How to Build a Dynamic Dashboard for Project Finance Models

How to Build a Dynamic Dashboard for Project Finance Models

Introduction to How to Build a Dynamic Dashboard for Project Finance Models

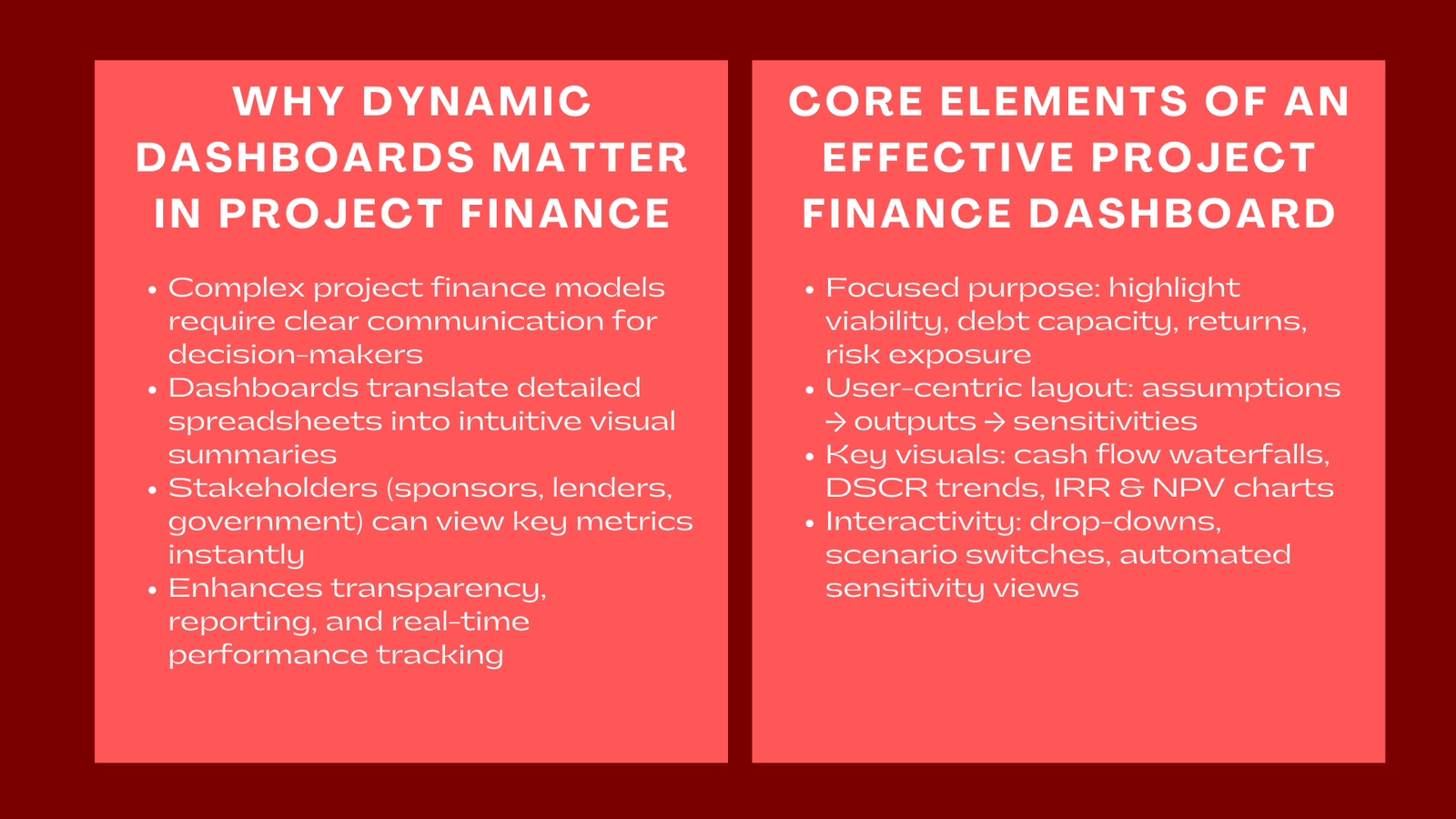

Delegation and clarity of communication should go hand in hand in the context of project finance, in terms of analytical accuracy. Financial model can only be as powerful as it can show its findings which can be used in real world decisions. Massive infrastructure and energy projects are characterised by complex financial structures, extended debt capital and a high number of stakeholders. In the case of such projects, decision-makers need to make sure that the model is not merely technically correct but the results would be readable and implementable.

A robust dashboard synchronizes the strategy of communication between the technical modeling and the strategy. It converts the complicated spreadsheets into a portrayal of interactive and user friendly visual summary that enables users to evaluate financial performance in one look. Sponsors are able to evaluate returns, lenders can evaluate the debt service cover and government agencies can evaluate the viability of the project all can be accessed on the same and cohesive interface.

In this article, how to build a dynamic dashboard for project finance models Singapore the author discusses the strategy to construct a successful dynamic dashboard when using project finance models. It discusses the integration, structuring, and visualization of data, the ability of interactivity and scenario testing to improve decision-making and the abilities of dashboards to support governance and strategy throughout the lifecycle of a project.

The Role of Dashboards in Project Finance Modeling

Transforming Complexity into Clarity

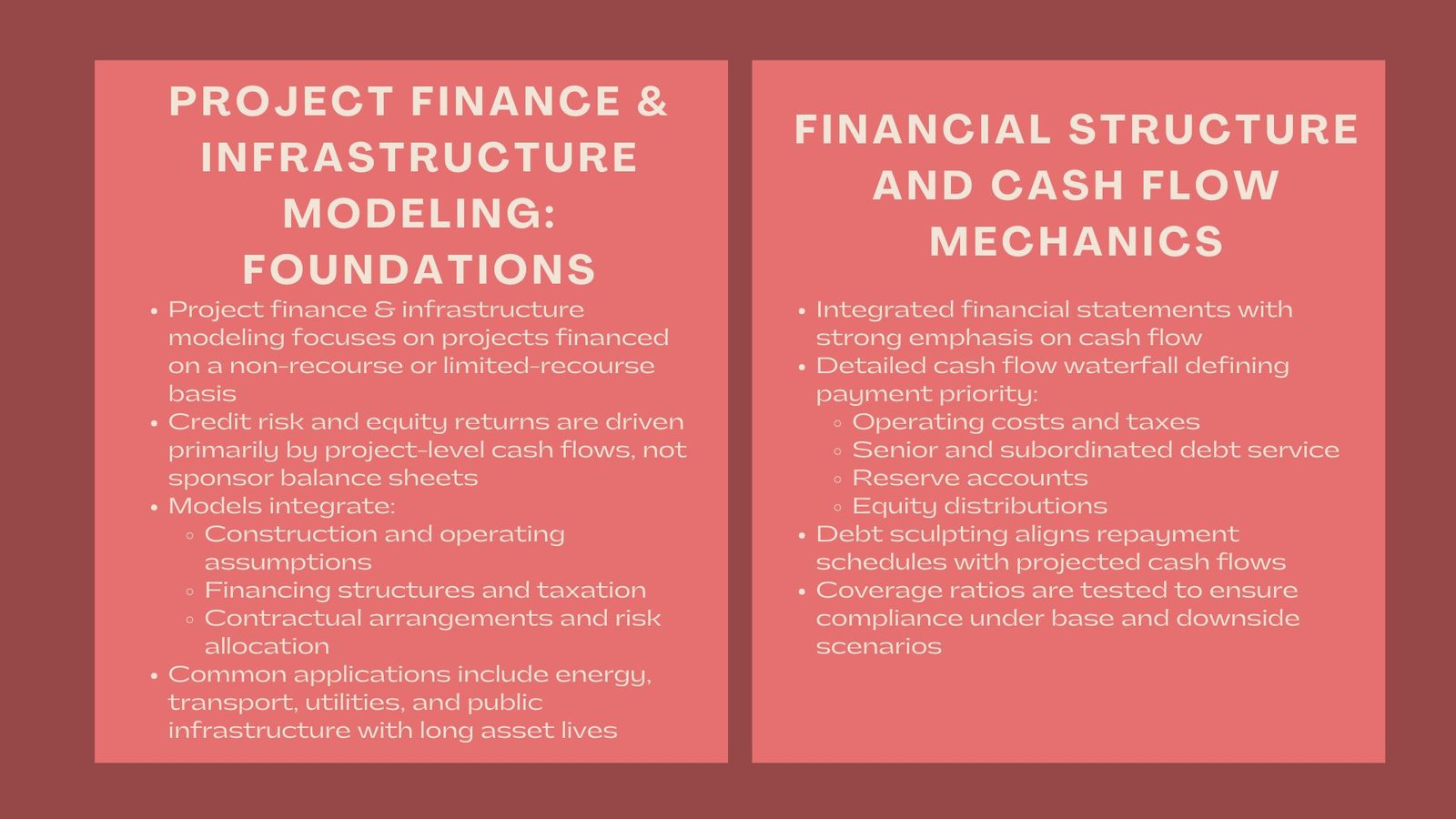

Project finance models are necessarily complex, and include the assumptions on the cost of construction as well as on the project revenue generation, operating cost, interests, taxation structures, and depreciation. Although this depth is necessary to guarantee analytical rigor, it may be overwhelming to the non technical stakeholders. In this context, project finance modelling Singapore on building dynamic dashboard becomes essential, as the dashboard will serve as a translation layer providing the necessary information in the form of the plain image and summarized data sets instead of calculation columns.

The dashboard enables its users to interpret performance immediately by turning raw data into significant indicators – IRR, NPV or DSCR. A project sponsor will know that cash flows are in the right range and a lender can quickly know that the debt cover ratios are in the right range in terms of loan covenant agreement. The simplicity of the presentation eases the analytical processing power and gives more assurances to the validity of the model.

Supporting Decision-Making and Transparency

In addition to the communication area, dashboards promote transparency and accountability. They also allow real time monitoring of the financial performance and assumptions of the project and ensure that all concerned parties can trace the results to trusted sources of results. The transparency is essential in the negotiations, refinancing talks, or in the audit, where interested parties insist on understanding the financial soundness.

Besides, dashboards enhance reporting. Users may extract pre-built visuals and summaries out of the model so that they do not have to compile them manually and as an output into presentation documents, which means that they can save time and still provide accurate information. By doing so, the dashboards will make financial models, instead of being back-office instruments, active decision-support and institutional governance instruments.

Conceptual Foundations of a Dynamic Dashboard

Purpose and Analytical Focus

A dashboard is based on its purpose. The fundamental question in project finance is whether this project is viable financially and stable to the fluctuation of assumptions. The dashboard needs to indicate such metrics that will provide the answer to the question: debt capacity, return on equity, sufficiency of cash flow, and sensitivity to external shocks. Each visual element is supposed to have a different analytical purpose. Extra information or additional ornament is irrelevant and makes it less clear and professional.

The purpose also needs to be specified in order to stay analytical. A sponsor specific project finance dashboard design and visualization Singapore dashboard is based on the emphasis on return measures and cash flow, and the lender specific dashboard is centered on DSCR, LLCR and repayment measures. Knowledge of the target audience makes the dashboard to convey the correct information at the appropriate depth.

User-Centric Design

An end user friendly dashboard is more emphasized on usability and simplicity of understanding. Without strong knowledge about the mechanics of spreadsheet, the overall decision-makers should be able to work through it using intuition, like they should be able to see what happens when they make assumptions. This involves coming up with rational flow, uniform colors and sensible positioning of visuals. As an example, assumptions can be presented on the top, the key financial outputs in the middle and the sensitivity results on the bottom.

A good dashboard reflects the psychological map of the users of the dashboard, it will lead them through what they input on it to what they will get back at the end of the day. The ease of navigation earned by users also instills confidence in the dashboard besides informing them.

Building the Framework: Data Integration and Layout

Establishing a Data Layer

Contingent on a well-architected data structure relationalizing analytical calculations and presentation, a dynamic dashboard relies on an operational and analytical paradigm: the visual representation of data highlights its underlying mathematical and computational character. The most appropriate approach is to develop a specific data summary layer which includes the important outputs, which are in total revenues, cash flow available to debt service (CFADS), debt service ratio, interest rate, and net present value. The advantage of this method is the separation of a dashboard by the computational complexity of the inner model and obfuscation of important formulae.

The efficiency is also added to the data layer. Each metric is an output using a single source that is reliable as opposed to hundreds of individual cells that are distributed in various sheets. The benefits of this structure include accelerated recalculation, trying out the auditing process, and keeping the model intact due to the changing assumptions.

Designing Logical Layouts

Layout The graphical rationale of a dashboard. The clean and consistent structure will allow users to understand the important information without any misunderstanding. Generally, the arrangement of the dashboard is in different parts as assumptions, financial results, and key performance indicators but they all flow together as one graphical user interface.

Color coding supports clarity: when one color is used to mean assumptions, another one to mean output, and a third one to mean alert or exception. Legends, axis labels and titles should not be too long, but must be descriptive. Each of the visual pieces ought to include a definite financial message whether it is a trend in cash flow, a rise in debt repayment, or variance in forecasted returns.

Visualization and Analytical Presentation

Cash Flow Visualization

Visualization of the cash flows can be considered one of the most effective applications of dashboards in project finance. The flow of gross revenues in every tier of dissemination, between the operating costs to the interest, principal repayment, reserves and dividends is graphically demonstrated in a waterfall or a cash cascade chart. With this format, it is possible to see the magnitude of value created, retained, or distributed throughout each stage which gives a clear picture of the finance dynamics of the project.

This view can be supplemented with line charts which demonstrate cumulative cash flows with time and area charts which demonstrate proportional contributions of revenue sources or cost item. Combined, these graphics convey the economic pulse of the project in a manner that cannot be done when using a table.

Debt Service and Return Metrics

To lenders, the most essential metrics will be the ones, which will show the ability to pay back. A properly-constructed dashboard will therefore contain a graphical display of the trends of the DSCR, the key amortization schedules, and the current loan balances. The relation between a debt service repayment and cash flow availability should be observed throughout the timeframe of the project and, thus, the financial stability may be immediately evaluated.

Dashboards show sponsors the following metrics that are returns which include project IRR and equity IRR. These are normally presented next to net cash flow to equity, enabling the stakeholders to visualize the impact of variation on assumptions to profitability and payback.

Sensitivity and Scenario Visualization

Sensitivity analysis and scenario analysis make the dashboard lively since it displays the change in performance subject to different circumstances. Tornado charts or spider graphs may be used to display how much the assumed values (cost of fuel, tariff rate, delay during construction etc) influence the IRR or NPV. Such a visual ranking of senses assists the decision-makers in directing the risk mitigation efforts on variables that are most important.

Scenario comparisons may be presented as parallel charts which are base, optimistic and downside cases automatically updating as input changes. Such dynamic images enable the stakeholders to decide the resilience with different futures without having to recalculate the whole model.

Conditional Formatting and Alerts

Conditional formatting was used to make a dashboard a live-imaging system. Cells or graphics will automatically turn to color in case of the violation of the critical levels e.g. in case DSCR has gone lower than 1.20x or equity IRR has lowered below the target hurdle rate. With these alerts, risks can be identified on time thus allowing managers to be proactive and not reactive.

Practically, this signaling would offer an early-warning mechanism hence enhancing the quality of financial control in governance in project finance operations.

Interactivity and Scenario Management

Creating Dynamic Controls

A dashboard is interactive as compared to a static report. Dynamic controls Any of drop-down menus, switch buttons or scenario buttons allows a user to change the important assumptions and see the current effect on outputs. This is due to the interactivity that this model gives, making it a decision-testing environment, but not a one-way report.

Indicatively, they can exchange currencies and timeframes or even contract forms and see how measures such as DSCR or IRR react. These functions are based on index and look up formulas, which automatically revise data references rather than function based recalculations.

Testing Scenarios and Sensitivities

Scenario management can be used to make comparisons between various conditions of projects in an organized way. Through the upside, downside and base cases, a user can review financial resilience. Sensitivity testing is also more comprehensive by separating the impact of individual parameters, to be able to understand a bit deeper what risk parameters have the most impact on performance.

All of these analytical characteristics combined together make dashboards indispensable strategic decision-making tools. They also allow investors and financiers to drill quickly and with a lot of certainty into what could happen or what would happen in the event of a certain scenario, a culture of evidence-based planning would be developed.

Implementation, Performance, and Quality Control

Model Integration and Testing

A dashboard is needed to be developed with meticulous attention toward the core model. All metrics should have a proven formula, which guarantees the accuracy of data. After integration, the dashboard must be tested repeatedly under various circumstances to ensure logical consistency as well as computing stability.

Several tests are also important, namely performance testing. Large project finance models may be reduced to a crawl when the models are burdened with heavy calculation requirements. The use of reduced formulas, the reduction of volatile functions as well as efficacious data table optimization ensure speed and responsiveness whilst making presentations fast during a live presentation.

Ensuring Consistency and Professionalism

Branding and visual consistency makes it more professional. The visual order is created with the help of coherent fonts, aligned axes, and standard colors. To avoid misinterpretation of all charts, clear units and time have to be provided. It is not only a competent communication through a professionally-formatted dashboard but also would improve the trust of stakeholders in the fact that the financial analysis is well-conducted.

Strategic and Institutional Perspectives

Driving Decision-Making Efficiency

An interactive dashboard intervals the manner in which financial performance is understood. To the management teams, it gives them instant access to project performance, sustainability of debts and returns of investments. The capability to test the assumptions on a real time basis increases the speed of decision-making eliminating the need to resort to manual recalculations.

Dashboards are also the basis of learning in the institution. Through the standardization of formats in several projects organizations are able to benchmark their results, monitor their portfolio trends and comparisons of risk profiles across regions and sectors.

Supporting Governance and Accountability

Dashboards improve institutional financial governance realms. These enable lenders to monitor the compliance to covenant as well as the reserve adequacy and are also useful to enable the sponsors in order to have equity distributions and reinvestment decisions made timely. Dashboards aid in government control because of the public-private partnerships they highlight transparent, easily available evidence regarding affordability and fiscal exposure with regard to the project.

Dashboards make the private incentives comply with the requirement of accountability in the society and increase the long-term credibility of infrastructure finance.

Conclusion

A living dashboard also is used to make a project finance model not a technical object, but a strategic communication device. It combines data structure, design, interactive nuances, and rigor of analysis and, as a result, large and small business domains are linked at a new level.

These dashboards are performing not only better efficiency and transparency, but democratize the use of financial intelligence – enabling sponsors and lenders as well as regulators to have meaningful interactions with project performance. A technical competency as well as a professional standard of elite expertise in an era where infrastructure investment is becoming more and more data-driven and questionable, the skill to construct and run an environmentally dynamic leave of green is additionally a technical skill.

Finally, a dashboard narrates the financial history of a project – how it is doing today, its performance in challenging times and its future strategic decisions. When constructed beyond accuracy and intention, it alters the intricacy into self-confidence.