How to Master Infrastructure Project Valuation

Project Finance & Infrastructure Modeling: A Professional Guide to Structuring, Valuing, and Managing Large-Scale Capital Projects

Introduction on How to Master Infrastructure Project Valuation

The infrastructure of economic growth is also based on large-scale projects and capital-intensive projects, which concern energy, transportation, utilities, telecommunications and public services. The requirement to finance such projects necessitates a different fundamental analytical discipline as compared to traditional corporate finance. The core of the field is the project finance and infrastructure modeling, which is a professional tool, which concentrates on the cash-flow-based valuation, risk management, and financial sustainability over the long-term. Due to the growing dependency of governments, sponsors, lenders and investors on structured project finance solutions, the skill of constructing and decoding sound financial models has developed into a core professional competency.

The article aims at highlighting both practical and strategic aspects of project finance and infrastructure modeling, describing the mode that they are built, how models are used to make decisions and why they are essential in the assessment of complex infrastructure investments. The discussion also explains the difference between project finance modeling and infrastructure modeling and the standard corporate financial modeling and application in a real world project set up.

1. Understanding Project Finance & Infrastructure Modeling

1.1 Defining the Project Finance Modeling Framework

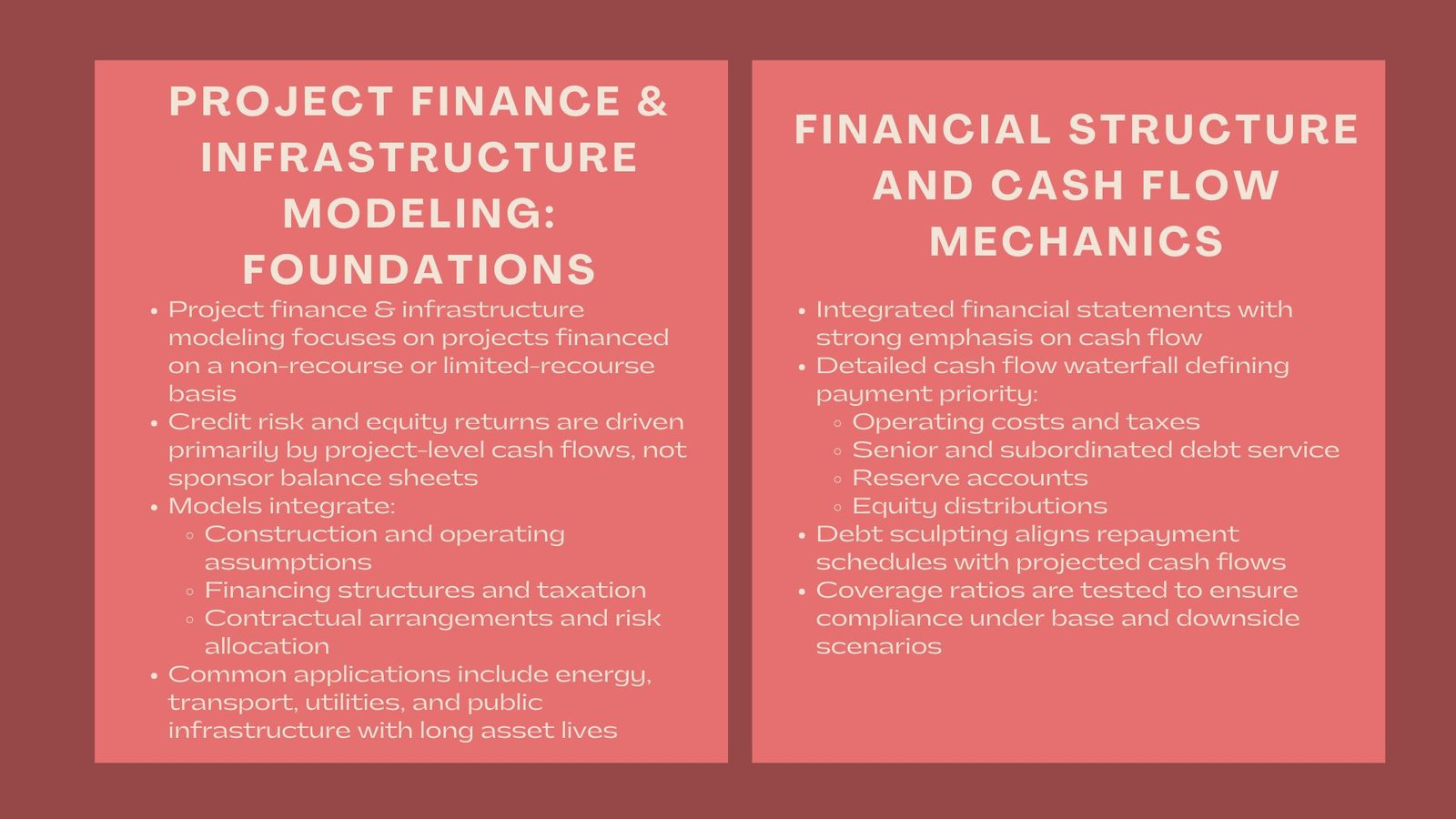

Project finance and infrastructure modeling can be defined as the formulation of elaborate financial models that are developed to analyze non-recourse or limited-recourse based projects that are financially funded. Project finance structures are based mainly on the cash flows of a project as opposed to the overall balance sheet of a company as is the case with corporate finance. The model is thus the main instrument in measuring credit risk, equity returns and financial viability in the long run.

In reality, project finance and infrastructure modelling merges assumptions of construction, operating performance, financing terms, taxation, and contractual related arrangements, in one analytic model. The model should replicate the distribution of risks and rewards among the sponsors, lenders, governments and other stakeholders throughout the life cycle of the project which is usually 20-40 years.

1.2 Why Infrastructure Projects Require Specialized Models

The infrastructural assets (power plants, toll roads, ports, and water treatment plants) have high initial capital investment and stable cash flow over a long period. The modeling of project finance and infrastructure modeling will bring this economic profile. It is focused not on short-term profitability but on debt service ability, covenant and stability of cash generation over time.

As an illustration, a project finance-financed renewable energy project is based on the long-term power purchase agreements. These contractual revenues need to be converted into estimated cash flows by the financial model and show that the project can finance the debt repayment in different cases.

2. Core Structure of Project Finance and Infrastructure Modeling

2.1 Integrated Financial Statements and Cash Flow Waterfall

One of the major characteristics of a project finance and infrastructure modeling is the combination of financial statements with an in-depth cash flow waterfall. The model normally involves the projected income statements, balance sheets, and cash flow statements, but mainly it is focused on cash flow available to service the debt and equity.

Cash flow waterfall identifies the order of payments, with the first being the operating costs and taxes, then the senior debt service, reserves accounts, subordinated financing and lastly the distribution of equity. Proper modeling of this hierarchy is important in project finance and infrastructure modeling since it directly influences lender risk and equity returns.

2.2 Debt Sculpting and Financing Structures

Project finance modeling Approximately 30 to 50 percent of the collected research focuses on the core analysis task of the debt sculpting used in project finance modeling and infrastructure modeling. Project finance models will not preset specific repayment schedules but will adjust debt service according to forecasted cash flows. This will ensure that the coverage ratios are not exceeded in the course of loan tenor.

As an example, lenders of infrastructure usually insist that minimum debt service coverage ratios are kept. Debt sizes, repayment profiles, and tests of the capability of the project to survive in poor conditions like reduced demand or increased operating expenses are learnt with the help of the model.

3. Risk Analysis in Project Finance & Infrastructure Modeling

3.1 Construction and Completion Risk

Construction risk is one of the biggest risks that have been handled in project finance and infrastructure modeling. The economics of the project can be significantly impacted by delays, cost overruns, and technical problems. Financial models use construction schedules, contingency budgets and drawdown profiles to determine the effects of Peter Pan of possible disruptions.

Practically, the lenders use these models extensively to determine whether contingency buffer and support systems of sponsors are adequate to cushion the debt during the construction stage.

3.2 Operating and Market Risk Assessment

After a project is operationalized the emphasis of project finance and infrastructure modelling changes to operating performance and market risk. Models are used to test the assumptions, which are concerning how efficiently the operations should be run, what the maintenance cost be, how the demand should vary, and how the prices should be determined. In this regard, scenario and sensitivity analysis is an important tool, as it can enable the stakeholders to assess downside cases and resilience.

Indicatively, in the transport infrastructure projects, the assumption of traffic volume would be stress-tested to determine the impact of less than expected usage on cash flows and capacity to meet debt service liabilities.

4. Applications of Project Finance Modeling & Infrastructure Modeling

4.1 Public-Private Partnerships and Government Projects

Project finance modeling and infrastructure modeling are used in the application of public-private partnerships. Governments rely on such models to measure value of money, affordability and risk transfer, whereas private sponsors rely on such models to measure returns and financing viability.

The model is a common analytical language between the public authorities and the private investors, which allows the transparent assessment of the long term contractual arrangements.

4.2 Energy and Renewable Infrastructure Projects

One of the most significant applications of project finance and project infrastructure modelling is in energy (especially renewable) projects. Solar, wind, and hydro projects are founded on a long term revenue contract and structured financing. Models determine the interaction between regulatory structures, tariff structures, and operating performance to achieve cash flows that are stable over decades.

These models help investors and lenders to compare projects based on their geographies and technologies to ascertain that risk-adjusted returns conform to investment standards.

5. Differences Between Corporate Financial Modeling and Project Finance Modeling

5.1 Balance Sheet Versus Cash Flow Focus

One of the differences between conventional corporate models and project finance and infrastructure modeling is the focus on the analysis. Corporate models will tend to value the profitability metrics and balance sheet strength whereas the project finance models will tend to value the predictability of cash flow and the ability to service debts.

Equity value in project finance modeling and infrastructure modeling is based once all the contractual requirements are met which demonstrates the significance of correct cash flow forecasting.

5.2 Contract-Driven Assumptions

Project finance models are very contract intensive. Revenue, expenses, terms of financing and risk distribution are in most cases regulated by long term arrangements. These contracts must be accurately modelled and this is why project finance and infrastructure modeling is more detailed and assumption-intensive as compared to the common models.

6. Professional Use of Project Finance & Infrastructure Modeling

6.1 Role in Investment and Credit Decisions

Project finance and infrastructure modeling is an input that financial institutions use when making decisions in relation to credit approval and investment. News Lenders test or evaluate the adequacy of projected cash flows to service debt on the basis of conservative assumptions, and equity investors test internal rates of return and distribution patterns.

Credibility of the model also has a direct impact on the financing terms, pricing and the eventual project feasibility.

6.2 Importance for Financial Advisors and Sponsors

Project finance and infrastructure modeling help advisors and project sponsors to organize, negotiate, and communicate value to project stakeholders. An effective model contributes to negotiations with lenders and allows explaining assumptions as well as offers grounds to monitor the project further.

7. Best Practices in Project Finance Modeling & Infrastructure Modeling

7.1 Transparency and Auditability

Project finance modeling Best practice and infrastructure modeling – Transparency is stressed in best practice. It should be documented that the assumptions are also clearly defined, the calculation well organized and the results simple to trace. This is necessary since the models will be reviewed by various parties such as the lenders, technical advisors and auditors.

7.2 Long-Term Flexibility and Scenario Testing

Since infrastructure projects are long-term, the models should be adaptable to meet the changes in assumptions and refinancing situations. Sound project finance and infrastructure modelling enables users to edit the inputs of the model, experiment with different structures, and assess the possibilities of refinancing or expansion without the necessity of recreating the model.

Conclusion

Project finance and infrastructure modeling is a key factor in facilitating development of large scale capital intensive projects which are the backbone of economic growth. Project finance and infrastructure modeling offers an intensive framework of the evaluation of investments that cannot be measured in the usual corporate finance methods alone by concentrating on cash flow sustainability, risk allocation, and financial viability in the long term. With the ever growing infrastructure investment around the world, individuals who are highly competent in project finance modeling and infrastructure modeling will still be needed to package bankable projects, risk management, and infrastructure provision of value to sponsors, lenders, and the general populations.