Risk Identification and Mitigation in Project Finance Models

Risk Identification and Mitigation in Project Finance Models

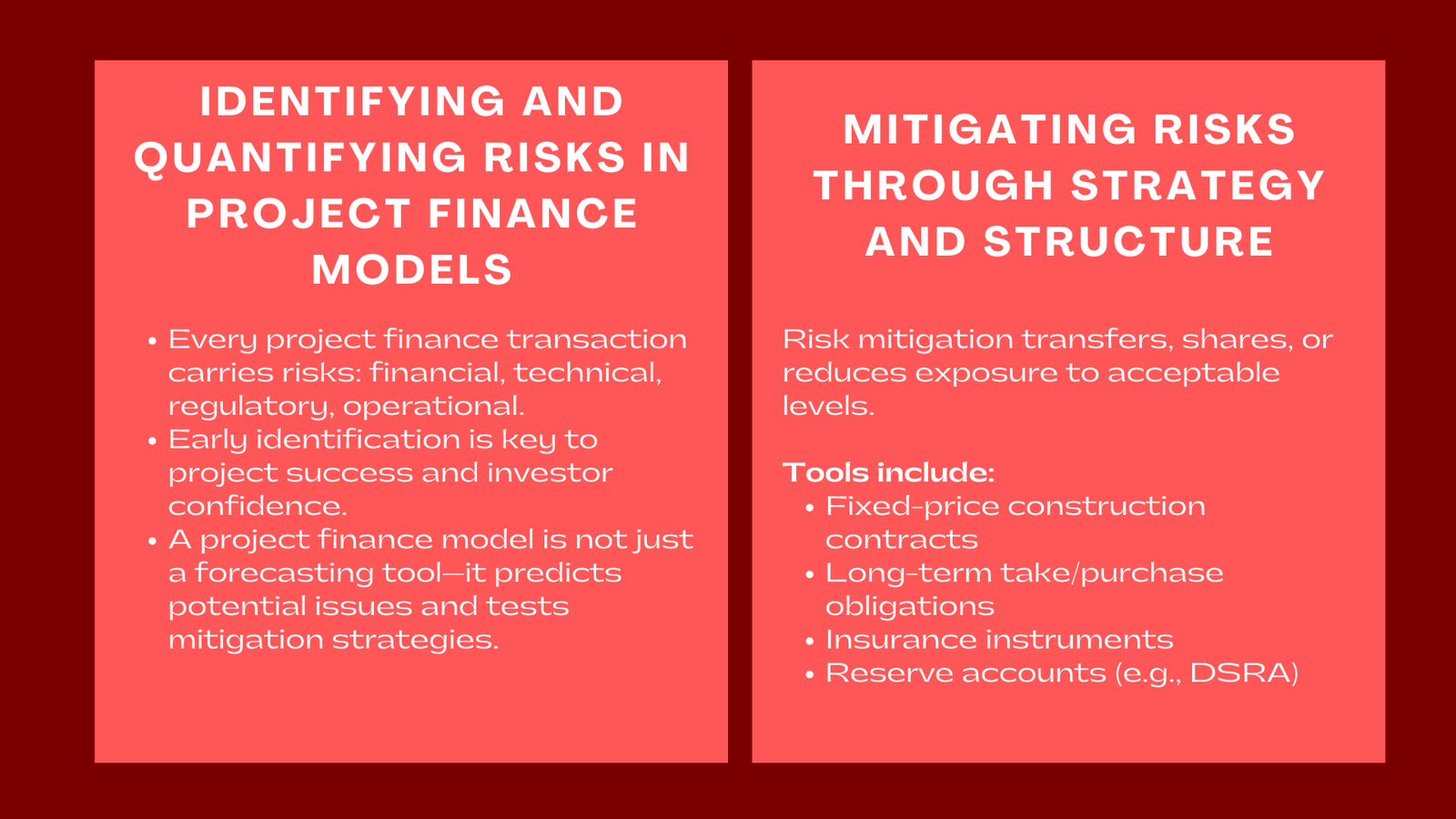

Every project finance transaction has risk involved – financial risk, technical risk, regulatory risk, and operational risk. Early identification and management of such risks is critical to the project success and investor confidence. A project finance model is not only a financial prediction; it is a great risk management tool as well. It yields the possibility of analysts to predict where issues or problems could happen and test how different mitigation strategies influence the final and all around performance.

In practice, this means that a well-designed model goes beyond forecasting; it becomes an early-warning system that identifies financial stress points, tests downside cases, and provides a roadmap for how the project might perform under different conditions. This proactive approach empowers decision-makers to design safeguards—whether through contractual protections, reserve mechanisms, or hedging instruments—that reduce the impact of uncertainties and external shocks.

Effective identification and mitigation of risks lie at the centre of good project finance modelling Singapore. By continuously integrating updated information and stress-testing the assumptions, analysts ensure that projects remain financially viable even under adverse market conditions. They make sure that projects are financially viable even in uncertain circumstances and that lenders and investors believe that the project will be capable of delivering stable returns.

This article covers how the risks are identified, assessed, and mitigated in the project finance models with a strong focus on the importance of transparency and forward- looking management, and the integration of robust risk analysis into every stage of financial modelling and project decision-making.

Identifying Risks in Project Finance

When risk management, the first step is to know what causes the risk. In the case of project finance, risks emanate from various sources such as construction delays, cost overruns, equipment breakdown, interest rate fluctuations, exchange rate fluctuations or regulatory changes. All of these risks can have major effects on the cash flows and debt repayment capacity of the project.

A project finance model is useful in identifying these risks by measuring the impact of changes in assumptions on key financial measurements. For example, how project finance models help manage financial and operational risks analysts can introduce a delay in construction and see how that impacts interest during the construction (IDC), total project cost and the beginning of revenue generation. Similarly, trends can be modeled for factors such as energy prices or exchange rates to determine the impact on profitability and loan coverage ratios.

Similarly, scenario-based decision-making converts intangible risks into financial results that stakeholders can quickly and easily summarise to determine which risks require the most of their attention.

Quantifying and Modeling Risk Impacts

Once risks are identified the next step is to quantify the possible impact of the risk. The analytical laboratory for this process is the project finance model. With input adjustments and scenario testing, analysts are able to discern the project’s sensitivity to particular risk factors.

For example, if an increase of 5% in the cost of the construction significantly reduces the project’s equity IRR or DSCR, it is an indication of high cost sensitivity. The knowledge created helps shape negotiations and Comments decisions regarding contingency budgets, insurance provision or contract structures.

Financial risks like interest rate or foreign exchange volatility are often simulated by means of variable rate assumptions or currency conversion schedules. Operational risks (e.g. reduced production efficiency) are modeled in the form of reduced output, or higher assumptions for OPEX. The purpose is to convert each risk into a measurable impact on cash flow; achieve transparency in terms of evaluation and comparative aspect.

Mitigating Risks Through Structure and Strategy

Mitigation tools in project finance are meant to transfer, share or reduce risks to acceptable levels. The model is important in assessing the performance of the strategies. Popular mitigation instruments include early procurement of those mitigation instruments that are fixed-price type construction contracts, long-term take or purchase obligations, insurance instruments, and reserve accounts. Learning these techniques in a project finance modelling course Singapore helps professionals understand how to effectively apply these risk mitigation strategies in real-world financial models.

For example, a debt service reserve account (DSRA) can be incorporated in the model to provide for a cushion against temporary shortfall of revenues. In addition, revenue stabilising instruments can be modelled based on inflation-linked tariffs or foreign exchange hedging instruments in volatile markets.

The model is also used to understand the impact of alternative capital structures on the exposure to risk. Higher leverage can increase the financial returns but, at the same time, influence higher sensitivity to cash flow fluctuations. By simulating different debt-to-equity constructions, stakeholders can find the construction with the optimum relationship between danger and return.

Conclusion

Risk identification and mitigation are not one-off exercises – they are an ongoing process inherent in every part of the Project finance modeling process. A good model offers a transparent way to find vulnerabilities and to evaluate the effectiveness of the prescribed mitigation strategies.

At the end of the day, risk management in project finance is a visionary task. The ability to forecast and anticipate potential disruptions and prepare for them defines project success or failure. By incorporating the use of rigorous risk analysis into financial modelling, professionals can ensure that decisions are not merely made based on the outcomes they are likely to see – but rather that they also take into account how they are more resilient when the unexpected takes place.

In an industry where billions of dollars and decades of operations hang in the balance, the art of financial modelling has transformed from a skill to a necessity, where achieving success in the long run, relies on identifying and mitigating risk.