How to Perform Sensitivity and Scenario Analysis in Project Finance Modeling

How to Perform Sensitivity and Scenario Analysis in Project Finance Modeling

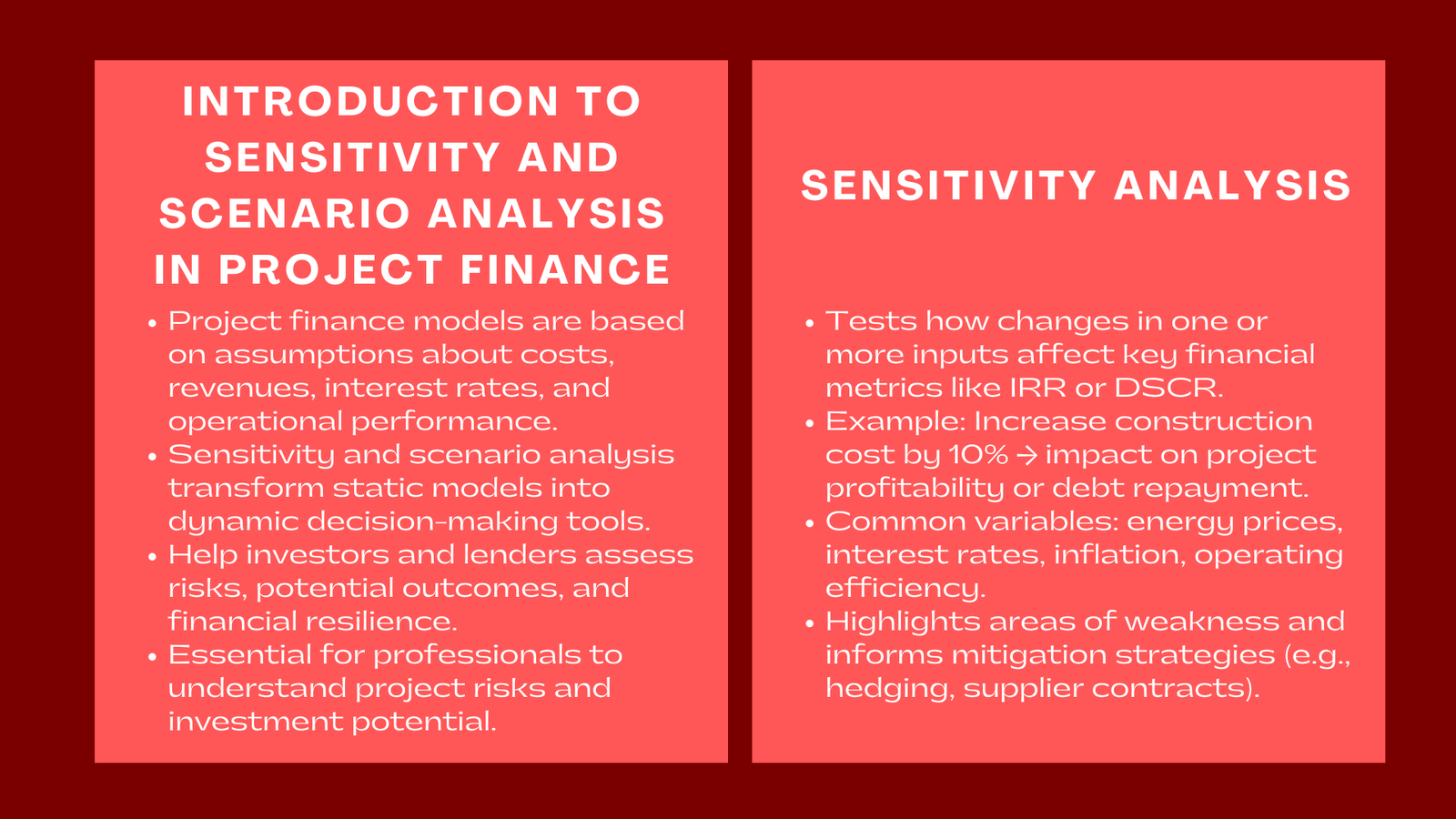

Project finance models are constructed on assumptions- concerning both costs and revenues, interest rates, and performance of the operations. But in the world, things hardly work out as they are supposed to. That is where sensitivity and scenario analysis is in place. It is through these analyses, the financial professionals are able to experiment on how the variation in the key assumptions would impact the project results to facilitate decision making by investors and lenders based on risk awareness.

Sensitivity and scenario analysis make a static financial model dynamic as a decision-making tool. Participating in project finance modeling Singapore can demonstrate the extent to which individual factors have the most significant influence on the viability of a project and indicate how the project will be resistant to uncertainties. Anyone in the project finance profession will find it essential to master these analyses in order to understand project risks and the potential of a project.

This paper will discuss the principles of sensitivity analysis and scenario analysis, their application in project finance and ways they can be put to good use in modeling practice.

Understanding Sensitivity Analysis in Project Finance

The sensitivity analysis tests how changes in one or more inputs influence some important financial priorities such as the internal rate of return (IRR) or the debt service coverage ratio (DSCR). That is, it calculates the sensitivity of the results of the model to individual changes.

As an illustration, an analyst could want to test the impact of increase in construction cost by 10% on the gains on the project or the reduction in revenue to repay debt. This is because sensitivity analysis assists a researcher in determining how sensitive and hence risky the assumptions are by varying each variable in the research.

The sensitivity tests that are common in project finance are the changes in the energy prices, the interest rates, inflation, or the operating efficiency. The findings are usually presented in a table or a chart that illustrates the effects on the financial indicators with respect to changing the assumptions. A project which can withstand the negative changes and still be financially viable is said to be stronger and enticing to the investors. Professionals attending project finance modeling training in Singapore will learn how to conduct these sensitivity analyses effectively to assess project risks and resilience.

The sensitivity analysis does not only indicate the areas of weakness but also informs decision making. In the event that the model indicates that project returns are sensitive to the price of fuel, such as long-term contract suppliers of fuel or hedging may be requested by the sponsors to control the risk.

Scenario Analysis: Testing Real-World Conditions

Whereas the sensitivity analysis examines one variable at a time, scenario analysis compares the overall impact of a number of changes. It sets up specific scenarios, which resemble the possibilities of the real world, that is, a delay in construction, cost and demand failures.

The scenarios are individual logical stories: a base case (what is likely to happen), a downside case (what can go wrong), and an upside case (what can go right). In every scenario, analysts determine the overall change of all the major assumptions in order to observe the performance of the project under the different conditions.

Scenario analysis also offers a more complete picture of the risk since it has been designed to take into account the interdependencies of variables. In such an instance, as an illustration, the reduction of revenues can be accompanied by the increase of maintenance expenses and the constrained conditions of financing in the downside scenario. Simulation of such relationships assists the interested parties to know what possible consequences might happen and make a more effective strategic decision. Professionals seeking to understand what is project finance and how does it work will find scenario analysis particularly valuable in assessing project risks and making informed financing decisions.

Scenario analysis can be one of the requirements in financing negotiations. It is utilized by lenders both in determining that the project is feasible to continue its debt service obligations in unfavorable circumstances, and by sponsors as an indication of resilience to seek investment.

Applying Sensitivity and Scenario Analysis Effectively

Effective sensitivity and scenario analysis involve accuracy with a technical approach and being a good thinker. This is initiated by determining the major drivers of project value that are the variables that have a great impact on cash flows, costs, and returns. The analysts then establish realistic ranges or other assumptions of these variables and make sure the tests capture the reality in the market or the operations of the operation.

Not only numerical but also strategic interpretation should be made on the results of these analyses. The base case may indicate that a project would seem to be financially healthy but extremely sensitive when it comes to risk borne by the adversity of factors. The financial structuring decisions which are also aided are sensitivity and scenario analysis, which include issues like how much leverage to put on and the level of reserve requirement.

Besides, it is essential to convey results in the best way possible. Tornado charts or scenario matrices are some of the visualizations that are used to simplify the findings of analysts and present the complicated data in a way easily accessible to decision-makers. This openness creates trust in the stake holders including investment committees as well as lenders.

Conclusion

The sensitivity analysis and scenario analysis are the key tools in changing the uncertainty into something actionable. They enable the project finance professionals to foresee the challenges, capital structure optimization, and resilience to project designs. Assuming that a particular series of assumptions interacts and sorting out their impact helps analysts to cease reactively predicting and instead proactively managing the risk.

This is ultimately important in a career where financial commitments span over decades and therefore, end user flexibility and planning is indispensable. The performance of a project with adversity as opposed to its base-case performance tends to make it successful. Sensitivity and scenario analysis give the insights allowing the measurement and enhancement of that resilience.