Key Financial Ratios and Performance Metrics in Project Finance Modeling

Key Financial Ratios and Performance Metrics in Project Finance Modeling

In project finance, decisions that are worth hundreds of millions of dollars are based on a few indicators of performance. Financial ratios and metrics are used to assess the feasibility, sustainability, and creditworthiness of a project. A well built project finance model must therefore go beyond forecasting revenues and expenses – it must provide a good picture of how efficiently and securely a project can generate, manage and distribute cash.

Financial ratios and metrics evaluate performance as they serve as the pulse to a project finance model. They represent the financial health of the project in measurable terms and take the complicated cash flows and convert those into something that is actionable. These ratios do not only tell us whether a project is able to meet its debt obligations, but whether key financial ratios and performance metrics used in project finance models Singapore such a project is able to provide attractive returns to the investors under different market conditions.

This article delves into some of the main ones that are used in the modeling of project finance and how they can be interpreted, as well as how they can drive decision-making among various stakeholders – from the lender with respect to their ability to afford debt service, to the equity investors looking for long-term value creation.

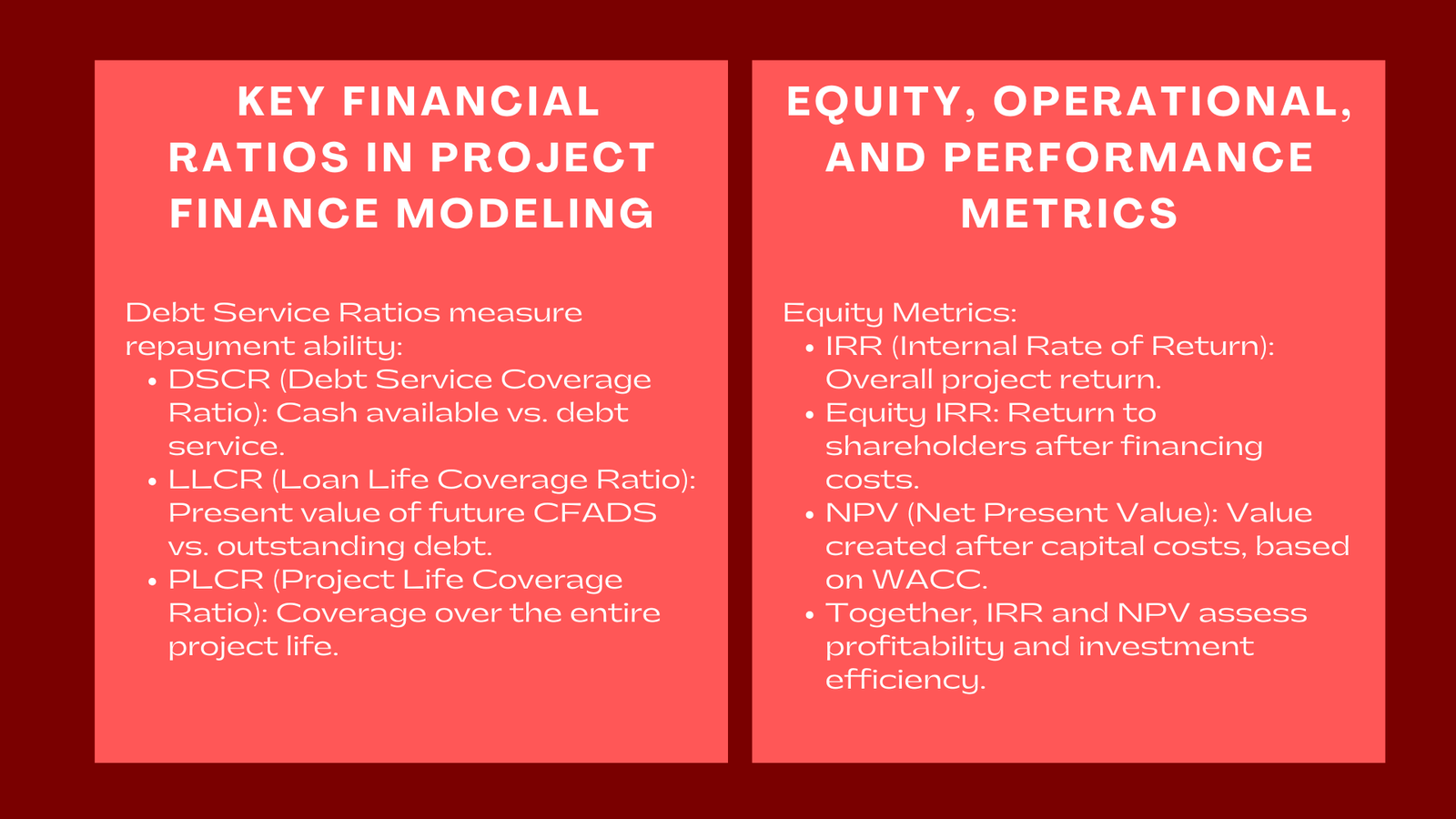

Debt Service Ratios: Measuring Repayment Capacity

The most commonly used ratios in the project finance concern debt servicing. The Debt Service Coverage Ratio (DSCR) is a measure used to check the capacity of a project to meet its debt obligations using the cash available. This is calculated as the ratio of cash flow available for debt service (also known as CFADS) and total debt service (which includes interest and principal repayments). A DSCR more than 1.0 means the project has sufficient cash to pay its debt, how to analyze DSCR, LLCR, IRR, and ROE in project finance modeling; however, lenders usually insist on higher ratios – commonly 1.2 to 1.4 – to account for a cushion against uncertainties.

The Loan Life Coverage Ratio (LLCR) takes this analysis one step further, where obviously the remaining life of the loan is longer, so we must also discount future CFADS to present value and equate it to outstanding debt. LLCR is especially useful in determining long term sustainability concerns because it incorporates both future revenue potential as well as time value of money. Similarly, Project Life Coverage Ratio (PLCR) is an index of coverage not only over the loan period but over the entire operative life of the project.

These ratios are the foundation of lender faith. These indicate the resilience of a project to short term downturns, and are the basis for covenant provisions in financing transactions. A dropping DSCR or LLCR trend over time often indicates risks that need to be restructured or additional measures taken to mitigate the risks.

Equity Metrics: Assessing Investor Returns

While lenders are concerned with the debt repayment capacity, equity investors are mainly concerned with profitability as well as efficiency of returns. The most common of which are Internal Rate of Return (IRR), Net Present Value (NPV) and Equity IRR (to isolate the returns to shareholders, but after financing costs).

The project IRR is the rate of return calculated on the overall project investment (the project is the sum of the debt and equity investments). On the other hand the equity IRR considers the rate of return only from the equity holders and considers the effects of leverage. This is a crucial distinction because high leverage increases the equity returns – and increases financial risk.

NPV complement IRR in that it indicates the value generated by the project (after discounting future cash flows at some sort of discount rate which is often the weighted average cost of capital (WACC). A positive NPV means that the project can generate the value aside from the capital cost involved, while a negative value means that the project may be unprofitable.

However, when used together, IRR and NPV give a complete picture of profitability and financial efficiency. Often, these numbers may be compared to industry standards or other investment alternatives prior to the capital allocation decision being made.

Operational and Cash Flow Metrics

Operation performance: Operation performance parameters are set up to ensure the cash generation of the project after the project gets into operation. Common examples are cash flow available for distribution (CFAD), operating margin and free cash flow to firm (FCFF). These ratios are used in estimating dividend capacity and evaluating if business is stable enough to repay debts and provide returns on equity.

Ratios like Operating Margin, or EBITDA Margin, show how well the project turns revenue to profit while Return on Assets (ROA), and Return on Equity (ROE) represent how efficiently the project is using capital. These metrics are usually tracked after financial close to ensure expectations based on the models are the actual operating performances. Developing advanced project finance modelling skills Singapore enables professionals to analyze these ratios more accurately and align real results with projected outcomes.

By tracking financial ratio over time, problems such as cost overruns or decreasing efficiency can be addressed as early as possible. When used together, those are a powerful set of indicators that give us a complete view of the health of a project – and close the disconnect between financial forecasts and reality.

Conclusion

The language of confidence of project finance is financial ratios. They measure the ability of the project to endure risk, pay debt and return to the investors. Understanding and reading them correctly and properly helps a financial model to transition from being a spreadsheet to being a strategic tool.

By Mastering these Metrics from DSCR & LLCR to IRR & ROE, financial pros can clearly communicate performance to their stakeholders, and craft decisions to affect their long-term success. In the complex universe of project financing, ratios aren’t mere figures which are more to the compass to steer investment offerings, risk administration, and to create value.

They measure the ability of the project to endure risk, pay debt, and return value to investors. For lenders, these ratios provide assurance that debt obligations can be serviced on time, even under stress scenarios. For equity investors, they indicate whether the project’s profitability and cash flow generation are sufficient to justify the capital at risk. A project that demonstrates strong ratio performance not only instills confidence but also attracts competitive financing terms, reinforcing a cycle of credibility and investment trust.

Understanding and reading them correctly and properly helps a financial model transition from being a static spreadsheet to becoming a dynamic strategic tool. When analysts can interpret key metrics with depth and context, they transform raw data into actionable insights. This allows management to anticipate potential financial bottlenecks, optimize funding structures, and communicate value propositions effectively to stakeholders. A well-structured financial model backed by insightful ratio analysis becomes a decision-making instrument that guides policy, negotiation, and execution throughout the project’s life.