Debt and Equity Modeling Explained in Project Finance

Debt and Equity Modeling Explained in Project Finance

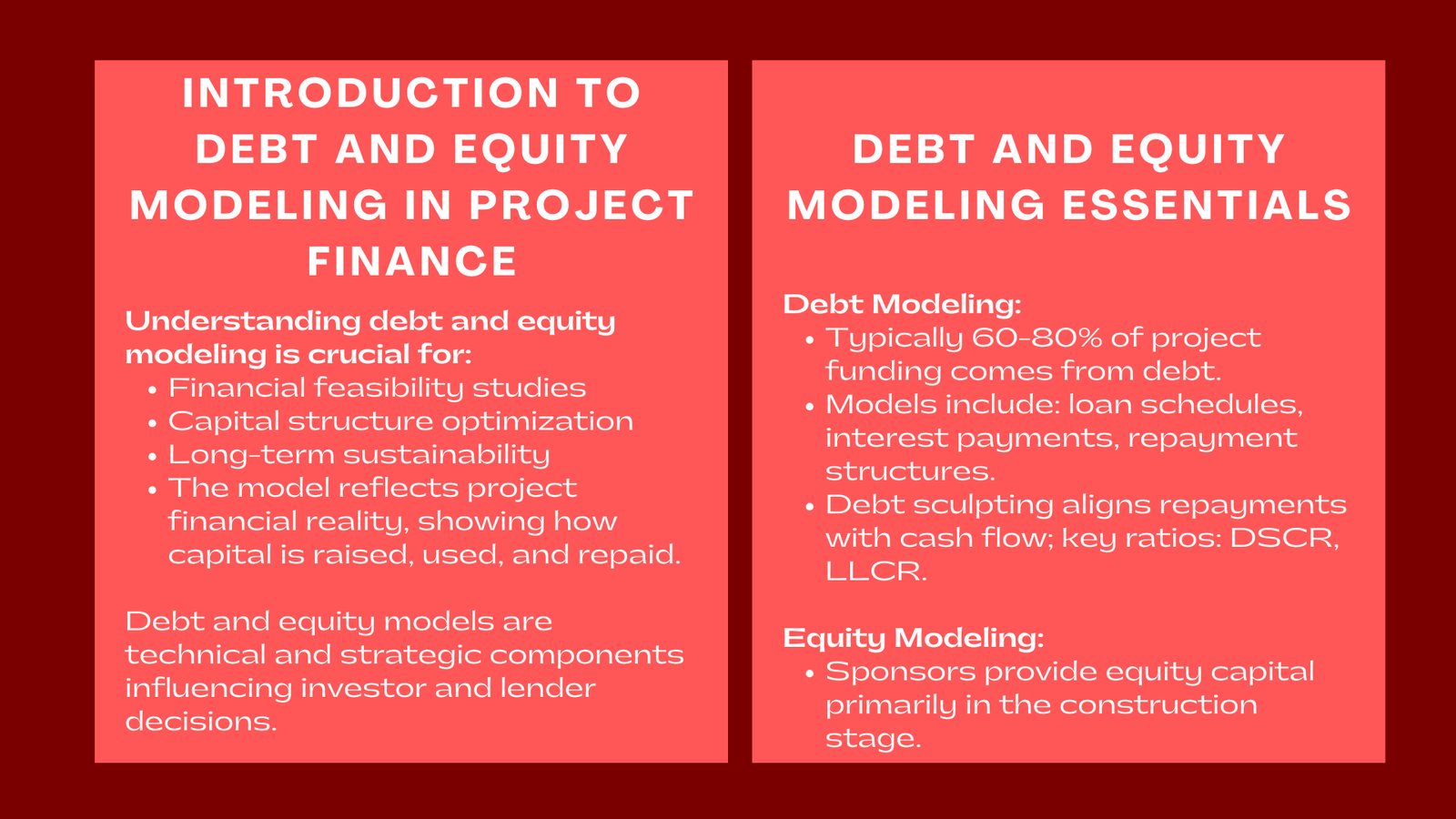

A project finance transaction is based on debt and equity (dominants). Their interaction will dictate the process by which a project is funded in addition to the sharing of risks and returns among the stakeholders. Learning the framework of the debt and equity modeling in project finance is crucial in completing the financial feasibility study, optimization of the capital structure, and sustainability in the long term.

The model is a reflection of the project financial reality in project finance. Participating in project finance modeling Singapore demonstrates the manner in which capital is brought on board, its use, and the manner in which it is paid by giving a clear picture of the interaction of the various sources of funds throughout the life of the project. Debt and equity models are some of the most technically, as well as strategically, important components of the process. They dictate allocation of cash flow, compensation of investors, and protective facilities of lenders.

Today, this paper discusses the modeling of debt and equity in project finance, the importance of the balance between these two that make decisions by the investor and the lender.

The Role of Debt in Project Finance Modeling

Debt is one of the keys to project finance since it permits the sponsors to use their equity to invest and earn more returns. The larger part of a project funding is usually financed by loans made by banks or institutional lenders in most cases to the tune of 60-80 per cent of the total at a project. Given the nature of these loans, they are arranged in either non-recourse or limited-recourse format according to which repayments rely on the cash flows of a given project as opposed to the balance sheets of sponsors.

The debt modeling is concentrated on projecting loan repayment schedules, interest payments and adherence to the requirements of the lender owners with utmost accuracy. The model should replicate timings and tune of debts withdrawals throughout construction and principal and interest payments throughout operation. It can contain different debt structures including senior loans, subordinated debt or mezzanine financing, all of which would have different repayment structures.

A major characteristic of the debt modeling in project finance is debt sculpting. Participating in Project finance modelling training Singapore demonstrates how this approach matches cash flow patterns of projects with repayments to ensure debt service is done easily within the loan term. Other ratios that are calculated in the model are the debt service coverage ratio (DSCR) and the loan life cover ratio (LLCR), which describe the capacity of the project to meet its debt obligations. These ratios are observed very keenly by lenders in an effort to determine how creditworthy the person is and to establish financial covenants.

The model provides the stakeholders with an opportunity to assess the financial sustainability by highlighting the debt structure of the project accurately. It is also useful in negotiations with the lenders so that the sponsors can prove to the lenders that the project can pay its obligations even in the case of the base-case and downside scenario.

Equity Modeling: Capturing Investor Returns and Risk

Whereas debt offers leverage, equity offers risk and equity capital. Sponsors or investors provide equity capital in terms of assisting in the initiation of a project especially in the construction stage when the project is not generating any revenue. Equity modeling is concentrated on the contributions, distributions and returns through time.

Major metrics that have been calculated in the model are the equity internal rate of return (Equity IRR) and net present value (NPV), which quantify the profitability of investors. Participating in a finance project finance program helps professionals understand how these figures are affected by various variables such as project performance, leverage, and dividend policy. Equity investors would receive a substantial amount of money based on the long-term success of the project, as only after operating costs and debt liabilities are paid out would individuals be repaid.

Timing is an important aspect that should be considered in equity modeling. The waterfalls in cash flow in the model are used to make sure the money is allocated in order of priority, i.e. in operating expenses, then debt service, reserve accounts, and the last, equity distributions. Such structure bears the risk gradation inherent between lenders and investors.

Sensitivity test is also achievable using equity modeling. The model can be used to forecast how the returns of investors vary with varying conditions on the market by adjusting assumptions based on the assumption of revenue growth, cost increases, or refinancing. This assists the sponsors in deciding the amount of leverage to employ and also assists them in making decisions corresponding to the investment requirements.

Balancing Debt and Equity: The Capital Structure Optimization

The relationship between debt and equity is the core area of project finance modeling. It is critical to balance these two sources of funding and ensure maximum value is achieved at the same time without going bankrupt. High debt levels may show cash flows and create a risk of default and too much equity may dilute returns and decrease financial efficiency.

The model enables the analyst to experiment with the varying capital structure so as to find the most appropriate combination. This is done through the modelling of the results when in different leverages and the trade-offs of higher returns versus increased financial risk. As an example, a high leveraged structure can increase the equity IRR but decrease the DSCR indicating the increased susceptibility to the shortage of revenues.

Optimization is not merely a financial ratio, it also presents reflectance of market reality and preferences by stakeholders. Maximum leverage can be restricted by lenders and particular minimum returns can be desired by investors. With these constraints, the project finance model turns out to be a moving decision-making tool, because it can be adjusted to strategic objectives by integrating capital structure.

Moreover, with maturity of the projects, there might be refinancing. The model can be used to model refinancing cases, in determining whether replacement of the current debt with inexpensive financing would enhance returns without reduction in risk levels. This flexibility is essential in the sustainability of project in the long term.

Conclusion

The technical accuracy of finance is met with strategic decision-making where the debt and equity modeling are concerned. The two of them are used to determine the financing of a project, the distribution of cash flows and reduction of risk taken by stakeholders. To project finance professionals, this interplay is not only necessary to developing correct models but also to effect deal structure that will appeal to investors and meet the lenders.

An adequately formulated capital structure adds accountability, equilibrium and stability to a project. It makes financial commitments sustainable, optimises its returns and keeps all the stakeholders in line. With the world still investing in sustainable infrastructure and energy transition projects, whether in the form of modeling debt and equity interactions, it will remain one of the most marketable skills in the contemporary field of finance.

To the novice project finance modeller, learning this element of the project finance model is a prerequisite to greater proficiency. After time, the spreadsheet turns out to be more than a technical task; it emerges to be a strategic tool that allows its users to work out methods of financing which drive long-term economic growth and stability.