Modeling Construction and Operational Phases in Project Finance

Modeling Construction and Operational Phases in Project Finance

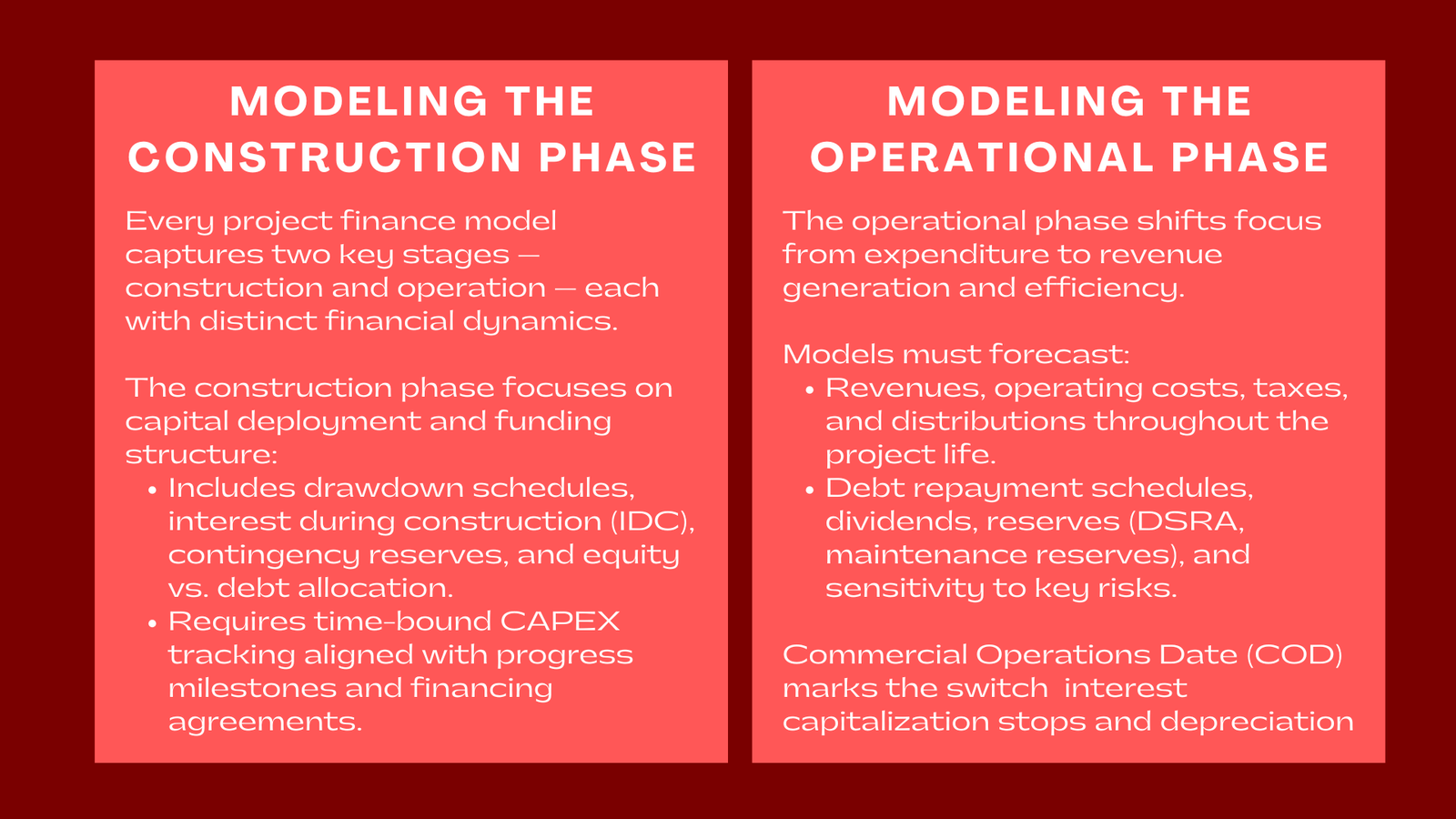

Every project finance model is a story from start to finish since construction all the way to long term operation. Since these two environments are financially very different, it is vital to properly capture the different characteristics of each phase. The capital phase is devoted to capital expense and the funding phase and the operational phase is concerned with cash generation and repayment.

A well-structured understanding of how to model construction and operational phases in project finance Singapore in a finance model clearly distinguishes between these two life cycles, showing how short-term capital deployment evolves into sustained revenue streams. During the construction stage, the model must account for drawdown schedules, interest during construction (IDC), contingency reserves, and the allocation of equity versus debt financing. Any variation in timelines or cost assumptions during this stage can have a significant ripple effect on project returns and overall feasibility. Detailed modeling of milestone-based payments, contractor advances, and completion tests helps to ensure financial realism and supports better communication between lenders, sponsors, and developers.

Once the project transitions into the operational phase, the emphasis shifts from expenditure management to revenue optimization and efficient operations. The financial model must simulate operational parameters such as production output, tariffs, operating costs, maintenance cycles, and inflation impacts. It should also project debt repayment schedules, dividend distributions, and reserve requirements to test the project’s ability to sustain stable cash flows. Sensitivity analyses during this phase often highlight the robustness of the project against risks such as lower demand, price fluctuations, or increased operating expenses.

The proper way to model these phases is to make sure the stakeholders can recognize how the project evolves, the funding gaps and how early decisions may impact the profitability in the long term. A robust project finance model successfully creates a clear picture of where the financial project is going, from beginning to end.

This paper focuses on the analysis of construction and operational phases with emphasis on main assumptions, timings and string needs forming the core of any realistic project finance analysis.

The Construction Phase: Capturing Capital Intensity

Construction phase of any project is the most capital intensive stage of a project. Cash flows are negative during this time period as some money is spent on procurement, engineering and development. Accurately simulating these costs necessitated information about the detailed construction schedule and payment nodes and sources of financing.

Capital expenditure (CAPEX) should have a time-bound attached to it to keep expenditure in line with actual project progress. Typically project finance model structure for construction and operations Singapore of the supply chain requires several financing agreements that allow for draw downs in the form of debt and injections of equity, planned to support the construction commitment without impacting liquidity. Interest during construction ID, Interest during construction must also be modelled as the cost of borrowing is capitalized before operations start.

A major output during this phase is the sources and uses of funds statement to ensure that total funding is equal to total expenditure. Lenders pay close attention to this section to see that capital requirements are financed in their entirety and that there are contingencies in case there should be an overrun in costs.

The Transition to Operations

The days of handover of construction to operations marks an important point in project finance modelling. Once construction is completed, and the project is operational, the revenue generation process commences and the direction of the cash flows of the model begins to reverse. This transition is generally marked by the Commercial Operations Date (COD) which stimulates loan amortization, debt service and recognition of revenue:

It is one thing to link this transition logically in the model. For example, the interest capitalization should stop at COD and in income statements, depreciation, operating costs, and taxes should start. The project also will need to fulfill conditions precedent to operations, including regulatory approvals and performance testing, which may affect the date revenue will begin inflows.

A good model gives flexibility to test delay in COD as the effect of delay can have a significant impact on financing costs, DSCR and investor returns.

The Operational Phase: Sustaining Long-Term Value

During the operational phase, distinction is made in the process from spending to earning. The model needs to forecast revenues and operating expenses, taxes and distributions over the life of the project. Cash flow forecasts are very important as they directly impact the repayment of debt and paying of dividends. Attending a project finance modelling training for operational phases in Singapore helps professionals develop the skills to build accurate forecasts and manage project cash flows effectively.

The financial performance is very much based on assumptions regarding outputs, pricing, inflation and maintenance costs etc. Reserves, including debt service reserve account (DSRA) and maintenance reserve, leading to financial stability. The operating phase is also a phase during which sensitivity analysis is very useful, as it enables stakeholders to explore the effects of changes in critical inputs on long-term viability.

Finally, sustainability is represented by this phase of the project. Therefore, it examines whether or not the original funding structure is able to survive against the challenges of reality and if the investors are able to get the returns expected of them.

Conclusion

Modeling construction and operational stages is not about figurative language or numbers – it is about reflecting reality. Different phases have their own special risks, cash flows, and financial commitments. Different phases have their own special risks, cash flows, and financial commitments. During construction, risks typically revolve around procurement, engineering, and contractor performance. Cost escalations, design changes, or regulatory approvals can drastically alter funding needs and completion timelines. These must be modeled through flexible assumptions and dynamic linkages that allow stress testing of interest during construction (IDC), contingency reserves, and funding drawdowns. Once the project transitions into operation, the focus shifts toward operational efficiency, tariff adjustments, maintenance costs, and reserve account management. Revenue assumptions are tested for sensitivity to market demand, inflation, and operating downtime, ensuring that the project can sustain debt service and equity returns under varied conditions. A model which realistically captures this transition designates credibility and robustness in the financial framework of the project.

From groundbreaking to revenue-generating, a project finance model’s strength comes in how it bridges the gap between the two. When executed correctly, it becomes an evolving document – one that reflects the complexity and the opportunity inherent in the life cycle of every project.