Building and Interpreting the Cash Flow Waterfall in Project Finance Models

Building and Interpreting the Cash Flow Waterfall in Project Finance Models

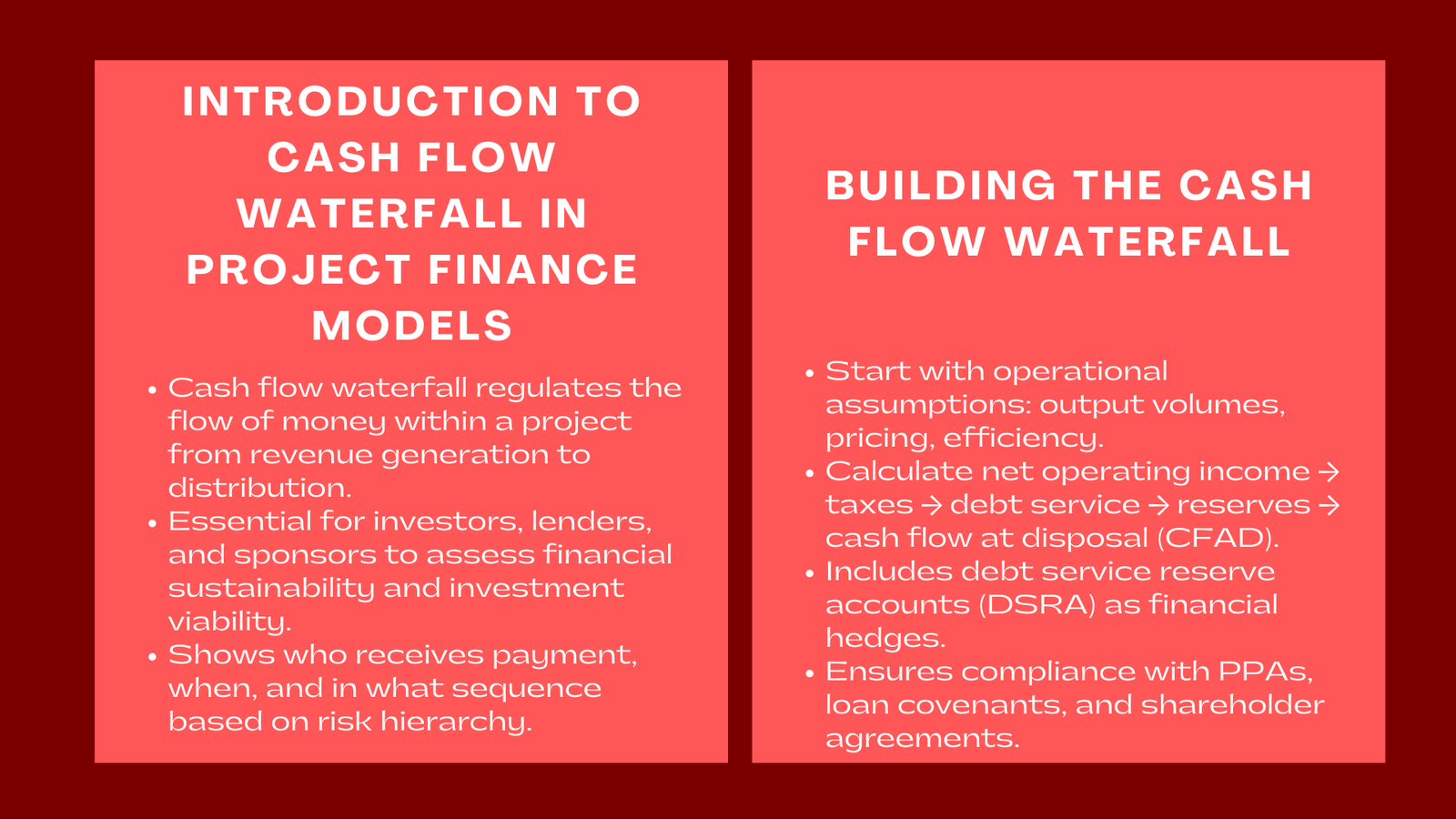

Project finance models are based on cash flow waterfall, which regulates the flow of money within a project involved in the production of revenue to distribution. To investors, lenders, and sponsors, knowledge of such a structure is key to determining the level of financial sustainability a project and also as an investment worth pursuing. The cash flow waterfall will show who receives payment, when, and in what sequence (according to the risk ranks of project funding).

Simply put, the cash flow waterfall is a procedural model following which the project contractual requirements are reflected. Participating in project finance modeling Singapore demonstrates how all the revenues will be distributed between the various financial stakeholders and liabilities, beginning with operating costs and concluding with equity issues. With proper modeling and interpretation of this waterfall, financial analysts are able to ensure the project is servicing debt according to schedule, maintaining sufficient reserves, and providing reasonable returns to the investors.

This paper describes how cash flow waterfalls are constructed in project finance models, their reasoning and order and how to interpolate them to make effective decisions and mitigate risks.

Understanding the Logic of a Cash Flow Waterfall

The cash flow waterfall term can be defined as a prioritization of payments in a project. It is the lifeline of a project finance structure in terms of finance since it determines how the revenues which come in are utilized to fulfill the operational requirements and financial requirements. The waterfall is typically built in a certain order to make sure that the critical payments like operating expenses as well as payment of debts are met before any money goes to the shareholders.

The order usually starts with the gross revenue at the top, representing the total revenue received through project operations. Based on this, there is a deduction of operating expenses (OPEX), which include day-to-day costs such as maintenance, staffing, and insurance. The second tier comprises taxes and reserve accounts, and the third tier covers debt service payments, including entitlement, principal, and interest. It is only upon accomplishing these basic requirements that distributable cash flow can be allocated to equity investors as dividends or distributions. Understanding the financial statements required for project finance modeling in Singapore is essential to accurately reflect each tier and ensure proper allocation.

Risk management is the reason why the structure is so. The lender who have a lower risk than the equity investors are given the first priority so that they are paid although equity holders who take a greater risk are paid last. Such hierarchy corresponds to the ultimate principle of project finance as the debt is to be paid with the project cash flow and the equity returns are to be made in case the operations are successful.

A properly designed cash flow waterfall makes the model transparent and gives rise to the interaction of the financial obligations of the project with the course of time. It also helps the stakeholders to determine a possible shortage of cash or liquidity shortfall to repayment capacity.

Building the Cash Flow Waterfall in a Model

When building a cash flow waterfall, the model structure takes the contract and financial arrangements in a rational order of calculations based on the legal agreements. It starts with correlation of operational assumptions (output volumes, pricing and efficiency), with the revenue projections. Then, all levels of waterfall are then calculated one after another to be precise and traceable.

As an illustration, once sales have been made, the model will then reduce the operating costs to calculate net operating income. This is then determined as taxes depending on the rates and concessions. The second stage is the debt service, which comprises regularly scheduled debt payments in terms of principal and interest. These are the same figures that will be taken out of the loan amortization schedule and therefore will be consistent with financing terms. Participating in a Corporate finance modeling course Singapore ensures professionals understand how to align these calculations with proper financial modeling practices.

The model then takes into consideration cash reserves after the debt service, which includes debt service reserve account (DSRA) or maintenance reserve. These reserves serve as financial hedge cushions, guarding the lenders and sponsors against any kind of unexpected shocks. Lastly, the initial one, the model calculates cash flow at disposal (CFAD), which can be used to pay returns to the investor.

The whole building will be the expression of legal and financial records of the project. PPAs, loan covenants and shareholder agreements all entail description of priority and time parameters in payments. The waterfall works to ensure that these contracts are followed and hence, makes it a very essential component of lender due diligence.

Interpreting the Waterfall for Decision-Making

After it is created, the cash flow waterfall is among the most potent project financial analysis tools. It enables users to evaluate the level of cash that the project is producing up to a point in which it can cover its commitments as well as surplus cash to the investors. Examples of such companies include lenders calculating the debt service coverage ratio (DSCR) based on the waterfall to establish the extent to which cash inflows surpass the debt payments in a safe margin.

Waterfall gives insight to investors about the volatility and when returns would be made. It makes them know in advance when they are going to receive dividends and how vulnerable the payment is to either operational or financial changes. The waterfall is useful in enabling sponsors to update financial structures and assess the liquidity of the project in any eventualities.

Besides, waterfall also enables clear communication amongst the stakeholders. It gives a clear understanding of the flow of finances in the project minimizing uncertainty and promoting faith amidst the interested persons. When it is laid out in an understandable manner it comes out as a story of economic responsibility, as it shows not what becomes of the money, but why.

Conclusion

The cash flow waterfall is much more than it is a technical exercise, it is the financial beat of any project finance modelling. It is the flow of value within a project and making sure that a contractual obligation is accomplished in the adequate sequence. This is an essential aspect to the analysts and investors as it is the interpretation and explanation of this waterfall that enables them to assess the stability of a project, potential returns and risk distribution.

A properly structured waterfall portrays organization, openness and economic soundness. It enables the participants of the project to view the distribution of cash as well as the amount of resilience of the project to change. One of the most essential skills in modeling project finance is the art of constructing and decoding the cash flow waterfall as infrastructure projects grow very complicated and require extensive expertise in construction and decoding in projects.