Understanding Financing Structures and Capital Sources for Infrastructure Projects

Understanding Financing Structures and Capital Sources for Infrastructure Projects

Learn Financing Structures and Capital Sources for Infrastructure Projects

Mega-projects in infrastructure, realestate, renewable energy and corporate growth depend very much on access to structured finance. Failure to have good financial planning and a blend of different sources of capital could kill the most innovative idea before it goes into execution. The nature of financing not only defines how a project is to be financed but equally identifies apportionment of risks, returns and responsibility among stakeholders. The investors, lenders, and sponsors will require their interests to be aligned by crafting appropriate financing structures. Knowledge of the multiple capital sources, including equity, debt and hybrid capital and instruments is essential in determining that projects attain financial viability, sustainability and long-term profitability.

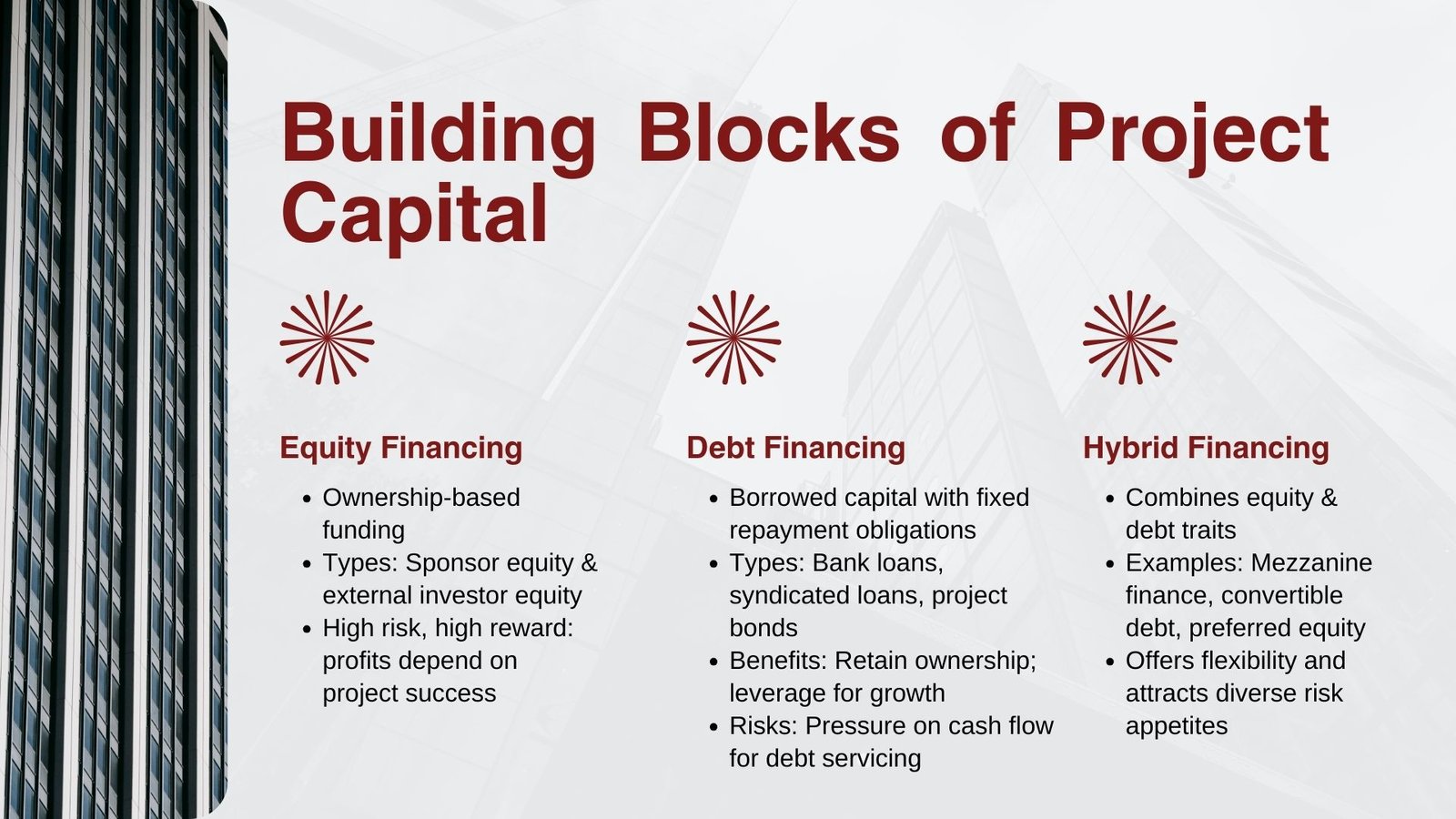

Equity Financing: Ownership and Risk Sharing

Equity financing is also central in the investment in projects, particularly those ventures that entail good commitment of sponsors and investors. Contrary to debt where one has to carry the projects that he has funded with an interest whether the project runs well or not, equity is ownership. Equity investors that invest in terms of equity funds are more heavily involved in risk bearing as the returns that they receive are based on the success the project achieves. In its turn, they also have an advantage of their possible share in profit and the growth of capital.

Equity in project financing comes in two broad categories; that of the sponsor equity and the outside investor equity. Sponsor equity is provided by the project investors or promoters who exemplify their confidence in the project by investing in it with their funds. This will be an indication of the viability of the project and also that the incentives of the sponsor is aligned with other investors. Equity capital may also be required from an outside investor such as institutional investors, Private equity firms, or venture capital funds depending on the type of the project and riskiness of the project.

Equity financing plays an important role at the initial stages of a project when risks are more pronounced, and it is important to attract more funds in projects by the lenders of the project. Because equity holders are residual claimants, all performance risk falls on them but also they can make a disproportionately large profit in case of a successful project. For professionals looking to master such concepts in depth, enrolling in the Best financial modeling course Singapore can provide the skills to evaluate equity financing structures, assess project risks, and forecast potential returns effectively.

Debt Financing: Leveraging Capital for Growth

Debt financing is the other pillar of investments in projects that offers funding of substantial amounts of capital yet enables the project sponsors to continue to be in control of ownership. Projects funded by borrowed capital in the form of bank, financial and/ or bond financing can utilize future cash flows currently in order to meet current project requirements. Debt has fixed obligations in the form of principal repayments and interest and therefore it is not as flexible as equity but tends to be less costly as far as the cost of capital is concerned.

In project financing, the debt allocation is differentiated by the type of project, the magnitude, and the rating of the project under consideration. Common avenues to use are traditional bank loans, syndicated loans and project bonds. Syndicated loans allow several lenders to combine funds in financing large and capital-intensive projects, and risk is shared amongst the participants. Issued in capital markets, project bonds allow projects to obtain long-term funds in the form of capital raised by institutional investors e.g. pension funds and insurance companies.

Debt financing poses the risk of having to service the loans in the instances where the cash flows are insufficient, thus putting pressure on the financial health of a project. To avoid such they usually use collateral, guarantees or special purpose vehicles (SPVs) which shelter the sponsors in relation to the project risk. Although debt has a stiff repayment regime, it has been a popular tool owing to the fact that it enables the sponsors to leverage investments and retain majority shares on the project.

Hybrid Financing: Bridging the Gap Between Equity and Debt

The hybrid financing instruments have gained relevance in the project financing environments. These vehicles have elements of both equity and debt instruments, and provide an intermediate between flexibility to the borrower and security of the lender. Examples are mezzanine finance, convertible debt and preferred equity.

The financing that is pertinent to the project that involves established cash flows is Mezzanine financing which involves the infusion of capital to the project that exceeds conventional loan finance. It is most commonly issued in the form of subordinated debt of higher interest rates, possibly combined with equity warrants. With convertible debt, lenders are able to exchange their debts with equity in the event of designated circumstances, and this makes their interests alignable with the performance of the project. Preferred equity Conversely, preferred equity confers dividend rights on investors, precedence over common equity holders, and is not as risky as a standard equity, but more lucrative than pure debt.

Hybrid financing structures are practical when the project has special funding needs, i.e. when funding needs accommodate various risk-return demands. They enable the sponsors of projects to exercise flexibility as well as attract more investors with different risk preferences. For professionals seeking to better understand these financing strategies, basic finance courses for professionals Singapore provide the foundation needed to analyze and apply such instruments effectively in real-world projects.

Alternative Capital Sources: Expanding Financing Horizons

In addition to conventional equity, debt and hybrid instruments, alternative sources of financing in the projects are also becoming increasingly common. The changing financial landscape has availed new insinuations of raising capital, most especially in areas like renewable energy, technology, and infrastructural development.

Public-private partnership (PPP) is one such avenue wherein governments (usually central governments) work to fund huge infrastructure projects in collaboration with other private investors. PPPs offer a compromise between the aims of the public sector and the effectiveness of the private sector, with sustainable delivery of basic service, including transport, water and energy.

Impact investing is another emerging capital source where the investors do not only aim to get a return function, but they also target a tangible environmental and social impact. This has especially had its impact on renewable energy schemes and sustainable urban development programmes. There has also been the development of crowdfunding platforms and peer-to-peer lending as financing sources to smaller projects where a broad base of individual investors is available to provide capital.

Another important role in facilitating projects in emerging economies is played by export credit agencies and the development finance institutions (ECAs and DFIs). They also offer mitigation tools to risk and lasting capital and guarantees to facilitate the project to break down barriers, which hinder the introduction of international capital markets.

The variety of these alternative sources of finance diversifies funding, lessens dependence on conventional capital sources, and removes goals of funding as regards to larger social and financial goals.

Structuring Project Finance: Aligning Risks and Returns

Whether or not project investments can be successful is not only determined by finding sufficient financing but also by the way this financing has been structured. Project finance is normally carried out via what is known as a Special Purpose Vehicle (SPV), in other words, a form of legal separation of the project risks, assets, and liabilities by the sponsors. The structure guarantees that the lenders and the investors will not possess claims on the balance sheets of the sponsors but just on the cash flows of the project.

An efficient financial structure would disperse risks among the stakeholders in a manner that is consistent with risk-management ability of the stakeholders. Such as construction risks can be carried by contractors in terms of fixed-price, date-certain contracts, and market risks can be apportioned among sponsors and off-takers through long-term supply contracts. To maintain the ability to service debt, lenders want to see plenty of due diligence, modeling and protection in the contracts.

Debt and equity must be balanced in order to sustain the financial status. There is an over-debt/liquidity/concentration which raises repayment pressure, and there is an over-equity which dilutes returns to sponsors. This balance can be optimized using hybrid instruments, alternative sources of financing. Finally, project financing mechanisms must be bankable, i.e. to persuade investors and lenders that the project is capable of making a steady profit.

Conclusion: Strategic Financing as the Key to Project Success

Considerable elements of trade in the configuration of financing structure in accordance with the selection of the risk sharing and several values of capital. Equity sources are naturally an ownership/risk capital and debt sources have leverage/scale and hybrids/alternative sources are flexible and increase the opportunities in the emerging sectors and markets. A combination of these financing facilities makes a kit that project sponsors can be converted to suit their individual specifications in a venture.

Innovative financing structures will remain central to ensuring global capital markets evolve and investments are made in a way that better considers sustainability as investors make this more of a priority. The project sponsor should also be flexible by being aware of the advantages and weaknesses of the financing alternatives as they need to relate their strategies to long term goals. After all, financing involves more than raising capital-it is ensuring financial viability of projects, their resilience and the ability to deliver value to all stakeholders.