How to Model Debt Service Reserve Accounts DSRA in Project Finance

How to Model Debt Service Reserve Accounts (DSRA) in Project Finance

Introduction to How to Model Debt Service Reserve Accounts DSRA in Project Finance

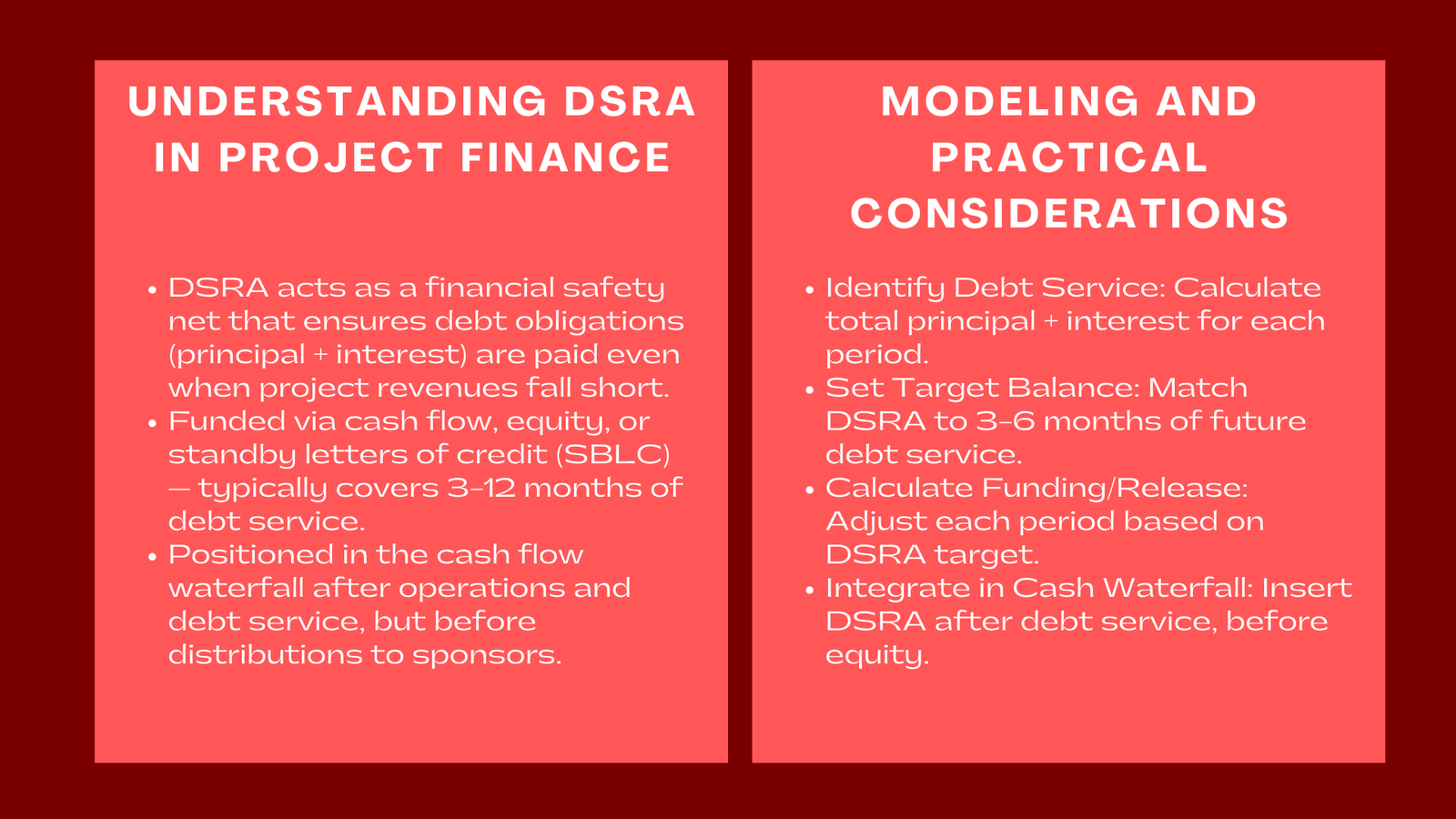

In project finance, consistency of debt repayment is quite important in the sustainability and creditworthiness of a project in the long run. Most infrastructure and energy projects are highly leveraged hence lenders tend to need extra mechanisms to cushion against cash flow deficits. The Debt Service Reserve Account (DSRA) is one of the most necessary mechanisms towards this end.

The DSRA is a financial insurance mechanism, whereby in case a project suffers temporary revenue decline or operational hiccups, there will be enough money to pay debt service obligations- usually principal and interest payment. For finance professionals, learning how to model debt service reserve accounts (DSRA) in project finance is an important skill that blends technical modeling expertise with a deep understanding of lender requirements and financial structuring.

Understanding the Role of DSRA

The DSRA aims at cushioning the lenders and investors against payment default when the cash inflows of a project are low. It is a specific account, which is funded either by cash flows of a project or an equity contribution, or in certain cases by standby letters of credit. The sum that is deposited in the DSRA tends to be a fixed number of months of debt service—often 3, 6 or 12 months depending on the risk profile of the project and the terms of the financing. Through project finance modeling training Singapore, professionals can master DSRA modelling techniques to ensure accuracy and reliability in financial models.

This is not a long term component of project liquidity. Rather, it is a buffer which is replenished during the course of using the loan and preserved during the tenor of the loan. Under normal cash flow waterfall DSRA funding or replenishment comes following operation costs and senior debt service, but prior to distribution to sponsors.

Major Elements of DSRA Modeling.

In developing a project finance model, the proper structuring of the DSRA will guarantee that the coverage ratios in cash flows are high and that all the lenders requirements are not overlooked. There are various ways of how the DSRA can be financed, and every funding mechanism has its influence on the cash flow of the model.

Initial Funding

The DSRA can be funded at the close of the financial year entirely with equity or a proportion of the initial drawdown of debt. This approach gives instant coverage but cuts other project costs. The source of funding should be well indicated in the model to make sure that full financing is balanced.

Slow Financing of Cash Flows.

Instead, it is possible to accumulate the DSRA progressively on the basis of the operating cash flows after the project goes operational. This is a way of alleviating the burden on start-up financing at the cost of lenders who are forced to bear it in the start-up period.

Standby Letter of Credit (SBLC).

On other projects, an SBLC is used instead of a funded reserve. This alternative does not tie up funds, but must have a bank guarantee and can have an annual fee. These costs should be captured in the financial model and the contingent liability revealed.

Each funding approach influences cash flow timing, internal rate of return (IRR), and debt service coverage ratio (DSCR). Therefore, modeling accuracy and transparency are vital for evaluating lender and investor comfort.

How to Model DSRA in Excel

Professionals who specialize in how to model debt service reserve accounts (DSRA) in project finance typically use Excel-based financial models that integrate the reserve into the project’s cash flow waterfall. The modeling process involves several logical steps to ensure accuracy and compliance with lender requirements.

Step 1: Define Debt Service Requirements

Begin by identifying the total debt service for each period—both interest and principal repayments. This figure will be the reference point for determining DSRA requirements.

Step 2: Determine DSRA Target Balance

Set the DSRA balance equal to the required number of months of debt service (for example, 6 months). This is often expressed as:

DSRA Target = (Debt Service for Next 6 Months)

This target remains dynamic—it changes each period based on upcoming debt payments.

Step 3: Calculate Required Movements

In each model period, the DSRA will either require funding (if below target) or allow release (if above target). The formula typically looks like this:

DSRA Funding / (Release) = Target Balance – Opening Balance

In case of a shortage in the balance, cash in the waterfall is toped up. When surplus is available, the model transfers such to project cash flow, which is usually made accessible before dividends are paid to sponsors.

Step 4: Cash Flow Waterfall Integration.

The DSRA should be shown on the cash waterfall of the model between the debt services and equity distribution. The right sequence makes sure that the lenders are safeguarded prior to the cash being discharged on shareholders.

An outlined simplified sequence would resemble the following:

- Revenue

- Operating Expenses (OPEX)

- Debt Service (Interest and Principal)

- DSRA Funding / Replenishment

- Reserve Release (where indicated)

- Sponsor Distributions or Dividends.

Step 5: Track Closing Balances

Lastly, make sure that the flow of DSRA in the balance sheet and financing schedule is made right. The balance at closing must be equal to the target one and must balance all the statements.

DSRA Design Practicalities.

It is not only a modeling exercise, but also a point of negotiation between the sponsors and the lenders. It has a number of practical factors that influence its structure and management in actual transactions.

Lender Requirements

DSRA sizing and maintenance is usually preferred differently by commercial banks, multilateral institutions, as well as bondholders. An example is that long-term infrastructure loans might require a 12-month reserve; whereas renewable energy projects with revenue contracts of non-volatility might only need 3-6 months.

Cost of Capital

Although the DSRA may be financed through equity, it will pull up cash that could be invested in other projects which gives the project an opportunity cost. With it being debt-financed, the total leverage of the project is higher, which lowers coverage ratios by a small margin.

Replenishment Mechanisms

A loan agreement normally stipulates the manner and manner in which the DSRA should be replenished when it is withdrawn. There are those that must be replenished in one period and there are those that can be replenished as project performance goes.

Release Triggers

Lenders can release the DSRA to the sponsors at the expiry of the loan tenor or under certain circumstances like having attained a minimum of DSCR in consecutive periods. Even this release ought to be modelled in the right way that shows upside to the investors.

The most frequent errors in DSRA Modeling.

The introduction of DSRAs in the project models may lead to mistakes even in the case of experienced analysts. Common issues include:

- They fail to dynamically associate DSRA target balances with debt service payment in the future.

- Mistakes made in sequencing the funding of the DSRA in the cash waterfall.

- Failure to reconcile DSRA movements and balance sheet entries.

- Excluding the interest income on DSRA in case of reserve earning deposit interest.

By attending to such details, the model will not only be accurate but also be credible by the lenders and the investors.

The Significance of DSRA in Project Bankability.

One of the important pointers of financial resilience of a project is the DSRA. Lenders consider it to be a vital risk mitigant especially in those areas where the revenues are variable as in the transport and utilities. Well structured the DSRA improves credit rating, eases debt syndication, and generates investor confidence.

To practitioners that seek to establish a career in project finance, the ability to master DSRA modeling is indicative of technical ability, detailing, and an excellent grasp of financial risk management concepts.

Conclusion

A properly designed Debt Service Reserve Account (DSRA) can be what will make the difference between the project that will survive short-term shocks and the project that will face the risk of default. In the case of finance professionals, knowing how to model DSRAs properly will provide them with transparency, coverage of lenders, and financial performance under different circumstances.

Knowing about financing, integrating cash waterfalls, and lenders to the various requirements, the analysts will be able to develop models that are not only technically fitting but also contribute to the increased project bankability. Ministers of project finance Mastering the art of DSRA modeling is a cornerstone in the world of an industry where credibility and precision are paramount.