to support a higher level of debt, but infrastructure projects with changing demand needs OR may necessitate a more reserved combination of finance.

Finally, the capital structure evaluation gives an idea about the strength of a company or a project in terms of the pressure it faces during the financial crunch. In the absence of this clarity the stakeholders will run the risk of over investing in ventures that are not able to support its own funding mechanism.

The Role of Assumptions in Financial Models

Models of finances are assumed and the assumptions dictate the precision and soundness of any projections. In due diligence, it is almost as significant to test the validity of assumptions as it is to review the numbers themselves.

Some of the usual assumptions are revenue growth rates, forecasts of prices, cost escalation agents, interest rates, foreign exchange rates, and macro-economic indicators. Assumptions are also made in project finance in operational performance levels like capacity, down time, maintenance cost and regulatory provisions to comply.

Too-optimistic assumptions are one of the most typical financial modeling pitfalls. It can include unrealistic revenue growth projections that are not taking into consideration competition costs; it can also include underestimating the costs of operations by omitting contingency plans. These blind moves could result in financial models that portray an overstated image of viability that is of no use in misinforming prospective investors.

Due diligence is a stress-testing of hypotheses in several scenarios. Analysts can do downside scenarios by reducing revenues, inflating costs or elevating interest rates in order to understand how strong the financial structure is. Another tool is sensitivity analysis, where since you may change your assumptions by a small amount it can drastically change your cashflow forecasting or project valuation.

Finally, the check of assumptions leads to the fact that the forecasts are both mathematically correct and based on market realities. It does not allow the decision-makers to use models that indeed look well on paper, yet fail to establish a relationship between the models and the operating environments.

Integrating Capital Structure, Cashflows, and Assumptions in Decision-Making

Although capital structure and cashflow analysis are part of financial due diligence as well as assumptions, the combination of the details yields the strongest information. An advantageous capital structure may not remain strong when there is a weak projection of cashflow. And likewise, strong cashflows cannot withstand impracticalities.

Practically, the relationship of these factors is measured by evaluating the interaction between the investors and the lenders. As an example, an infrastructure project in which cashflows have stable long term revenues where the leverage would be acceptable provided that costs are assumed realistically and the debt coverage is proved to be consistent. On the other hand, the same project might be associated with unpredictable demand that would necessitate higher equity backing to create a cushion to fluctuations in spite of its seemingly conservative assumptions.

The due diligence also takes into consideration the alignment of the stakeholders. The sponsor/lenders and regulators should jointly agree on acceptable risk in the capital structure and cashflow projections. Lack of alignment usually causes conflicts or renegotiations in the implementation of projects.

Through these elements, the financial due diligence creates an overview of the whole picture of financial sustainability. It allows stakeholders to make better decisions on whether or not to continue with an investment, refinance a loan or negotiate better terms.

Conclusion: The Value of Rigorous Financial Due Diligence

Financial due diligence is not a formality that only has to be checked. It is a security against wrong investment choices and a value-creating instrument. Through evaluating capital structure, reviewing cashflows, and testing assumptions, the stakeholders can distinguish between overstated projected and realistic opportunities.

Where the commitments made in project finance and corporate transactions may be over decades there can be a cost of failing to recognise the weak aspects of the due diligence which can be astronomical. Tough analysis will enable risks to be detected and mitigated and to be priced prior to putting capital to work.

With the financial environment becoming ever more complex, due diligence has to become increasingly sophisticated to reflect more advanced modeling, scenario testing and risk assessment. Nevertheless, there is no difference in its essence because it is also aimed at introducing transparency, lessening uncertainty, and making good financial judgment.

The determination of disciplined capital structure, the rational application of cashflows and assumptions and rigid adherence to financial due diligence have been critical pillars to long-term investment and financial success. An effective capital structure also enables organizations to achieve equilibrium between debt and equity and reduce risks whilst maximizing returns. When constructed on credible assumptions, cashflow analysis is the blood of financial planning, providing information on liquidity, solvency, and feasibility of a project or investment.

The aforementioned aspects are bound with financial due diligence that helps to determine the correctness of assumptions, the sensitivity of cashflows under various conditions, and the sustainability of capital structures in both positive and negative market situations. The combination of these practices can protect investor confidence and also help businesses to make sound, strategic decisions that are resistant to uncertainty and which can drive growth.