Renewable Energy Project Finance Modeling A Practical Case Study

Renewable Energy Project Finance Modeling: A Practical Case Study

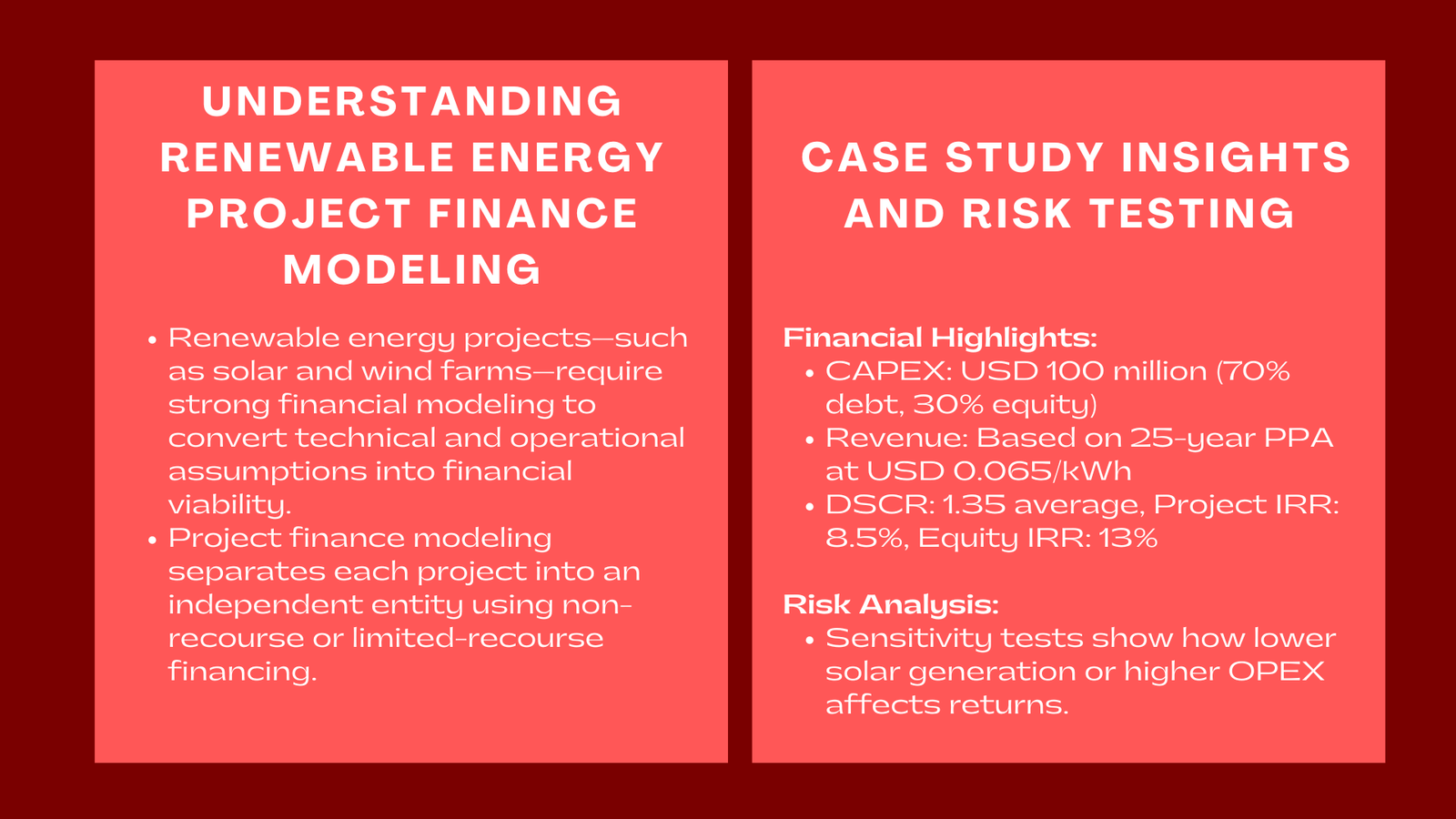

As the global economies embark on their rapid response to achieve sustainability, renewable energy development projects have become a main platform in present-day infrastructural investment. From solar farms in Southeast Asia to offshore wind setup in Europe, renewable entrepreneurs are joining the technological innovation with financial complexity. Behind each successful renewable energy development lies a well-developed project finance model – a tool that takes what may be complex technical, operational and commercial assumptions and turns them into financial certainty.

Renewable Energy project finance modelling is unlike conventional corporate finance. It separates each project and makes it an independent entity which performance is not based on the sponsors’ balance sheet. This financing technique, which is referred to as “non-recourse” or “limited-recourse”, is a financial technique that enables investors and lenders to determine project risks at the individual project level but also to ensure that capital is used in an efficient manner. For analysts, renewable energy project finance modeling case study for solar power projects Singapore this has implications of having a deep understanding of energy generation, tariff structures and the dynamics between the debt and the equity.

The article describes the application of project finance modelling to renewable energy projects by means of a case study application. We will provide an overview of the major elements of modeling a 100 MW solar power project, including revenue modeling, finance structure, and risk analysis, to show our understanding of the key elements of establishing financial viability and conveying this to the stakeholders.

Understanding the Financial Framework of Renewable Energy Projects

FDI projects have a completely different financial logic than traditional power plants have. Because these investments typically require a large capital outlay with small operating costs, the long-range cash flow prognosis is therefore critical to their success. The project finance model is the analytical engine which converts physical generation to financial viability.

Consider the case of a 100 MW solar project in a location with high irradiance with a 25-year Power Purchase Agreement (PPA). The developer, Special Purpose Vehicle (SPV) would develop, own the plant and operate it. Under the PPA, power generation is sold at a set tariff which creates steady stable income throughout the contract period.

The model starts with technical assumptions for the equipment like the capacity factor, the degradation rate and the availability on the grid. These determine annual generation of energy, the basis of which is used to determine revenue projections. OPEX is in the form of maintenance, insurance, land lease and inverter replacement cost. Depreciation and tax rates are local jurisdiction dependent whereas long-term cost growth is related to inflation and foreign exchange rate assumptions. For professionals aiming to build project finance models for renewable energy Singapore, understanding these assumptions is essential to ensure accurate forecasting and financial feasibility.

From a financing point of view, renewable projects usually use the project finance structures based on a combination of equity and debt. Assumptions with respect to debt tenor, gracious period and interest rate assumptions are essential as they directly affect the debt service coverage ratio (DSCR) and overall bankability of a project. The model brings all these variables together in a resolute structure that predicts the cash flow waterfall of the project from gross revenue to equity distributions.

Case Study: Modeling a 100 MW Solar Power Project

To get a clearer idea of the practical use of renewable energy project finance modeling, let us consider the structure of a 100 MW solar PV project in Southeast Asia, which has been developed under a 25-year PPA of USD 0.065/kWh. The objective of the model is to ascertain whether the project is financially viable or not and whether it will be able to meet debt and provide competitive returns to the investors.

The first stage of modeling is dedicated to the revenue estimation. From the data of solar irradiation, the capacity factor of the plant is estimated at 22%, with about 192 GWh per annum produced in the first year. Based on panel degradation that drops at the rate of 0.5% every year for the life of the project, the model predicts a steady decline pattern of output. Multiplication of generation with the PPA tariff will give you the overall revenue stream per annum, which will serve as the basis for your project’s income statement and cash flow predictions.

Next, the model includes the capital expenditure (CAPEX) of $100 million, which is funded by 70% debt and 30% equity. The terms of a debt may be structured with a schedule of 15 years tenor, 2 years construction grace period and an interest rate of 6%. During construction, interest during construction (IDC) is capitalized and is added to the total cost of the project. The equity component of the deal is paid out in tranches that follows the EPC payment schedule.

Operating expenses are estimated to be USD 12 per kW per year, which includes operations and maintenance (O&M) contracts, insurance and land rental. Inverter replacements are also considered in the model every 10 years. Taxes are charged at the local corporate income tax rates and accelerated depreciation is modeled in order to maximize tax shields in the early years.

With these inputs in place, the model computes annual cash flow available for debt service (CFADS) and computes debt amortization in order to compute the Debt Service Coverage Ratio (DSCR). In this case study, the base-case DSCR has an average value of 1.35 which implies that the debt repayment capacity is comfortable. The Equity Internal Rate of Return (IRR) is expected to be 13 percent and the Project IRR is 8.5 percent (both debt and equity). These metrics mean that the project makes financial sense and is Covid-1 friendly for both lenders and equity sponsors.

Analyzing Risks and Testing Model Resilience

While the base case shows it is financially feasible the true power in a renewable energy project finance model is the ability to test risk scenarios. There are a number of uncertainties involved in renewable projects, starting with the availability of solar resources and the performance of equipment, through to interest rates and exchange rates.

In the model, sensitivity analysis is carried out through individual variance of key inputs to determine the respective financial effect. For example, if there is a reduction in solar generation of 5%, the equity IRR of the project is reduced from 13% to 11.8% and the minimum DSCR is reduced from 1.25 to 1.15. Similarly, an increase of 10% in OPEX will only slightly affect the profitability but is not going to hurt debt repayment and thus the robustness of the project.

Scenario analysis is an advance step, where there are multiple changes all put together – lower irrad, higher interest rate and delayed COD – to test how the project is doing under unfavourable conditions. This provides lenders and investors with a new way to be holistically aware of downside risks. In our case study downside scenario the project IRR is lowered to 7.2%, but debt service beyond the minimum DSCR of 1.10 was still maintained, indicating that the structure has the ability to withstand moderate stress.

Risk mitigation solutions are also modelled. For example, long-term O&M contracts, insurance policies and performance guarantees are used for mitigation of operational risks, and interest rate swaps or fixed rate debt are used for mitigation purposes against volatility in the financing market. The model calculates the cost of the measures, and will give a clear picture of the cost-benefit trade-offs.

In addition to financial measures, risks (qualitative risks) such as changes in regulation or curtailment risk are also taken into account. This model enables the factors to be converted to probabilistic results or scenario weighting to provide a final investment decision that is financially and strategically sustainable.

Conclusion to Renewable Energy Project Finance Modeling A Practical Case Study

Renewable energy project finance modeling is the missing link that bridges the gap between engineering and finance to provide the bankability of technical feasibility. The case study of a 100 MW solar project shows how an integrated model models the entire lifecycle, including construction to operation, both quantifying and qualifying profitability as well as risk.

For investors, the outputs from the model offer clarity as to their return expectations, cash flow timing and dividends potential. For lenders, it shows the project’s ability to service debt even in the event of stress scenarios. And to sponsors it provides a roadmap to optimise the capital structure to optimise long term performance.

As renewable energy has continued to grow and spread across the globe, the complexity of project finance modelling will become a pivotal part in facilitating the flow of capital. Accurate, transparent, and dynamic models while not only helping attract financing but also helping in ever ensuring that sustainability objectives provided are met without the loss of financial discipline. In the changing scenarios of clean energy investment, how to build a project finance model for renewable energy investments Singapore by mastering renewable energy project finance modeling is not just a technical skill to use by virtue of the fact that it is rudimentary to responsible and resilient project development.