Understanding Project Financing Structures and Funding Sources

Understanding Project Financing Structures and Funding Sources

Introduction to Understanding Project Financing Structures and Funding Sources

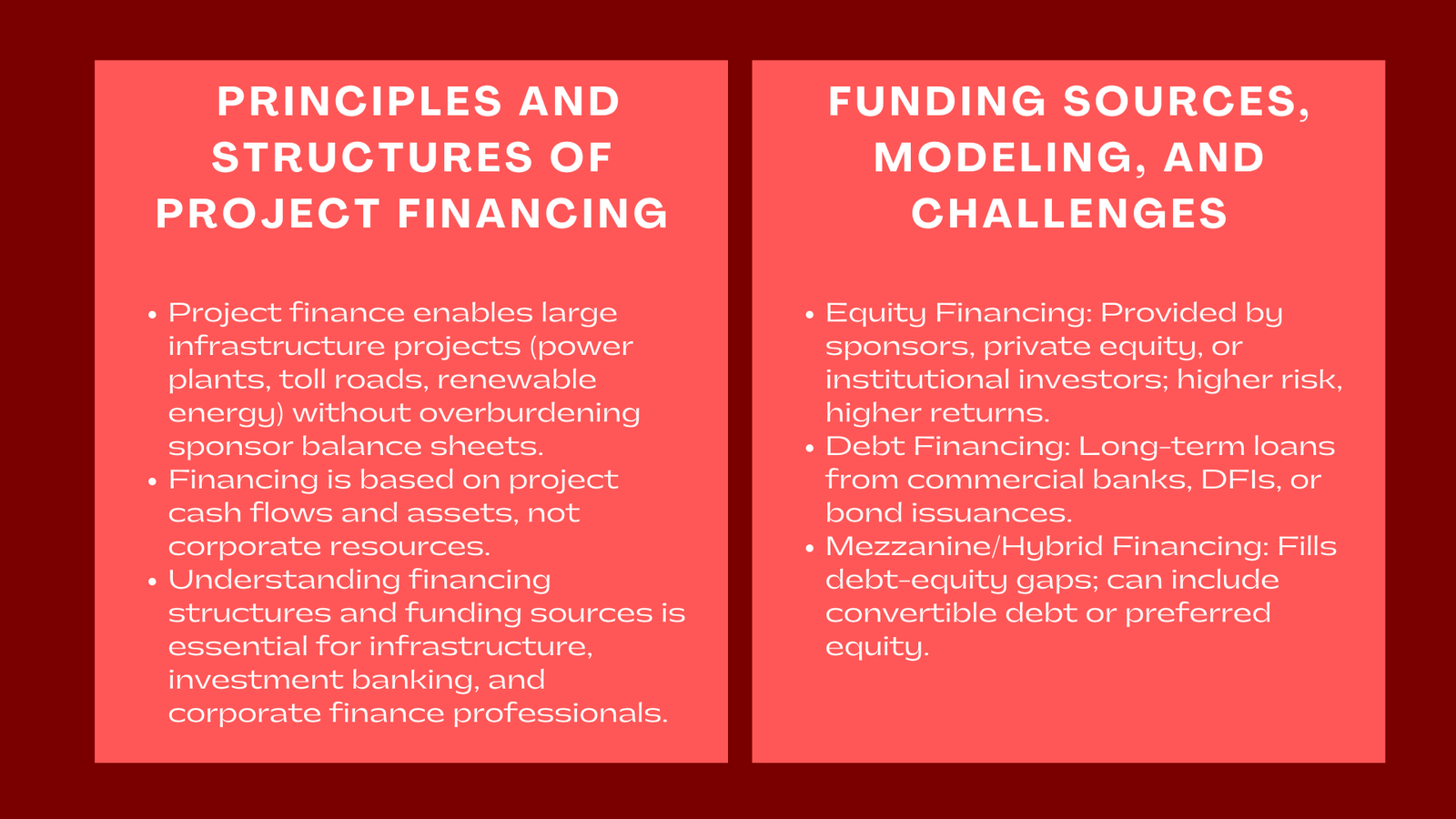

Project finance is a key element in facilitating massive infrastructure and industrial projects in the globe. As opposed to conventional corporate financing, project financing is organized based on the cash flows and assets of the project, not the balance sheet of the sponsor. By means of this form of financing, companies are in a position to undertake capital intensive projects like power plants, toll roads, renewable energy plants and telecommunications infrastructure without overburdening their corporate resources.

Knowledge of project financing structure and source of funds is very essential to those working in the infrastructure development, investment banking and corporate finance field. It gives an understanding of the distribution of risks, returns and responsibilities among the stakeholders so that the projects are not only viable in a financial manner but also bankable. Professionals seeking to enhance their expertise often explore how to build realistic assumptions for project finance model Singapore, which helps ensure accurate forecasting and credible project evaluations.

The Principles of Project Financing.

Long-term infrastructure and industrial projects with the stable and predictable cash flows are normally financed by project finance. The funding is designed in the form of non-recourse/limited recourse where lenders depend on the ability of the project to generate revenue to pay them back as opposed to the assets of the sponsors.

A standard project finance is whereby the project is owned by a Special Purpose Vehicle (SPV), which is a legally separate vehicle, with which the project contracts, raises both debt and equity and assumes the risks of the project. The SPV and all the financial obligations are ring-fenced and project risk is separated off the parent companies.

In this context, the investors, lenders, and sponsors consider a number of significant aspects before investing capital:

- The revenue model, that will include the source of income (e.g. user fees, power purchase agreements or government concessions).

- The cost structure, which involves construction, operations and maintenance cost.

- The risk distribution between parties, which includes construction risk, market risk and regulatory risk.

Typical Project Financing Structures.

Various projects have varying financing arrangements depending on the nature of the sector, riskiness, and capital requirements. Others such as the most widely used ones are:

Build-Operate-Transfer (BOT)

The project in a BOT structure is financed, produced and run by a privately incorporated organization over a set time and then handed over to the government. The model is used in the public infrastructure scheme of projects like the toll roads, water treatment plants and airports. It enables the state sector to utilize the private sector experience and resources and retain ownership eventually.

Build-Own-Operate (BOO)

In a BOO type, the ownership of the asset is held by the private company indefinitely. This is typical of energy and utilities projects where long-term control enables investors to reap the benefits of perpetual cash flows in the long run.

Public-Private Partnership (PPP).

PPP arrangements are partnership arrangements between the public and the private. They share risks and rewards between the two parties and this makes them suitable in social infrastructure projects such as hospitals, schools and public transport systems. The design, financing and functioning of the project are usually done by the private partner, with the regulation and policy underpinnings by the state.

Joint Venture (JV) Project Financing.

In joint venture models, there are several sponsors who have an equity stake and an obligation in a project. This is common in resource extraction and renewable projects and is viewed as a way of limiting a financial risk and also integrating technical skills.

All these structures affect the financing mix of the project and its ownership structure, as well as its sustainability.

The Major Funding sources in Project Finance.

Finding and ensuring the appropriate mix of funding sources is a great determinant of the success of a project. The majority of project finance transactions are either equity, debt, or hybrid instruments, as they would fit the requirements of the project, in terms of finance and operations.

Equity Financing

Project sponsors, institutional investors or private equity funds tend to provide equity. Sponsors assume greater risk as well as make higher returns when the project turns profitable. In others, equity participation is often distributed among the local partners or governments to make them responsible towards national development orientation.

Debt Financing

Most project finance deals depend on debt as a major source of funding. It can either be on commercial banks or development finance institutions (DFIs) or export credit agencies (ECAs). Careful due diligence is done by these lenders to evaluate the cash flow projections of the project, credit worthiness, and contract protection.

The long-term loans are usually the loans with a maturity of 10-25 years and which are usually made in power area, infrastructure, and utilities. Debt financing can also involve the issuance of bonds in developed markets where investment in infrastructure investments is high among the investors.

Mezzanine and Hybrid Financing.

Mezzanine financing fills the debt-equity gap. It offers extra funds and still is flexible in repayment. It is also possible to attract investors to a balance between a stable income and upside potential by use of hybrid instruments like convertible debt or preferred equity

Government and Multilateral Support

Many large-scale infrastructure projects benefit from government guarantees, subsidies, or viability gap funding (VGF) to attract private investors. In developing countries, multilateral agencies such as the World Bank, IFC, or Asian Development Bank often provide credit enhancements or co-financing arrangements that improve project bankability and mitigate political or regulatory risks.

The Due Diligence and Financial Modeling Role.

Under every project finance transaction, sound financial modeling is necessary in order to test the feasibility of the project and the identification of risks. The financial model brings together assumptions regarding the revenues, costs, terms of financing and the effects of taxes to predict the performance of the project during its lifecycle.

Professionals working on project financing structures and funding sources use detailed models to determine optimal capital structures, calculate debt service coverage ratios (DSCR), and assess sensitivity under various scenarios. The models aid in the lending, investment, and government agency decisions by giving clear information on the exposure to risk and anticipated returns.

Due diligence is also imperative. Legal, technical, environmental and market analysis are used to make sure that the project is in accordance with the regulations and sustainability norms. Detailed due diligence will enhance the confidence of the lending parties and it will enhance the chances of financial closure.

Project Finance Challenges.

This notwithstanding, project finance has a number of challenges. Project viability may be influenced by political instability, uncertainty in regulations and fluctuations in foreign exchange. Also, the projections in finances may become overstretched due to lengthy approval processes and cost overruns in the construction.

A second major issue is the conflict of interests between various stakeholders, who include governments, investors, lenders, and contractors and all are having different priorities. Effective projects must have open governance systems, proper exposure of risk-sharing and never-ending stakeholders action.

Conclusion

The knowledge of project financing structures and funding sources is a crucial aspect to the professionals operating in the infrastructure, energy, and industrial projects. Learning the principles of non-recourse financing, SPV structure and multi-layered funding structure, finance professionals can help in ensuring sustainable project development and effective financial closing.

The world infrastructure development is increasing, and this raises the demand of experienced project finance specialists. Individuals that grasp the inter-relationship between structure, funding, and risk management will be in a good position to be on the forefront of this dynamic and high impact area.