Guide to Project Finance Primer with Cash Flow Analysis

Guide to Project Finance Primer with Cash Flow Analysis

Introduction to Project Finance and the Central Role of Cash Flow

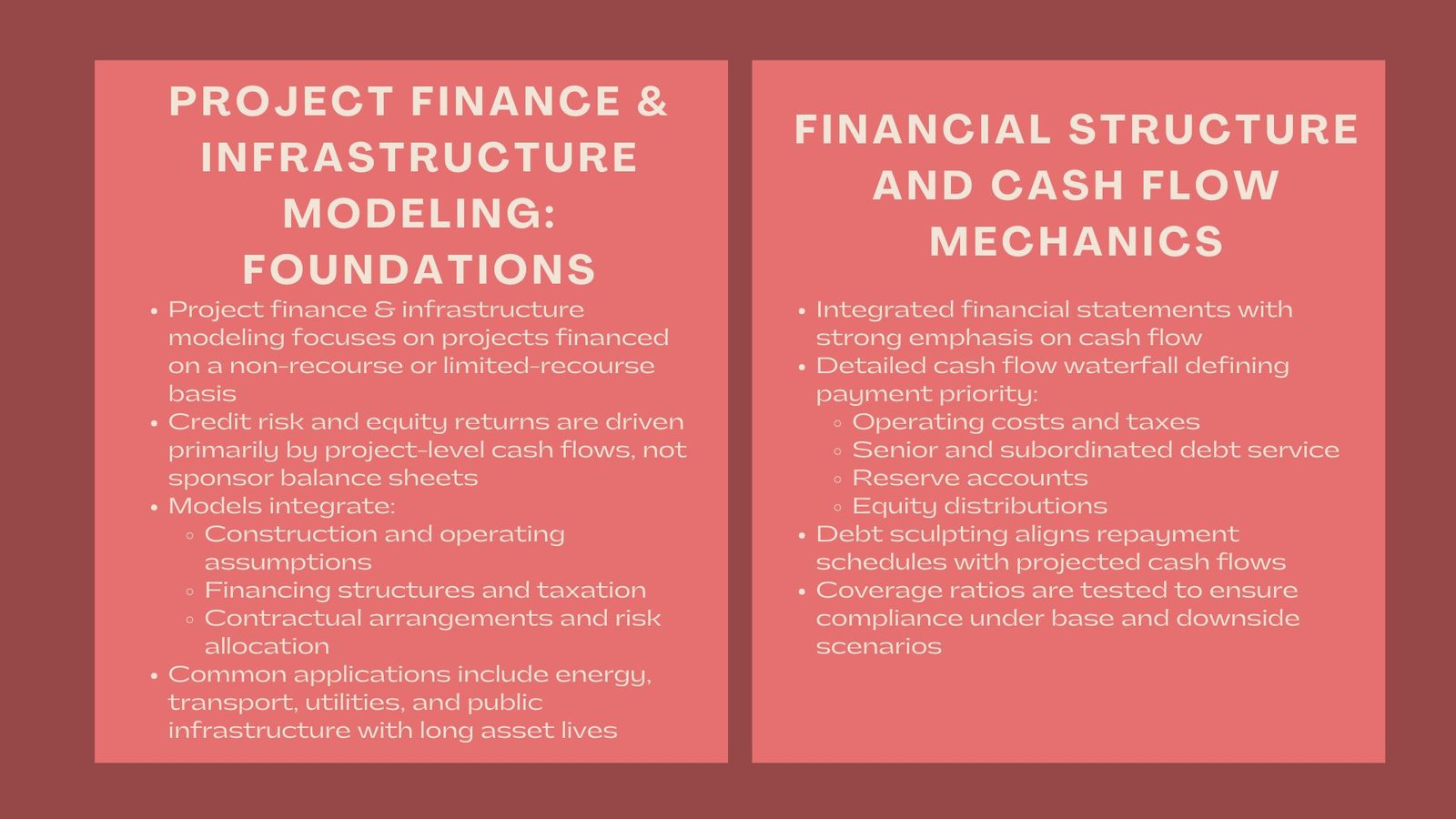

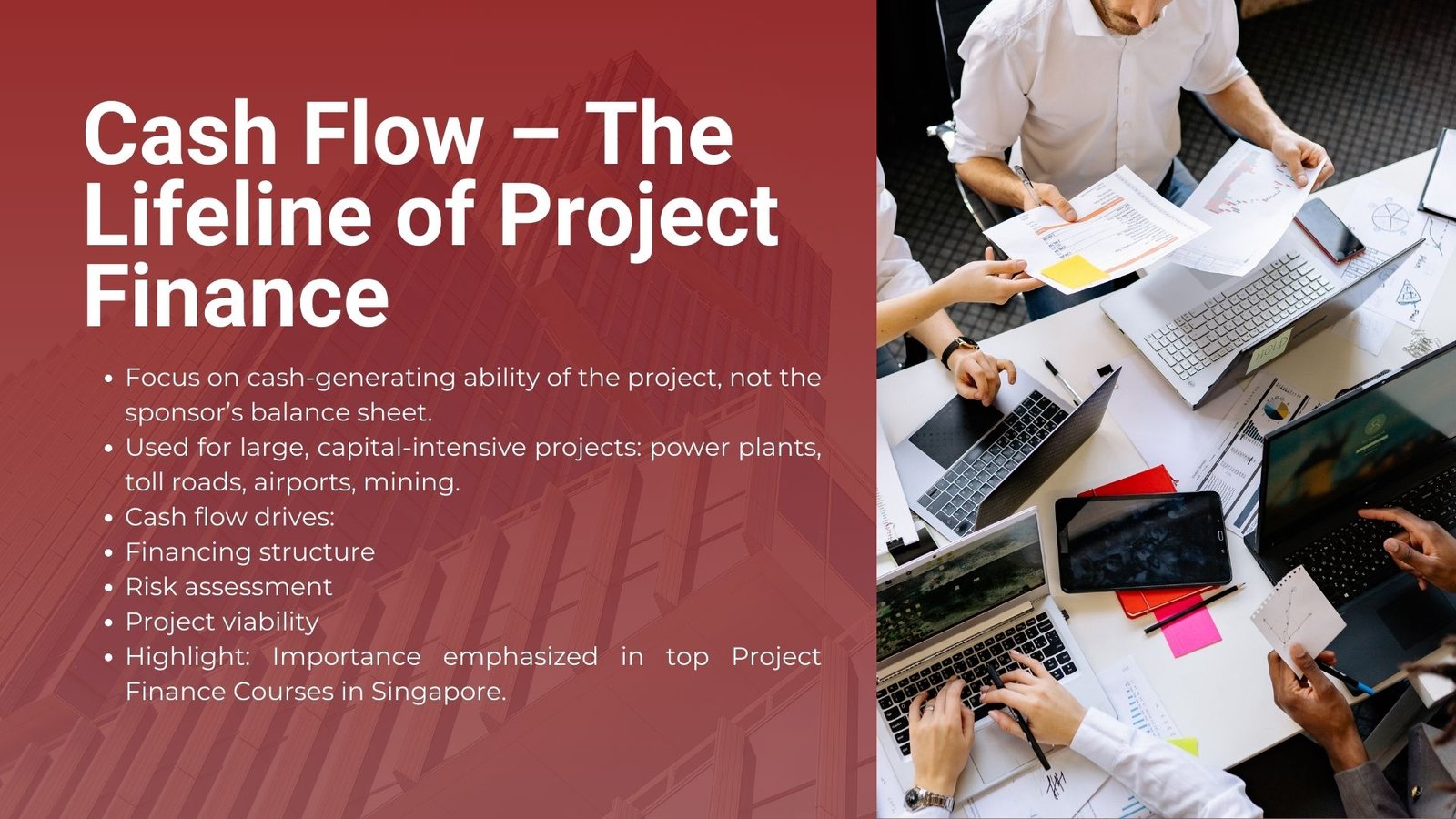

Project finance is a niche finance structure, which focuses on the cash generating capacity of a given project in the future rather than the balance sheet of participating companies (sponsors). In contrast to corporate financing, where a lender would determine its loan based on the overall credit position of an entire business, project finance will isolate one project and build a repayment methodology around the revenues generated by the same. This not only translates cash flow to a financial indicator, but also to the lifeline of the transaction.

The cash focus is due to the nature of project finance, with investments often being of large magnitude and capital intensity, e.g., power plants, renewable energy-related projects, toll roads, airports, or mining. Such projects normally cost billions of dollars on upfront investment, but the key to their economic survival is in long-term stable income flows.

To the lenders and investors, and sponsors, cash flow is critical in the structuring of the financing, assessment of the risk and also whether the project is viable throughout its lifecycle. The Best Project Finance Course for Professionals Singapore also emphasizes how critical cash flow analysis is in structuring and managing such large-scale projects.

Understanding Cash Flow in the Context of Project Finance

Project financing in Cash flow involves more than the flow of money in and out of the project entity. It is the modeled and projected inflows and outflows of the model that characterize whether the project is able to earn sufficient revenue to finance its debt, cover operating costs, and finally, pay returns to equity owners.

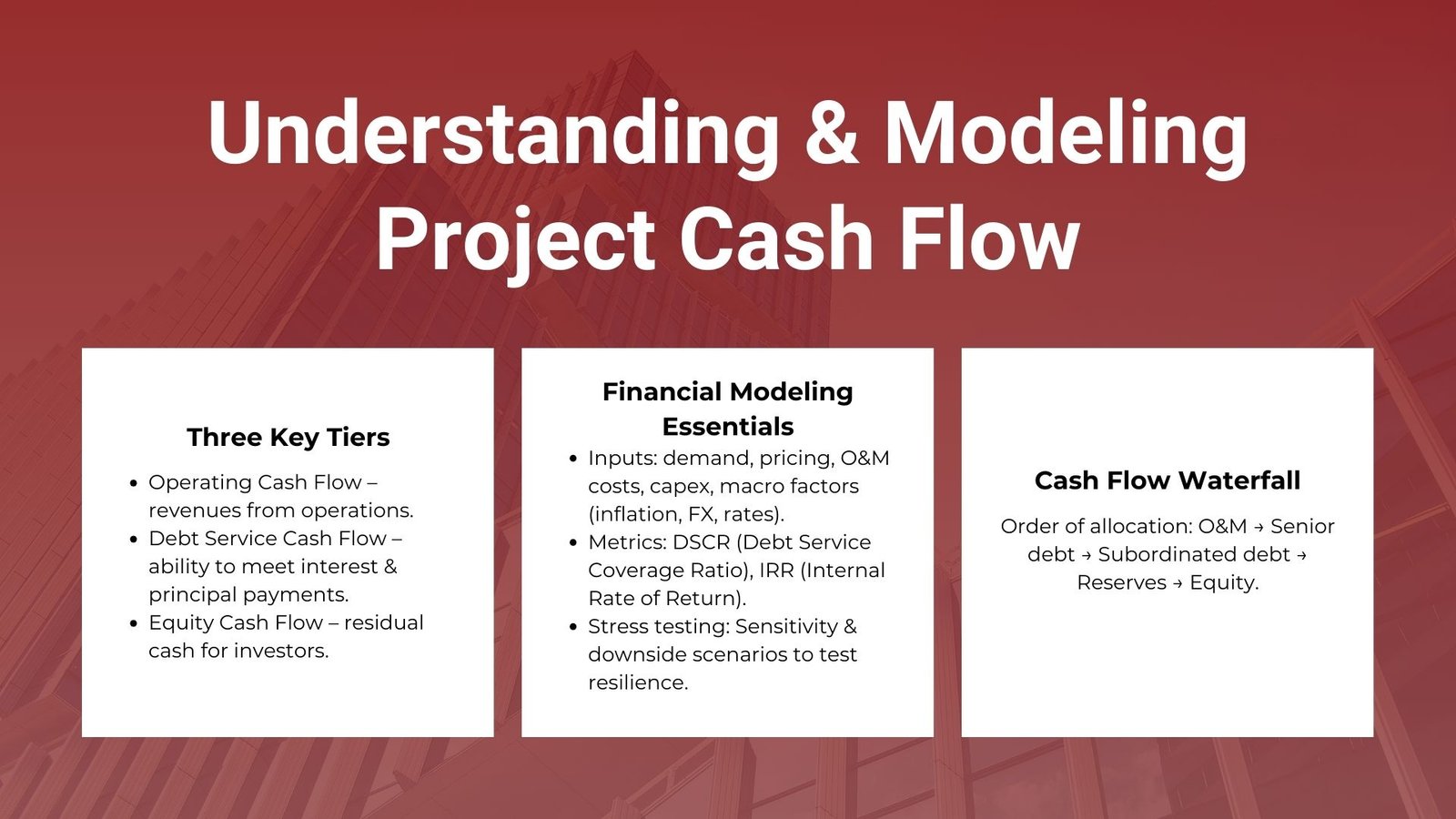

Project finance examines three major tiers of cash flow as follows:

- Operating Cash Flow is the amount of money that the heart of the business is able to produce, i.e. the sales of electricity at an electric power plant, or the collection of tolls on a highway concession.

- Debt Service Cash Flow is interested in knowing whether the project will provide enough cash, which will bear the interest and fund the principal itself to the lenders.

- Equity Cash Flow looks at totals available cash left over to stockholders by the time all costs and bond payments are answered.

The layers are interdependent and alignment is the basis of financial modelling. With a project finance format, equity investors become the lowest to be paid, and this further enhances the need to correctly forecast the cash flow using conservative amounts to the various stakeholders involved in the financial sectors.

Cash Flow Forecasting and Financial Modeling

Probably the most crucial step in project financial forecasting is cash flow forecasting. Cash flow forecasting in financial modeling determines the availability of lenders and investors who will fund the project due to the reliability of the model. Financial models take a simulation scenario of the movement of cash throughout the project during the lifecycle of the project which tends to run many decades.

The construction of these models has to realize a delicate composedness of technical, financial, and operational assumptions. These inputs come in the form of revenue projections that depend on the anticipated demand and prices, operating and maintenance costs that are pegged to the expenses of maintaining and serving the workforce and capital expenditure requirements such as continuous reinvestments in infrastructure. Beside operational specifics, the effects of macroeconomic indicators that include inflation rates, fluctuations in the foreign exchange rates and interest rates also play relevant roles.

The result of the model is usually a list of measures which demonstrate financial vigor of the project. An example is the Debt Service Coverage Ratio (DSCR), which will show whether the project can produce enough cash to pay the debt service. Another equal measure to the Forecasted Cost of Capital Method is the Internal Rate of Return (IRR) which provides equity investors with an avenue to identify whether the project fulfills their required returns or not. Both the metrics are dependent on a good representation of cash flows.

Due diligence financial models should also consider downside scenarios. The sensitivity analysis, where the assumptions are subjected to risks of negative shifts like reduction in revenue or increase in costs are tested, these threats are inevitable and prove that when they occur, the project is resistant to them. With the stress-test of cash flow, the stakeholders understand more about project resilience.

Cash Flow Waterfall and Allocation of Funds

The cash flow waterfall which is an organized sequence of cash allocation of available funds is one of the characteristics of the project finance. This device makes it transparent, predictable and fair to distribute cash to various stakeholders.

At the head of the waterfall, there are operations and maintenance costs, without which the project can not be at work. Then come senior debt obligations, which are ranked highest as the lenders are the major financiers and they demand that they be paid off punctually. Next, and in the case of subordinated debt, is subordinated debt, then reserve accounts to repay future obligations, like a major maintenance period or an undersupply of money to cover debt. Last, any unused cash is shared amongst equity investors.

The waterfall structure is presented to protect the lenders by standing their claims prior to getting returns to equity holders. In the eyes of the equity investor, this creates a powerful incentive to manage operations as efficiently and to maximize revenues, since the investor derives his/her returns as success in the project is achieved longer-term. All the participants also get clarity through the hierarchy, which minimizes the possibility of conflicts regarding the allocation of funds.

Risks Impacting Project Cash Flow

Project finance cash flow analysis is not possible to separate with risk analysis. There are several risks that may interfere with the anticipated cash flow and therefore, it is important to find, assign, and avert upside down risks at the structuring stage.

One of the greatest threats is the revenue risk. In the case of projects that rely on demands made by consumers in the market, any change in the usage, or price can decrease the cash inflows. As an example, a toll road can experience a reduced traffic volume lower than forecast or an independent power producer could be hit by unanticipated changes in electricity demand. To curb this, a large proportion of the projects employ long-term contracts like Power Purchase Agreements (PPAs) which ensures revenue streams are locked.

Another situation that might influence the cash stream is the operating risk. The cost of unforeseen maintenance, supply chain, or operational inefficiency may increase and net cash may decrease. These uncertainties are reduced through insurance and pre-payments guarantees and robust contracts with the operators.

This is also influenced by financial risks. Projects involving revenues in one currency and debt in another are susceptible to fluctuations in the exchange rates. Along with the modification of interest rate, the debt service obligations may change, especially in cases involving the floating-rate loans. To stabilize these variables and ensure there are predictable cash flows, projects tend to hedge with hedging instruments.

Lastly, the cash flow of the project can directly be affected by regulatory and political risks which can take a toll on a project. Revenue estimates may be modified by law changes, changes in tax regimes or changes in government policies and pose costs. Government assurances or political risk insurance are utilized in numerous jurisdictions to satisfy investors about potential unfriendly regulations that can affect an investment.

Conclusion: Cash Flow as the Cornerstone of Project Finance

Cash flow is not merely a financial value in project finance, but the basis upon which the entire scheme of financing is based. Cash flow is used by lenders to recover their money, equity investors require it as the source of returns and sponsors require it as the foundation to justify the feasibility of the project. The project financing considerations such as estimation and modelling, risk management and capital deployment are all founded on the concepts of not only understanding, but also protecting and even maximising the cash flow.

The principle of cash flow analysis are very important to superficial knowledge of any person entering this project financing world. It requires not just technical skills in modeling, but a sense of forces operating in the operational, financial and regulatory realm that govern the flow of funds. Once cash flow becomes the prime area of concern, the projects designed by the stakeholders will be not only bankable but able to endure the vagaries of uncertainty.

In addition to the numbers, cash flow analysis of project finance also indicates the timing of inflows and outflows, which is equally important as their magnitude. Slows in revenue collection or spikes in operating expenses can cause a considerable change in the risk profile of a project. This is the reason why sensitivity analysis and stress testing are usually conducted on forecasted cash flows to predict potential negative outcomes. The methods give insight into how a project can still be viable in case some assumptions in the project, including demand forecasts or interest rates, are not true.

Cash flow is not merely a financial value in project finance, but the basis upon which the entire scheme of financing is based. Cash flow is used by lenders to recover their money, equity investors require it as the source of returns and sponsors require it as the foundation to justify the feasibility of the project. The project financing considerations such as estimation and modelling, risk management and capital deployment are all founded on the concepts of not only understanding, but also protecting and even maximising the cash flow.

The principle of cash flow analysis are very important to superficial knowledge of any person entering this project financing world. It requires not just technical skills in modeling, but a sense of forces operating in the operational, financial and regulatory realm that govern the flow of funds. Once cash flow becomes the prime area of concern, the projects designed by the stakeholders will be not only bankable but able to endure the vagaries of uncertainty.

In addition to the numbers, cash flow analysis of project finance also indicates the timing of inflows and outflows, which is equally important as their magnitude. Slows in revenue collection or spikes in operating expenses can cause a considerable change in the risk profile of a project. This is the reason why sensitivity analysis and stress testing are usually conducted on forecasted cash flows to predict potential negative outcomes. The methods give insight into how a project can still be viable in case some assumptions in the project, including demand forecasts or interest rates, are not true.