Common Mistakes in Project Finance Modeling and How to Avoid Them

Common Mistakes in Project Finance Modeling and How to Avoid Them

Introduction to Common Mistakes in Project Finance Modeling and How to Avoid Them

Billion-dollar infrastructure and energy investments and projects are being analyzed based on project finance models. These models either make or break the bankability of projects, allocation of risks and distribution of values to the stakeholders. Owing to their complexity and high stakes any small modeling errors may carry disproportional implications – causing mispricing, breach of covenant, or wrong investment choices.

Mistakes are not rare even with improved standards of modeling. These are usually caused by overconfidence, inadequate structuring, version control, or inadequate knowledge of financial linkages. In other instances the models can be too complex to audit so that they will have the default vulnerabilities hidden only to be revealed when it is under stress. It takes a technical skill, discipline, documentation and governance to avoid these pitfalls.

This paper identifies the most common errors relating to best practices for financial model auditing Singapore and specifies the ways to prevent them. It dwells upon errors of the concept, technical inefficiency and failure in governance giving an insight into how modeling can be beyond being a mechanical endeavor to an analytical finesse and professionalism.

The Nature of Errors in Project Finance Modeling

Why Modeling Errors Occur

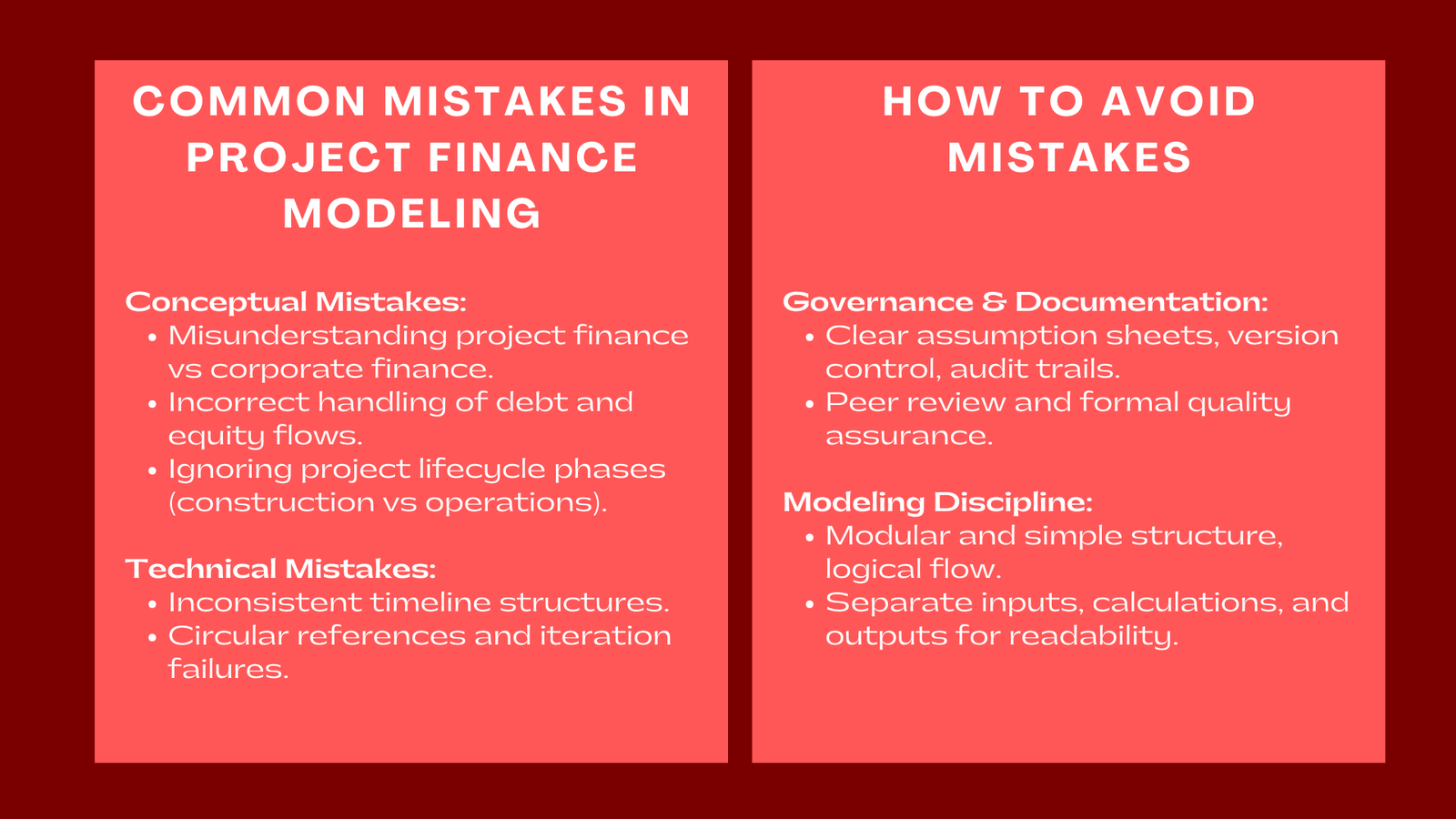

The causes of modeling errors have a hold in a complex of the human, structural, and procedural factors. Human interferences usually entail wrong formulae, inaccurate presumptions, or wrong data entry errors. Structural problems arise when the structure of the model, the organization of worksheets, timelines, and calculations is unnecessarily complicated or otherwise logically inconsistent. Procedural errors, in turn, are caused by the version control, improper documentation, or peer review. A project finance modelling course Singapore often emphasizes understanding these factors to minimize errors and improve model reliability.

These errors are magnified by the fact that project finance models come in various forms: they can be used in valuation, to measure the size of loans, to test covenants, and to report. Only a small problem with one link may spread to the rest of the structure resulting in in-accurate financial signals like internal rate of return (IRR), debt service coverage ratio (DSCR), or net present value (NPV). Pertaining to corporate financial models, project finance models are more leveraged, thus any error in the payment of debt may easily spell the doom of the project.

The Cost of Inaccuracy

Modeling errors have both reputational and financial impacts. When there is wrong cash flow projection, the wrong financing structure might be made, credit worthiness may be wrongly considered and also there may be poor relationship between lenders and the organization. To sponsors, the errors can be used in the distortion of equity returns whereas to governments it can lead to public-private partnerships (PPPs) that cannot be sustained economically.

A valid project finance model is not an excel spreadsheet after all, it is a contractual and financial tool. It is based on its accuracy when negotiating, obtaining regulatory licenses and financings. The importance of the cost of inaccuracy is understood as a strong motivator to implement a more disciplined and verified model practice of continuous improvement.

Common Conceptual Mistakes

Misunderstanding Project Finance Structure

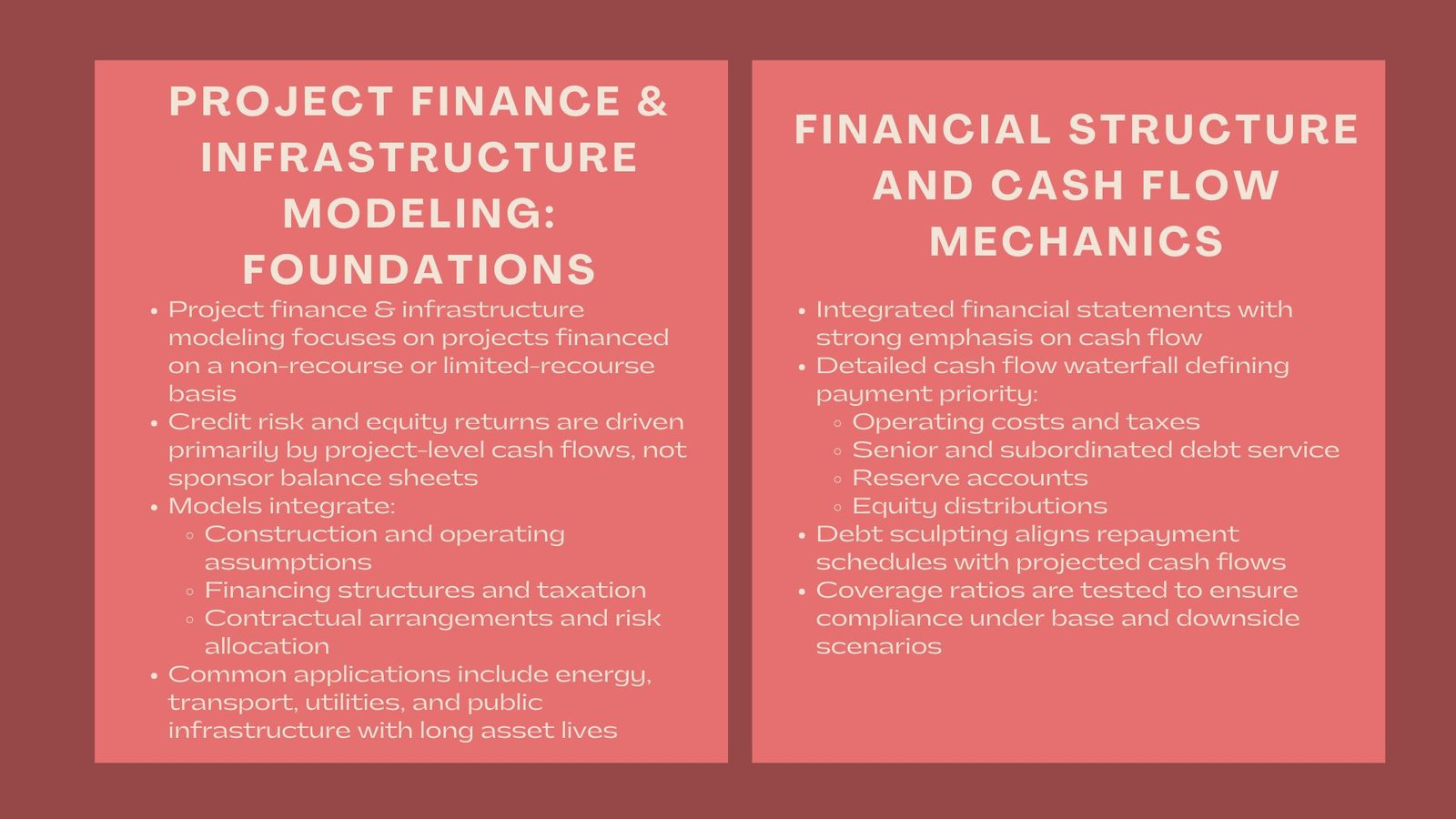

There can be very few conceptual mistakes such as misunderstanding the very nature of project finance. In contrast to corporate finance, project finance is based on a non-recourse or limited-recourse structure, where any lender of such finance is significantly based on cash flows produced by the project itself and not the balance sheet of the sponsor. Models that cannot isolate project-level cash flows i.e. via amalgamation with sponsor-level assumptions do not portray the risk allocation and debt capacity.

A properly planned model considers the special purpose vehicle (SPV) to be an independent entity, its own financial statements, source of funds and repayment. This conceptual clarity is to make sure that the analysts are right in evaluating the ability of a project and to avoid the count being made twice in evaluating money flows.

Incorrect Treatment of Debt and Equity Flows

The other similar conceptual problem is the distortion of the interaction of debt and equity. Other models mislead the injection of equity with sharing a loan, or mis-separating between the pre-financial-close development cost and the excessively capital expenditure in the future (post-close). This blurring of the lines makes the calculation of cash flow as well as the calculation of returns to be distorted.

Within the financial aspects of projects, it is necessary to have explicit modeling of every source of Finance, and their draw downs, repayment and interest capitalization schedules are clear. Both the misalignment of these flows and the analysis of the data results in improper cash flow waterfall as well as the incorrect calculation of the IRR and NPV.

Ignoring Project Lifecycle Phases

Another conceptual shortcoming that has come out over time is the inability to differentiate between construction and operational levels. The cash flow pattern of these two phases, risk profile and financing requirement is different. The assumption that they should be treated as a continuum in which there is no calculation in terms of construction interest, grace period, or cost to commission, leads to inaccurate financial pointers.

When constructing operation-driven models, modelers need to capitalize interest and other fee payments of construction period, only after mechanical completion, and ramp-up assumptions should be realistically set. The confusion of these stages can make the economic feasibility analysis of the project useless.

Technical Modeling Mistakes

Inconsistent Timeline Structures

A financial model uses the timeframe as its foundation. Construction mistakes in time series, e.g. lack of consistency in period lengths, mismatched start dates, wrong reference to an end-of-period, etc., cause cascading problems. As an example, when debt service is modelled on a quarterly basis and as revenues on a projected annual basis, the discrepancy between the two will create a distortion in the calculation of DSCR and in the payment of interest.

Time structuring: consistency is crucial in making cash flows in the right place and ratios generated out of the cash flows meaningful. The best-practice model follows one integrated timeline in the management of all the calculations and this is how the income statement, balance sheet, and cash flow projection are synchronized.

Circular References and Iteration Failures

Project finance modeling carries so much in circular references since interest, taxes, and cash balances have an effect on each other. Although, any form of circularity that is not controlled can render the model unstable or non-functional. The wrong configuration of the iterative calculations can result in varying outcomes every time it is recalculated or even failure to provide the same results.

To prevent it, circular dependencies should be separated and manipulated in an iterative logic or in a controlled utilization of calculation settings in Excel. Other modelers employ alternative techniques such as the mechanism of dividing pre and post cash flows of interest computations in order to eliminate unneeded loops. It is aimed at balancing between realism and stability so that the model would be accurate and operationally effective.

Incorrect Handling of Depreciation, Tax, and Deferred Items

Errors that can usually be found include combining depreciation, tax, and accounting adjustments. To illustrate, mistakes in calculating the tax as a result of not differentiating accounting and tax depreciation cause miscalculation of profit and equity forecasts and ignoring deferred tax position of this company. On the same note, use of a tax shield when there are non-deductible costs pumps up cash flow out of proportion.

A strong model implements the proper tax characteristics on all of the cost categories and resolves discrepancies between the accounting profit and taxable income. It also makes sure that the reverse of deferred taxes takes place with the course of time and that all the statements made internally are consistent.

Improper Linkages and Hardcoding

Hardcoding Hardly any more widespread modeling error is the direct typing of numeric values into formulas. It clouds the thoughts, makes auditing more difficult, and predisposes making mistakes when updating. Likewise, weak connections between the worksheets, where formulas call on different cells or concealed rows will bring about discrepancies that are hard to trace.

Professional models reduce hardcoding, employing explicit reference frames as well as assumption sheets which concentrate all key inputs. This practice not only guarantees transparency, flexibility and auditability but also in models which go through frequent revisions.

Analytical and Presentation Mistakes

Incomplete Sensitivity and Scenario Analysis

Not only is a project finance model supposed to compute the base-case results, but also test the conditions of resilience in varied conditions. Failure to undertake sensitivity analysis, e.g. analysis of the tariffs, interest rate, construction cost etc., means that the decision-makers are in darkness as regards risks involved. On the same note, using fixed situation scenarios with no inbuilt controls does not allow the stakeholders to evaluate financial flexibility.

Extensive sensitivity analysis and scenario switching provide users with an opportunity to test the project behavior when the situation is favorable and unfavorable. The lack of such analyses is a weakness of the confidence failure and results in over-optimistic decisions.

Inadequate Cash Flow Waterfall Structure

Project finance is characterised by the cash flow waterfall. It controls the way revenues are distributed – operations, debt payment, reserves and lastly equity distributions. The mistakes of this chain may break the covenants of lenders or falsify calculations on returns.

Models are required to reproduce specific order of payments as the financing agreements provide. Any failure to comply with this order or attempting to allocate cash on the equity before initiating the debt obligations may jeopardize the credibility of such projects and even result in a financial default.

Poor Dashboard Design and Miscommunication

Even the technically correct model is not valuable when the results are demonstrated in a way that is not good. Summary dashboards are often used by decision-makers to analyze the outcome in most instances. Dashboards filled with so much information are confusing instead of informative with inconsistent format or irrelevant charts.

A successful model gives results in a clear way and highlights such metrics as IRR, NPV, DSCR, and payback period. Tables, the use of colors, and visual consistency help ease the understanding and increase the confidence in the analysis. A technical model can be turned into a convincing way of making decisions by good presentation.

Governance and Process Mistakes

Lack of Documentation and Audit Trails

One of the most severe errors but neglected is poor documentation. Most of the models do not provide a clear description of the assumptions, data, and logic of formulas. This makes the model useless in the future since the user would not be able to comprehend the way results are obtained.

This is best practice, i.e. every model should have got assumption sheets, version histories, and documentation notes describing significant formulas. This openness does not only ease the auditing, but also continuity in the case of team and advisor rotation.

Insufficient Peer Review and Quality Assurance

Peer review is one of the pillars of modeling integrity, but it is rarely observed when time is a factor to consider. Independent verification serves to expose the errors that can be made by the original modeler as a result of familiarity bias. Financial close or lender presentations in the form of models must be formally quality assured, cell-by-cell reviewed, and stress tested no matter which method is used to develop them.

Introduction of systematic audit procedure- either by external auditors or by an internal model working group decreases the risk of errors and increases the institutional comfort level in the products.

Overcomplexity and Lack of Modular Design

It is not good modeling virtue to be complicated. Too complex formulas, too much cross-referencing and too large work sheets can seem complicated but tend to reveal weakness. Readability and debugging enhancement Readability A distributed model is designed with logical parts, like the inputs, calculations, and outputs, to ensure it is easy to read and debug.

The model can be as rudimentary as possible and as elaborate as need be. And when this principle is taken care of, complexity works in the favor of analysis, instead of, as it tries to do, obscuring it.

Strategic and Institutional Perspectives

Building Modeling Discipline

The technical skill alone does not allow avoiding errors but a rigorous approach to the matter. Developing modeling standardization, such as names, color scheme and calculus can establish uniformity within a project and project. Such institutes that are incorporated into discipline minimize reliance on individual modelers and guarantee that all models are of professional quality in clarity and reliability.

This discipline culture also changes the modeling process into a process of financial analysis which habitually and institutionalizes the repetitive mode.

The Role of Technology and Automation

Such factors as model auditing, version control systems are technological and assist in identifying inconsistencies and imposing precision. Repetitiveness in processes should be automated, e.g. via macros or template structures – this reduces typing mistakes. The project finance processes benefit by making the process more efficient and accurate in terms of multi-stakeholder, large-scale projects.

Conclusion

The project finance modeling errors Singapore requires accuracy and vision. Errors, conceptual, technical, and procedural may compromise the continuum of financial performance as well as the trustworthiness of a transaction in totality. To avoid them calls on critical rigorousness, institutional discipline and governance.

A properly developed model is stable, auditable and clear. It will provide reflection of the real economics of the project, facilitate informed decision making, and be vigorous when it comes to the scrutiny of lenders, investors, and regulators. However, a bad model dilutes trust and unveils risks and could roll over otherwise healthy investments.

Finally, project finance modeling is not a difficult process but a clear one. With lessons of experience in the engineering errors and best practice in structure, documentation, and testing, the professional can provide his model as reliable, stable, and reliable foundations to the most critical investments in the infrastructure of the world.