Best Practices for Developing Robust Project Finance Models

Best Practices for Developing Robust Project Finance Models

In the high stakes environment of project finance, a financial model is not just a tool-it is the basis of every important decision. From making sense of the costs to assessing risks and deciding project viability, the quality and validity of a model directly determines trust from the investor’s end. Creating a strong project finance model takes not only technical prowess, but also discipline, transparency and a strong understanding of financial logic.

A well-structured model creates one source of truth, from which all stakeholders can assess the project from the same assumptions and transparent calculations. However, if it is not structured and checked properly, other minor errors can lead to making big mistakes financially. Therefore, the process of developing a project finance model should be guided by a framework of best practices—covering logical structure, clear documentation, dynamic linkages, and transparent presentation of key assumptions. Independent model reviews and audit trails are also essential to ensure accuracy, consistency, and regulatory compliance. Ultimately, robust modeling is about combining technical expertise with strategic foresight—transforming data into insights and insights into sound investment decisions.

This article provides the best practices for building accurate and flexible project finance models that clients should adhere to in order to create robust and reliable project finance models that stand the test of time from lenders, investors, and auditors alike.

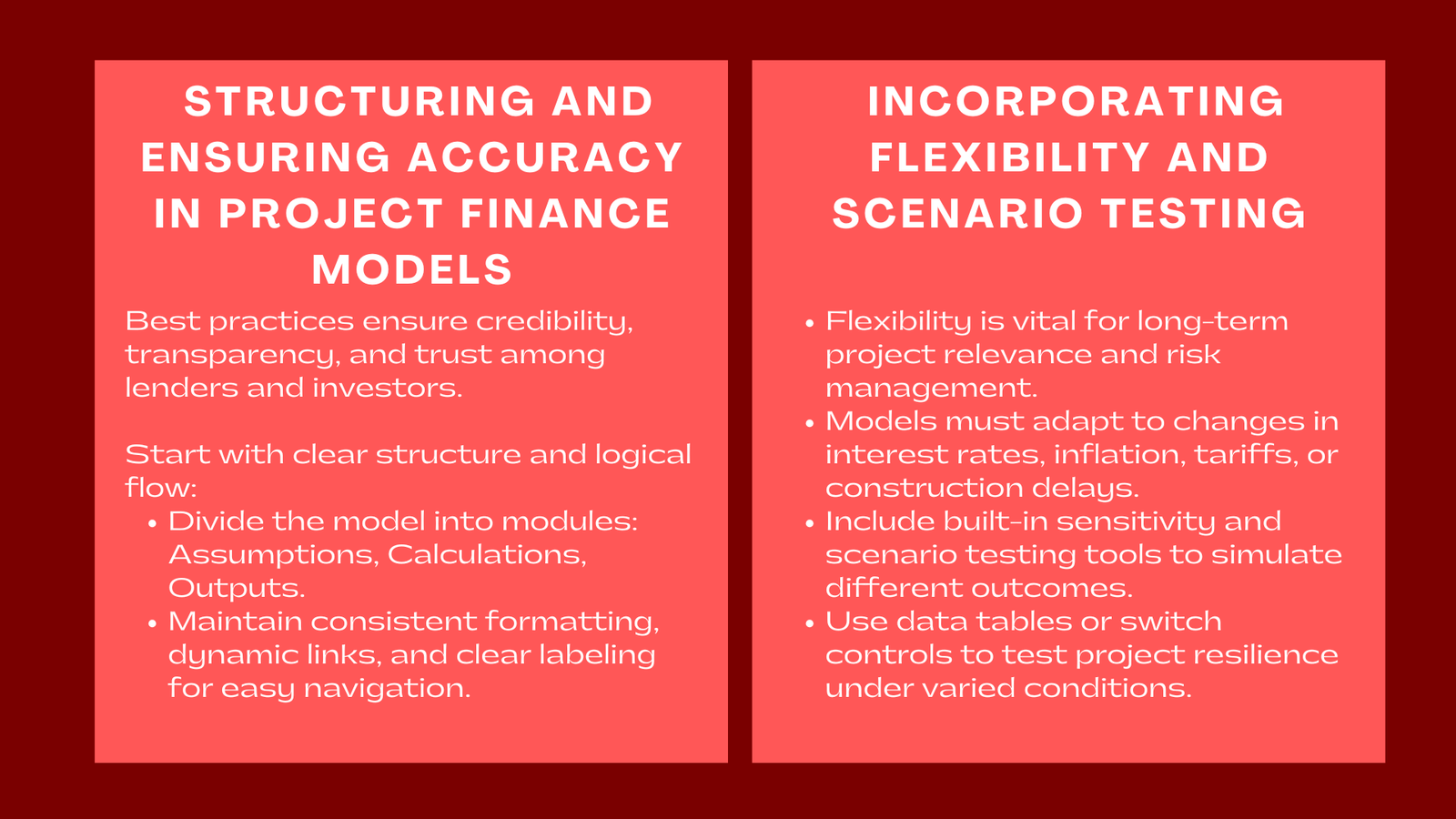

Start with Clear Structure and Logical Flow

The most important part of any effective model is structure. A good project finance model should be modular such that it divides major parts like assumptions, calculation, and outputs. This continues the cleanness in expression as well as reduces the possibility of circular references or formula errors.

Logical flow is also really important to take into account. Inputs go into well-defined calculation sheets and the outputs, including the income statement, cash flow, and balance sheet, are well-organized. A clear audit trail will enable the user to trace the results back to the assumptions, which is a crucial part of developing advanced project finance modelling skills Singapore professionals aim to master for ensuring transparency and reliability in financial analysis.

Professionalism is the opposite of obscurity. Models should be suitably labeled, maintain consistent formatting and contain dynamic links that are automatically updated as inputs are variant. The aim is to make any user – especially one that is not familiar with the model – by default, aware of how the model is structured, i.e. without having to guess. Dynamic linkages are another essential component of a professional model. When input data changes, results and summaries should automatically update throughout the model, eliminating the need for manual recalculation and minimizing human error. This makes the model adaptable to real-time scenario testing and stress analysis—critical functions in project finance where assumptions can shift rapidly due to changes in cost estimates, interest rates, or operational conditions.

Ultimately, a well-structured project finance model demonstrates clarity, consistency, and control. It allows users to understand not only what the numbers show but also how they were derived. Such a model fosters confidence among stakeholders, supports faster decision-making, and strengthens the credibility of the financial analysis. In essence, structure is what transforms a spreadsheet into a powerful strategic tool—a model that tells the project’s financial story with precision, transparency, and professional integrity.

Ensure Consistency and Accuracy

Accuracy cannot be compromised in project finance modeling. All formulas should be tested systematically and circularity has to be avoided unless necessary (e.g. interest capitalization). Balance sheet balancing and sources-equals-uses checking are some of the validation checks having an early indication capability for understanding inconsistencies.

Consistency over time periods is also of crucial importance. Cash flow timings should be planned with the timing of loan repayments and the operational timings. Fee False assumptions about the time needed may distort DSCR or IRR calculation leading to false conclusions about the viability of the project.

In addition to this, there should be an element of transparency in version control and documentation. Each iteration of the model should explicitly document changes so that it is clear who made them and there is less confusion in the lender reviews or audits of the model. In addition, modelers should maintain a version log or change history embedded within the model itself, tracking updates to assumptions, inputs, and structural elements. Combining this with consistent labeling, color coding for inputs versus calculations, and clear documentation notes enhances usability and reduces the risk of misinterpretation.

Ultimately, accuracy and transparency go hand in hand. A project finance model that is both mathematically sound and well-documented reflects professionalism, discipline, and accountability. It gives comfort to all stakeholders—from lenders assessing risk coverage to investors evaluating returns—that the numbers they are reviewing are not only correct, but also traceable, explainable, and dependable. In an industry where trust is currency, precision and transparency form the cornerstone of every successful financial model.

Incorporate Flexibility and Scenario Testing

An effective model should have the flexibility. Project finance is based on long-term commitments, and external factors such as inflation rates, interest rates or commodities can change dramatically over time. With the flexibility of incorporating any scenario into the model, users could test various scenarios without building the model from the beginning and how to structure and test project finance models for investors and lenders.

Scenario analysis tools should have provision for variation in different key assumptions – from construction delays to variation in tariff rates with visibility of results. This adaptability has the effect of conversion of the model to a decision making instrument rather than a static forecast.

Integrating the functions of sensitivity and scenario analysis into, for example, data tables or switch controls can help enable users to test how resilient they can be under different conditions and create greater credibility in presentations to lenders. Moreover, flexibility contributes to credibility and longevity. A model that can easily accommodate changes in assumptions remains useful throughout the project’s life—from initial bidding and financial close to refinancing or performance monitoring years later. It ensures that updates can be made efficiently as real-world data becomes available, reducing the risk of outdated assumptions leading to poor financial decisions.

Ultimately, flexibility transforms a project finance model from a simple forecasting tool into a strategic decision-making instrument. It empowers users to navigate uncertainty, anticipate challenges, and present resilient financial outcomes under different scenarios. In a constantly changing financial landscape, flexibility is the key attribute that allows a model not only to survive but to remain relevant, reliable, and insightful across the entire lifespan of the project.

Conclusion

Developing a solid project finance model is an art and discipline at the same time. It involves accuracy, formality and vision – and also the ability to tell an impactful financial story. A model based on the best practices goes beyond calculating the outcomes. It works for building trust among investors, lenders, and project sponsors. Accuracy is the foundation of trust. Investors, lenders, and project sponsors rely on the integrity of a financial model to evaluate viability, negotiate financing terms, and forecast returns. Even the most promising project concept can falter if its model lacks consistency, transparency, or analytical depth. Therefore, each input must be supported by documented assumptions, realistic market data, and clear sources. The model should present results that can be easily reviewed, audited, and stress-tested under different scenarios, reinforcing confidence in both the numbers and the people behind them.

Formality and structure are equally vital. A well-organized model follows logical sequencing, modular construction, and standardized formatting. This allows multiple stakeholders—from engineers to bankers—to interpret the same financial story without confusion or ambiguity. Clear labeling, consistent formulas, and comprehensive error checks ensure that the model remains robust even when adjusted or expanded. A model that adheres to formal design standards becomes a living document—capable of evolving with the project’s lifecycle, accommodating refinements, and responding to unforeseen developments without losing integrity.

By highlighting formality, correctness and fluidity, financial rivals construct models which defy or can accept adjustment. In the multifaceted and fluid nature of project finance, such models are invaluable assets for proper decision making and responsible success.