Introduction to Project Finance Modeling A Beginners Guide for Participants

Introduction to Project Finance Modeling A Beginners Guide for Participants

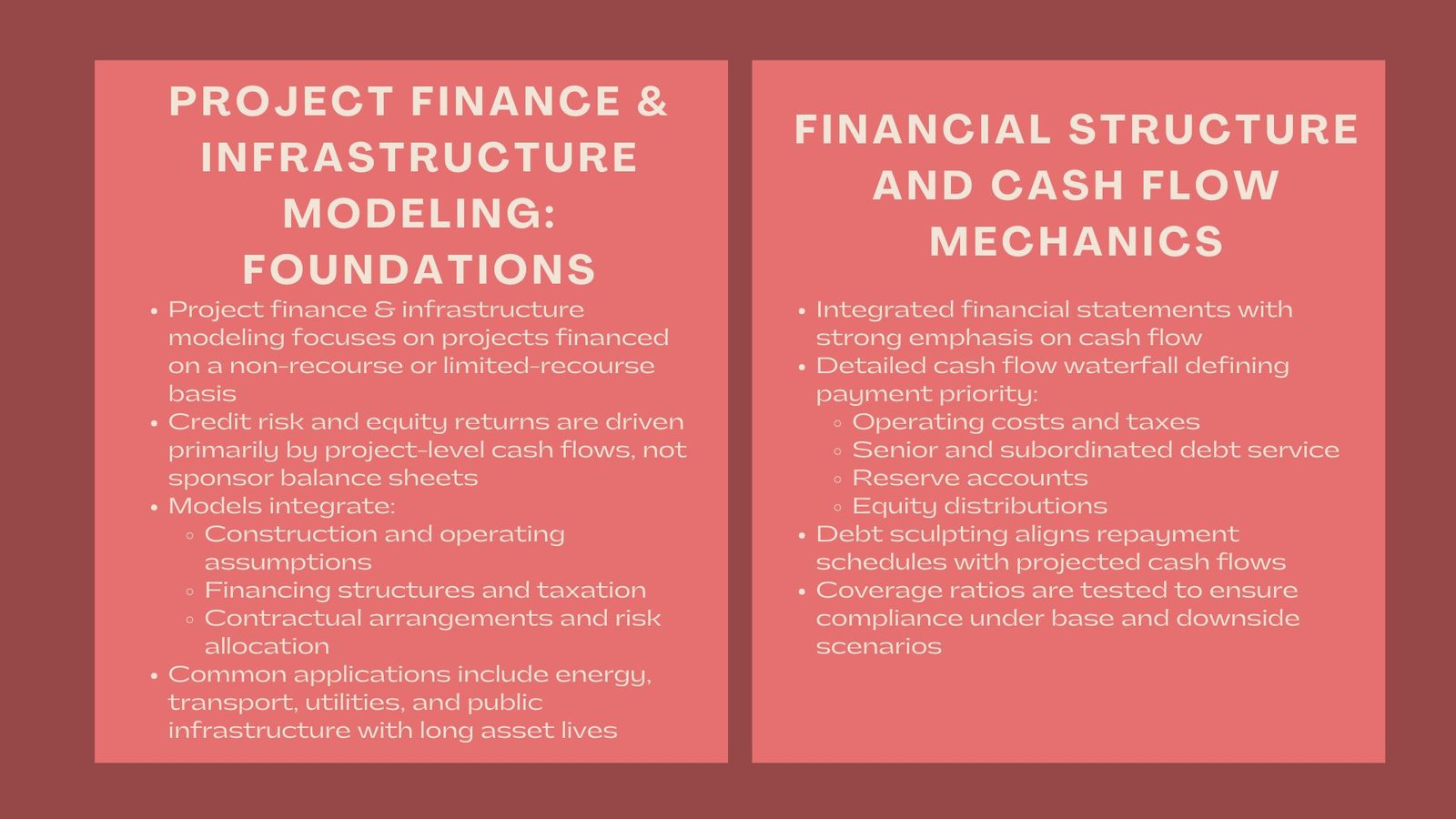

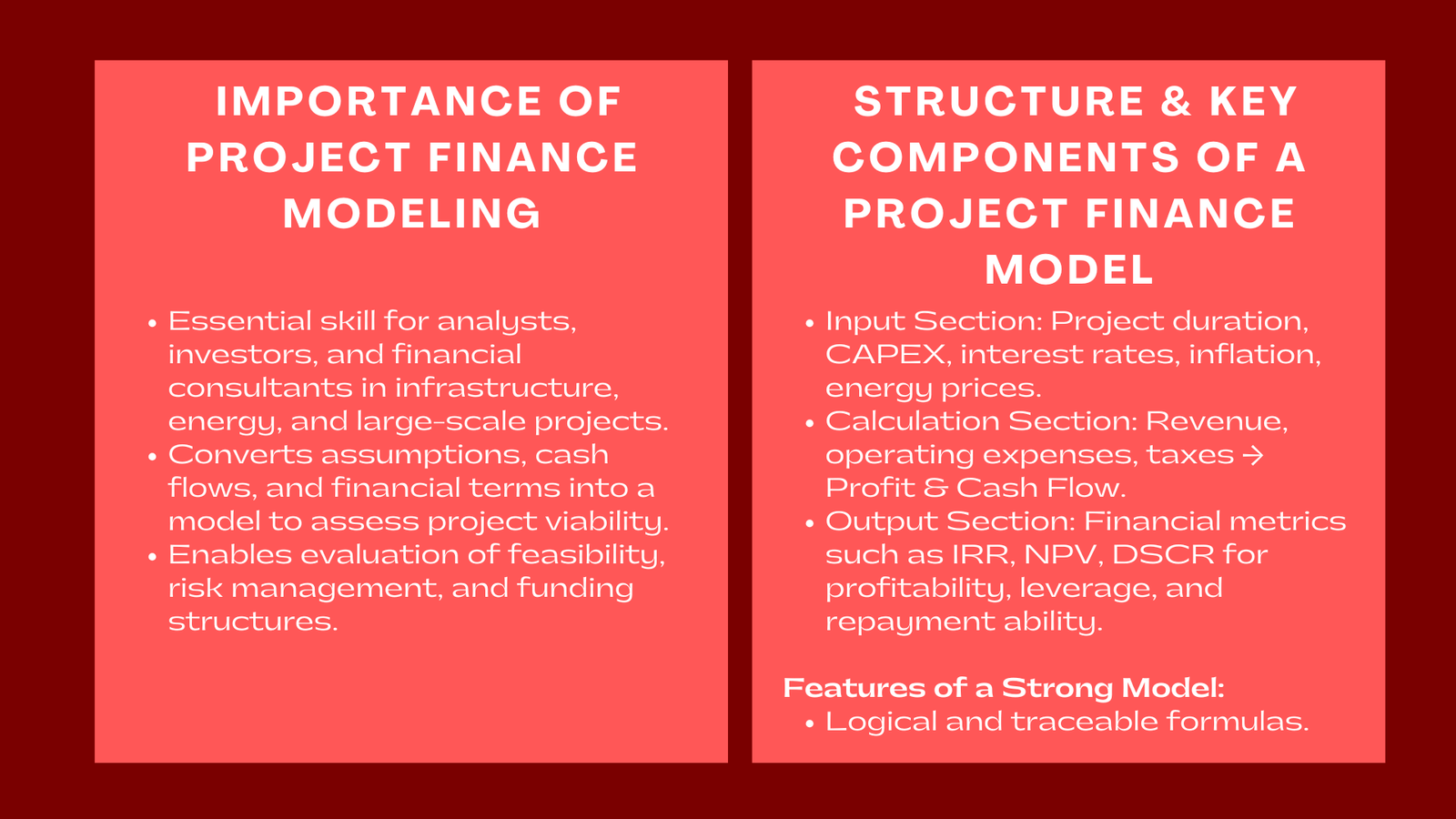

One of the most important skills of a professional involved in an infrastructure project, energy project and large-scale development projects is a project finance modeling. Be it an analyst, investor or a financial consultant, the topics of constructing and analyzing a project finance model are crucial in the determination of feasibility, management of risks and funding sources. The essence of a finance project model is the financial outline of a project- it has both assumptions and cash flows as well as financial terms, which are related to determine whether the project can maintain itself in the long term.

Project finance modeling may be overwhelming to the new writer. The models can be complicated with the formulae, timeframes and economic ratios, which are linking the engineering, operations, and economics together. Nonetheless, modeling is meant to make things simpler, and not to make things more complicated. This is achieved through a well-formulated model the transformation of technical and commercial data into actionable insights to enable the stakeholders comprehend the impacts of choices made on costs, revenues, and financing structures on project outcomes.

Project finance modeling is now an essential instrument in the sphere of finances due to the world-wide needs in infrastructure and clean energy whose needs are bound to rise. Investors and lenders use the correct models in assessing the predictability of cash flows and the ability to repay debts and developers to optimize their funding structures and negotiate with members. This paper presents the basics of project finance model, introducing the beginners into its major concepts, structure and significance in the contemporary investment decision-making process, which is also covered in a Project finance modeling course Singapore.

Understanding the Purpose and Importance of Project Finance Modeling

A project finance model is not a spreadsheet, but it is rather a decision making tool; it will enable the stakeholders to assess the viability and sustainability of a project financially. It mostly tends to predict the performance of a project in different conditions based on its construction cost, efficiency in the operations, and financing structure. The model provides answers to very important questions: Will the project be profitable enough to meet operating costs and prepare to meet service debt? What on the other hand happens in case of an increase in costs or a decrease in demand? To what degree is the project exposed to the fluctuations in interest rates or exchange rates?

As an example, consider a solar power company that is intending to construct a 100 megawatt solar facility. The company should convince the investors and lenders that the future cash flows of the project are high enough to repay the loans and provide expected returns before they choose to finance the project. The project finance model emulates this result, with assumptions on the solar generation, the electricity tariff, as well as the inflation and debt repayment. With the change of these variables, analysts would have the ability to experiment between the various scenarios to understand whether the project could still survive in a less desirable situation.

Project finance modeling is not limited with financial feasibility. It promotes accountability and transparency within all the parties. Since the majority of project financing deals are built on a non-recourse system or a limited-recourse platform (i.e. cash flows of these projects are key to repayment by lenders), the model has turned out to be an agreed upon reference point between the sponsors, the lenders and investors. Clear model minimizes the uncertainty, develops confidence and facilitates negotiation through the provision of shared analytical core.

Furthermore, the project finance models can be discussed as the tools of continuous management. Upon the project entering into the functioning stage, the model similar to what is taught in a project finance modeling course in Singapore is revised with factual information to monitor performance with respect to the forecasts. This will enable the managers to detect deviations at an earlier stage, review possible dangers, and provide a corrective measure. The model, in essence, transforms as the project progresses to become both a planning tool and a monitoring performance tool.

Key Components and Structure of a Project Finance Model

A project finance model structure is similar to the project life cycle, starting with its pre-development perspective throughout its building, running, and even demolition phase. Each part is formulated to indicate financial dynamics which occur in the real world in a rational and open manner. The inputs are the starting point of the foundation, the calculations and finally the outputs that are required to summarize the key financial indicators.

The input section determines the assumptions of the model as it addresses the duration of the project, the rates of inflation, the interest rate, the energy prices as well as capital expenditure (CAPEX). All the future calculations make their base on these assumptions. The calculation section then based on these inputs then constructs project revenues, operating expenses and taxes to give the project profit and cash flow statements. The results are then summarized under the final output to financial measures the project internal rate of return (IRR), equity IRR, net present value (NPV) and debt service coverage ratio (DSCR) each containing an indication of profitability, leverage and repayment ability.

The consistency is a crucial element of the model design. The reasoning should be logical and traceable, meaning that the users should be able to know how each figure is calculated. This is especially vital when it is external stakeholders making reviews of the models, including financial institutions or auditors. Participating in a project finance modelling training Singapore program emphasizes this need. The lack of consistency or clarity in a model may result in misunderstanding and a lack of trust in the analysis. Novices would always be strengthened on the need to develop clean and well-structured spreadsheets that have clear formulas and are well documented.

The other characteristic feature of a strong project finance model is that it is flexible. Lancaster (2009) states that the conditions of a project may vary with time thus; the model should enable users to run through numerous scenarios with ease. To illustrate, the effect of an increase in interest rates, postponements in construction or the reduction of revenue in the project can be simulated by analysts to measure the resiliency of the project. This is referred to as sensitivity analysis, and it assists in determining the most decisive variables that influence financial results to enable the stakeholders to concentrate on how to limit the significant risks.

Practically, project finance model structure also indicates the flow of finances in a project special purpose vehicle (SPV). This involves the modelling of cash flow of distribution- operating costs are met first then debt service and lastly equity returns. This structure allows the lenders to be priority-based which is in line with the risk-return expectation of various investors.

Building Confidence and Decision-Making Through Financial Modeling

The actual worth of project finance modeling is beyond technical calculations as it provides a sense of assurance to making decisions. An effective model that is well built will enable the stakeholders to make objective judgment on the performance of the project, compare the available options of planning to take and implement their strategies. The investors can, as an example, determine whether equity returns of a project are within their target levels and the lenders can determine whether or not cash flows are low enough to retain long-term loans.

The model is an effective negotiating tool to the project developers. To attract investors or banks to sponsor their projects, sponsors have the model portrayed to them to show that they are financially robust. The model tends to go through rigorous due diligence by the lenders as a way of ensuring the model assumptions and outputs. The clearer and more precise the model, the more authority it gives the project team, which has a high probability of attaining good terms of financing.

Besides, the models of project finance can assist in the collaboration of multidisciplinary teams. The model is known by engineers, economists, lawyers, and financiers as the fundamental revenue of financial fact. It matches technical facts – including capacity, rates of production, efficiency and business arrangements such as power purchase contract, or concession. With the combination of these various aspects, the model assists in making sure that the entire stakeholders work based on the same expectations.

The significance of model integrity is hard to overestimate. Such mistakes or negligence may have far reaching financial consequences, as well as overestimating returns and underestimating risks. Thus, model auditing and checking are the common procedures used in project finance transactions. The model may be checked by independent experts taking into consideration the fact that it adheres to the standards of the industry and incorporates reasonable assumptions. As an amateur one will always find it useful to know how to audit and validate a model just as you know how to construct a model.

Besides the financial uses, project finance modelling is also used in the wider strategic objectives. Models are gaining more and more popularity by governments and developers as an evaluation way of determining whether a project is sustainable and socially acceptable. In renewable energy, as an example, models can be used to determine the extent to which the savings of carbon can be converted into long-term economic returns, formulating policy and investment actions and making them in line with the target of sustainability.

Conclusion

Project finance modeling is in the nexus between finance and strategy and the real world development. It allows professionals to convert technical and commercial assumptions into financial results providing the gap between the idea and the implementation. To a beginner, learners should not only learn formulas in project finance, they should learn how the capitals, risks, and rewards work together over time in order to generate viable and long-term values.

With the world trend of investment moving to sustainable infrastructure, renewable energy and digital transformation, the role of the professional who is adept at getting the investment models out of project finance will continue to increase. Individuals who are able to construct, comprehend, and reveal model insights will be central in shaping the financial undertakings of the massive projects.

Finally, to the quest of becoming a good project finance modeler, it is a learning process that never ends. Every project presents a new challenge, fact, and market reality you have to take into consideration in your analysis. By gaining a strong base of mastery in structure, logic, and interpretation of financial models, you will not only be a financial modeler but as a strategist with the ability to transform numbers into actions to be taken.