Project Financial Modeling Guide

Project Financial Modeling Guide

Introduction to Project Financial Modeling Guide

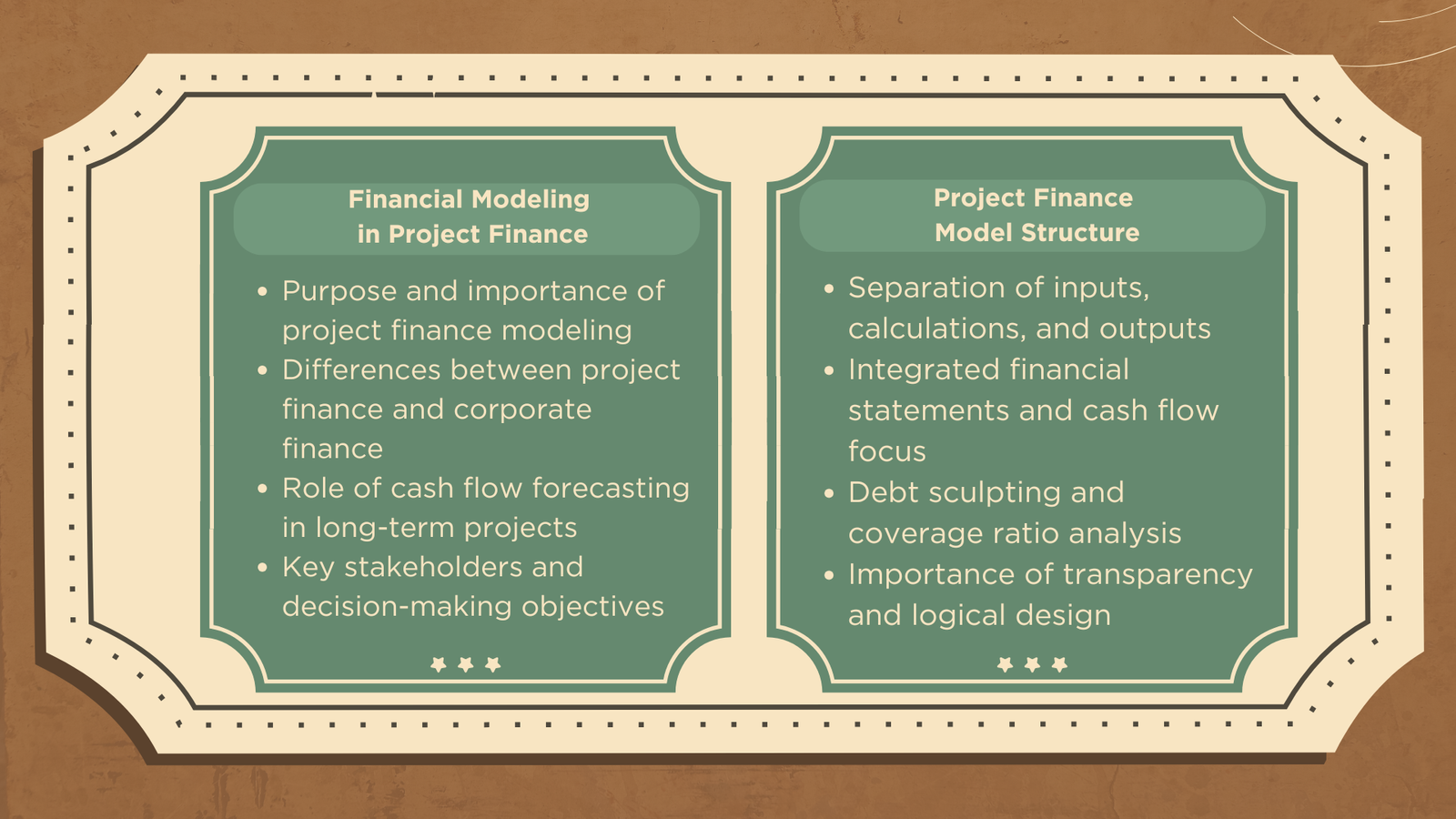

Financial modeling in project finance has become an essential skill for financial practitioners, lenders, sponsors, and policymakers, particularly in an era of capital-intensive infrastructure development and long-term investment planning. Unlike traditional corporate finance, project finance places greater emphasis on structured cash flow projections rather than balance sheet strength when assessing risk allocation. As a result, robust financial modeling is required to evaluate feasibility, bankability, and long-term sustainability.

With a properly constructed project finance model, stakeholders can understand how value is created, how risks are allocated, and how financial obligations are serviced throughout the project lifecycle. To achieve this, professionals must not only understand theory but also master project finance model structure and apply sound project finance model practice in real-world settings. This article examines these three dimensions to provide comprehensive insights for analysts, managers, and decision-makers.

Understanding Financial Modeling in Project Finance

Financial modeling in project finance refers to the process of developing a detailed financial representation of a standalone project, typically financed through a special purpose vehicle (SPV). The model forecasts cash flows over the project’s life, often spanning 20 to 30 years, and evaluates the project’s ability to meet its financial obligations under various assumptions.

Unlike corporate financial models, project finance models are highly sensitive to contractual arrangements such as power purchase agreements, concession contracts, and offtake agreements. Therefore, financial modeling in project finance must integrate legal, technical, and operational inputs into a single analytical framework. This interdisciplinary complexity makes project finance modeling both challenging and indispensable.

At its core, the model answers critical questions: Is the project financially viable? Can it service its debt? What returns can equity investors expect? By addressing these issues, financial modeling in project finance supports investment decisions, credit approvals, and risk management strategies.

Strategic Importance of Project Finance Models

The strategic value of financial modeling in project finance lies in its ability to translate assumptions into measurable financial outcomes. Governments rely on project finance models to evaluate public–private partnerships, while banks use them for credit risk assessment. Sponsors and developers apply these models to optimize capital structure and enhance equity returns.

A well-designed model promotes transparency and discipline by requiring stakeholders to clearly define assumptions related to demand, pricing, operating costs, and financing terms. Through scenario and sensitivity analysis, financial modeling in project finance enables decision-makers to assess downside risks and resilience under stress conditions.

As global investment in infrastructure, renewable energy, and transportation continues to grow, demand for expertise in financial modeling in project finance is increasing across industries.

Core Components of Project Finance Model Structure

A sound project finance model structure is essential for accuracy, transparency, and usability. Most models follow a logical flow, starting with assumptions and inputs, progressing through calculations, and culminating in outputs and financial metrics.

A robust project finance model structure clearly separates input sheets, calculation modules, and output summaries. Inputs typically include capital expenditure, operating costs, revenue assumptions, financing terms, and tax parameters. These inputs feed into integrated financial statements generated through calculation sheets.

A defining feature of project finance model structure is the close linkage between cash flow generation and debt servicing. Key metrics such as cash flow available for debt service (CFADS), debt service coverage ratios (DSCR), and loan life coverage ratios (LLCR) depend on a transparent and disciplined model design.

Integration of Financial Statements

Another critical aspect of project finance model structure is the integration of financial statements. The income statement reflects operational performance, while the cash flow statement tracks actual liquidity available for debt repayment and equity distribution. The balance sheet ensures accounting consistency by tracking reserves, debt balances, and equity contributions.

In financial modeling in project finance, the cash flow statement is often the primary focus, as lenders prioritize predictable and sufficient cash flows over accounting profits. A well-built model dynamically links all three statements, reinforcing analytical integrity.

Debt and Equity Modeling Considerations

Debt modeling is central to financial modeling in project finance. The model must accurately reflect drawdown schedules, interest calculations, repayment profiles, and covenant testing. Sculpted debt repayment aligned with projected cash flows is a common feature of advanced project finance models.

Equity modeling, while secondary from a risk perspective, remains vital for sponsors. Metrics such as internal rate of return (IRR) and net present value (NPV) are derived from projected equity cash flows. A strong project finance model structure ensures that equity distributions occur only after debt service and reserve requirements are fully met.

Project Finance Model Practice in Professional Environments

While theory provides the foundation, project finance model practice determines real-world effectiveness. In practice, models evolve throughout development, financing, construction, and operation phases, requiring continuous updates as new information emerges.

Effective project finance model practice emphasizes clarity, documentation, and auditability. Assumptions must be clearly stated, formulas must be traceable, and outputs must be understandable to third parties such as lenders and auditors. Poor modeling discipline can undermine credibility, even when project economics are fundamentally sound.

Version control is another critical aspect of project finance model practice, particularly when models are shared across multiple stakeholders. Uncontrolled changes can introduce errors with significant financial and reputational consequences.

Scenario and Sensitivity Analysis

Scenario and sensitivity analysis are among the most valuable applications of financial modeling in project finance. These techniques assess how changes in key variables—such as interest rates, operating costs, or demand—affect project viability.

In project finance model practice, downside scenarios typically receive greater emphasis, reflecting lenders’ risk-averse perspective. Stress testing helps identify break-even points and supports negotiations around risk allocation, guarantees, and contingency reserves.

Embedding structured sensitivity analysis within the project finance model structure transforms the model into a powerful decision-support tool rather than a static forecast.

Common Challenges in Project Finance Modeling

Despite its importance, financial modeling in project finance presents several challenges. Long project tenors increase uncertainty, making assumptions more difficult to validate. Regulatory changes, technological evolution, and macroeconomic volatility can significantly affect projections.

Another challenge involves balancing complexity and usability. An overly complex project finance model structure may be analytically sound but impractical, while oversimplified models may fail to capture critical risks. Sound project finance model practice requires professional judgment to determine the appropriate level of detail.

Human error remains an ongoing risk, reinforcing the importance of model reviews and independent audits.

Skills Required for Project Finance Modeling

Mastery of financial modeling in project finance requires a blend of technical, analytical, and commercial skills. Professionals must understand accounting and finance principles while also interpreting contracts, assessing risk, and communicating insights effectively.

Proficiency in spreadsheet tools is essential, but tools alone are insufficient. Strong project finance model practice depends on structured thinking, attention to detail, and disciplined documentation. As projects grow in complexity, these skills distinguish competent modelers from exceptional ones.

The Future of Project Finance Modeling

The future of financial modeling in project finance will be shaped by technological advancement, regulatory evolution, and shifting investment priorities. Automation and advanced analytics are improving efficiency, while sustainability considerations increasingly influence assumptions and evaluation criteria.

Nevertheless, the fundamentals of project finance model structure—transparent cash flow analysis, disciplined debt modeling, and robust sensitivity testing—will remain unchanged. Likewise, effective project finance model practice will continue to rely on professional judgment rather than automation alone.

Conclusion

In conclusion, financial modeling in project finance is a cornerstone of modern infrastructure and long-term investment decision-making. By converting complex contractual and operational assumptions into structured financial projections, project finance models enable stakeholders to assess viability, manage risk, and allocate capital efficiently.

A disciplined project finance model structure ensures transparency, accuracy, and consistency, while strong project finance model practice bridges theory and real-world application. Together, these elements form a comprehensive framework that supports sustainable and bankable projects.

As project-based financing continues to expand globally, the ability to build, interpret, and apply high-quality project finance models will remain a critical professional competency.