Build Project Finance Excel Templates

Project Finance Financial Model Excel Guide: Building, Using, and Downloading Reliable Templates

Introduction to Build Project Finance Excel Templates

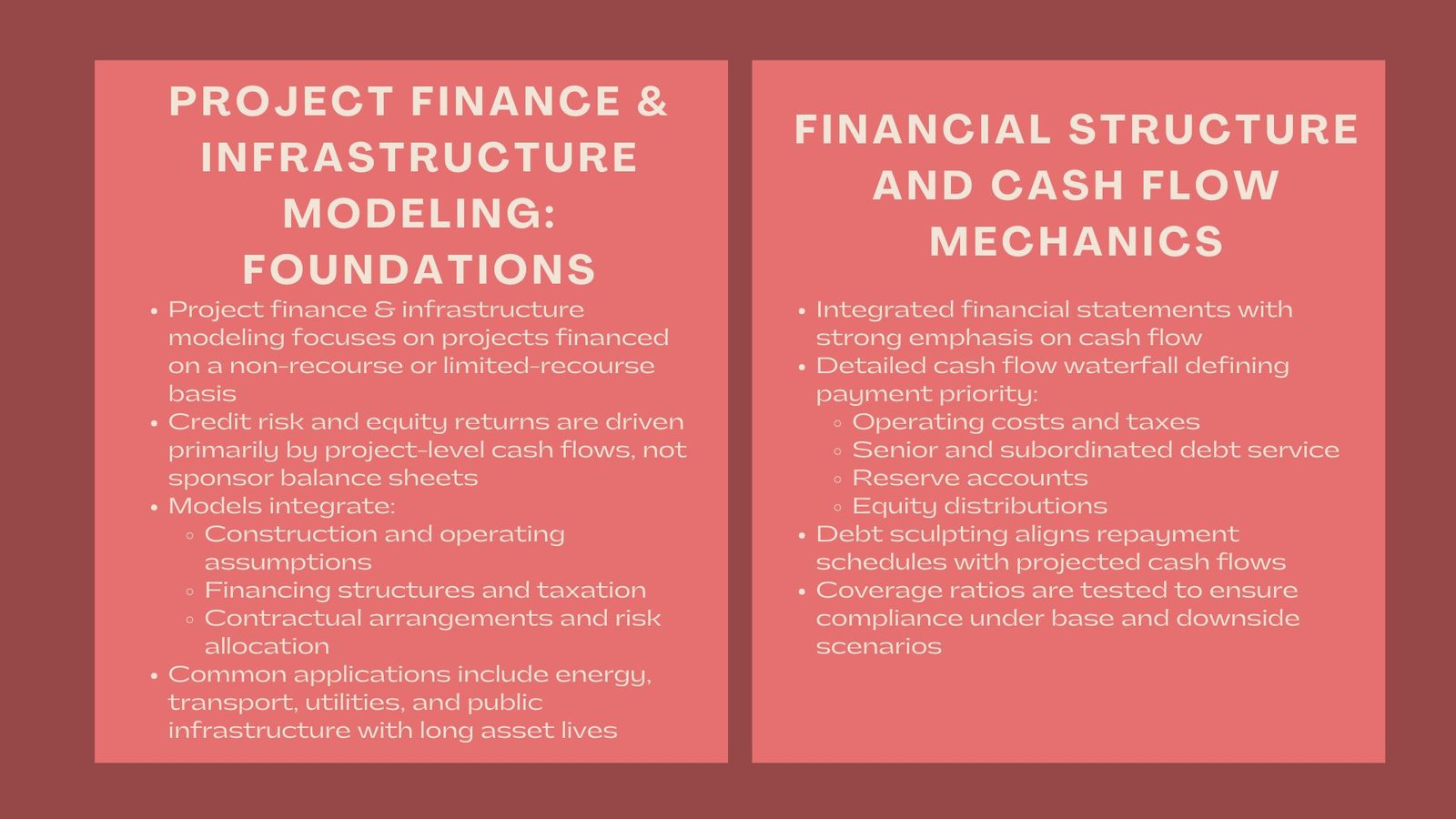

Project finance has established itself in the infrastructure, energy and the development of large-scale investment. The core of any successful transaction is the existence of a sound project finance financial model excel, which converts the intricate contractual, financial and operational assumptions into organised cash flow projections. As a professional and a business investor, it is vital to learn how to use a project finance model excel free download, how to make changes in a project finance model xlsx, and how to analyze a project finance cash flow model excel to make the necessary decisions and calculate the risk involved.

This article can serve as a detailed practical guide to the project finance modeling within Excel, elucidates the framework and functionality of a project finance model template excel, and it can be explained how these facilities are applied in the evaluation and financing of projects in the real world.

Introduction to Project Finance Modeling in Excel

A project finance financial model excel is a special purpose spreadsheet which is used to determine the financial viability of a single project on the basis of its standalone cash flows. In comparison with those of the corporate finance models which depend on the balance sheet of the entire company, project finance models of finance are limited to the project revenues, project operating costs, project debt service and equity returns. This arrangement enables the lenders and investors to evaluate the ability of the project itself to maintain its commitments.

At the initial phases of project formation, a project in the finance model free download excel is used by many practitioners to hasten the feasibility analysis. These templates are a standard template that is an expression of market conventions so that an analyst can concentrate on assumptions, sensitivities, and structuring instead of creating a template directly.

Core Structure of a Project Finance Financial Model

An effective project finance model xlsx has a structured and strict format. It is normally initiated by input sheets that establish major assumptions such as construction costs, operating expenses, financing terms, tax rates and drivers of revenue. These inputs are fed in calculation sheets which produce integrated financial statements.

Project cash flow waterfall is the most critical project finance cash flow model excel output. This structure distributes the cash in a pre-determined sequence, whereby, operating expenses are satisfied first, then servicing debt, and lastly, giving returns to equity investors. This is logical to project finance deals in the real world, and the core of lender confidence.

Although the balance sheet is simplified most of the time, it supports the project, so it is a tracking of assets, debt balances, and equity contributions in the project lifecycle. The combination of these elements constitutes the main elements of a believable project finance model template excel.

Importance of Cash Flow Modeling in Project Finance

The most important analytical tool in project finance is the project finance cash flow model excel. It identifies the capability of a project to fulfill its debt service and provide satisfactory returns to its equity. Coverage ratios of debt services, loan life cover ratios, and internal rates of returns among others are direct results of modeled cash flows.

Due to non-recourse or limited recourse of project finance, the lenders are more dependent on the honesty of cash flow projections in lieu of the balance sheet of the sponsor. An adequately organized project finance financial model excel thus emerges as the major risk evaluation tool of the banks, multilateral agencies and the individual investors.

Using Project Finance Model Excel Free Download Templates

An excel free download project finance model is usually applied in the initial analysis or training phase. The templates tend to contain pre-developed formulae, standard templates and typical financial ratios. Although they can never substitute transaction specific modeling, they are a great starting point.

Analysts using a downloaded project finance model template excel must always check all the formulas and assumptions. Templates are generic in nature and might not be a reflection of jurisdiction-specific tax regulations, financing structures, and contractual arrangements. The customization is hence necessary to make the model conforming to the real project structure.

Nevertheless, the shortcomings notwithstanding, a project finance model excel free download of high quality is known to save a lot of time in the development process, and assists in being able to keep pace with market standards.

Key Assumptions Embedded in Project Finance Models

All the project finance models xlsx are motivated with assumptions which directly impact on the valuation and bankability. Revenue assumptions rely on offtake agreements, tariffs or use projections whereas cost assumptions rely on operating costs and maintenance as well as lifecycle capital expenditure. Debt tenor, interest rates, debt repayment, and reserve requirements are characterized by financing assumptions.

One of the aspects that define a professional project finance financial model excel is the transparency of assumptions. The ability to separate inputs and calculations enables the stakeholders to test the sensitivities and know what drives the financial performance. This transparency is especially essential when carrying out the lender due diligence and credit committee review.

Role of Debt Structuring in Project Finance Models

The key part of a project finance cash flow model excel is the debt structuring. The model needs to capture precisely repayment mechanisms, capitalization of interest in construction, and shaped repayment profiles in a manner that is in line with expected cash flow. These aspects make debt service commitments to be sustainable during the life of the loan.

A well-developed project finance model template excel will enable the user to perform the experiment of alternative financing conditions that may include leverage changes, interest rates, or repayment schedules. Not only does this flexibility facilitate bargaining with lenders, it aids the sponsors in maximizing capital structure without unreasonable risk levels.

Equity Returns and Investor Analysis

The project finance financial model excel is used by equity investors to determine whether the returns projected are worth the risk. All the following measures are computed based on the model outputs: equity internal rate of return, net present value and cash yield. The metrics are vulnerable to the assumptions concerning the timelines of construction, operating efficiency, and the cost of finances.

Scenario and sensitivity analysis can also be done using a comprehensive project finance model xlsx. Investors can assess the downside risk and potential upside by modifying key variables, thus, the model should be perceived as a strategic decision-making tool and not a fixed calculation.

Practical Applications of Project Finance Model Templates

As a matter of fact, project finance model template excel is utilized during the project lifecycle. In the development, it assists in the case of feasibility studies, bid submission. In the financing process it forms the basis of negotiation with lenders and credit approvals. The model can then be revised on a periodical basis after financial close to observe performance and covenant observance.

To train and develop, a Project finance model excel free download will assist analysts to know the logic of the modeling used by the industry. A large number of practitioners develop these templates and make them more specific to a certain industry, developing proprietary models (e.g., renewable energy, transportation, or public-private collaboration).

Model Governance and Best Practices

A project finance financial model excel can be said to have credibility not only based on its structure, but also on governance and quality control. It is necessary to use version control, documentation and independent review particularly where the transaction is large. The formula or assumption mistakes can have a significant effect on investment decisions and financing.

It is a best practice that all project finance cash flow model excels are auditable with clearly labeled and rational flow. This field improves the confidence of stakeholders and the chances of misunderstanding are minimized.

Technology and the Evolution of Project Finance Modeling

Although Excel is still the leading platform, financial modeling technology has been impacting the construction and review processes of project finance model xlsx files. Project finance modeling is being enhanced with automation, add-ins and integration with the data sources, but underlying principles and models have stayed the same.

The skills required to design, interpret, and challenge a project finance model template excel still form a fundamental part of the skill set of a finance professional even with the development of the tools. Excel based models remain the standard as far as their flexibility, transparency and commonality are concerned.

Conclusion

A properly prepared project finance financial model excel is a must have in gauging viability and bankability of large scale projects. Regardless of whether it is constructed in scratch or based on the project finance model excel free download, the model should mirror the cash flows, financing frameworks, and risk distribution. Knowing how to work with a project finance model xlsx, the way to analyze a project finance cash flow model excel, and how to tailor a project finance model template excel will enable a professional to make wise investment and financing choices.

With the growing project finance activity worldwide, proficiency in the Excel-based financial modeling is now a pivotal asset to developers, lenders, investors and even advisors.