Project Finance Fundamentals for Project Managers

Project Finance Fundamentals for Project Managers

Introduction to Project Finance Fundamentals for Project Managers

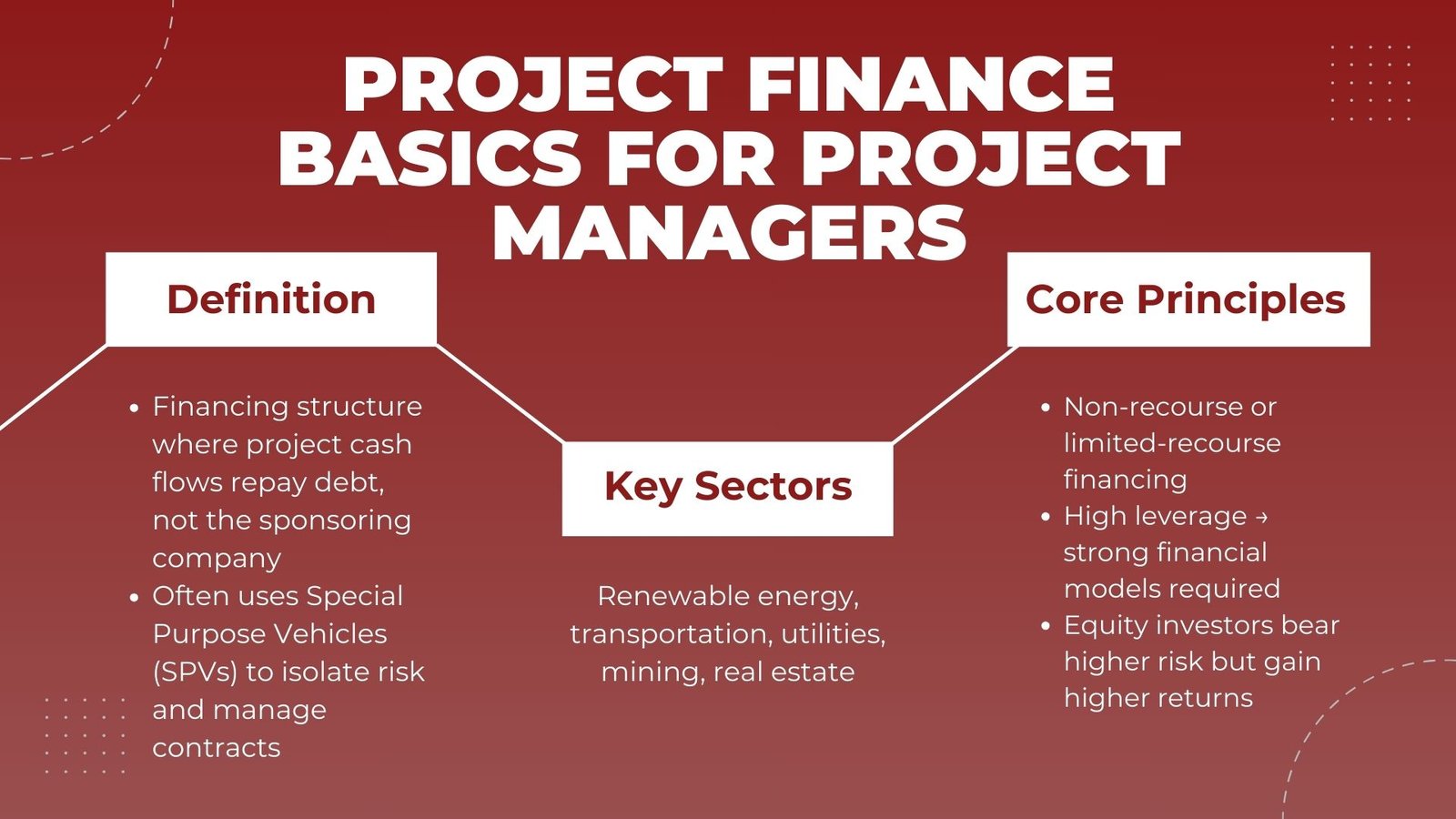

Project finances is a type of financing that involves projects of large infrastructure and manufacturing which aims at funding the project cash flows of large projects as the means of repayments. In contrast to corporate finance, whose key driver is the credit rating of the sponsoring firm, the structure of project finance involves making the project a stand-alone project with its own legal status, which is sometimes a separate legal identity. This strategy separates the financial risk of the project with the sponsors and opens the way to make large investments without a direct load on the balance sheet of a company.

Project finance is no longer a luxury to the project managers. With the increase in complexity of projects, especially in some sectors, such as renewable energy, transportation, utilities, mining and big-scale real estate development, project managers are supposed to be involved in the understanding of the financial reasoning behind the actions. The principles of project finance will affect schedules, resources, sourcing protocols and risk treatment. This is because, through knowing the basics, the project managers are able to structure the operational implementation in accordance with the expectations of investors and lenders as well as other vital stakeholders in the industry.

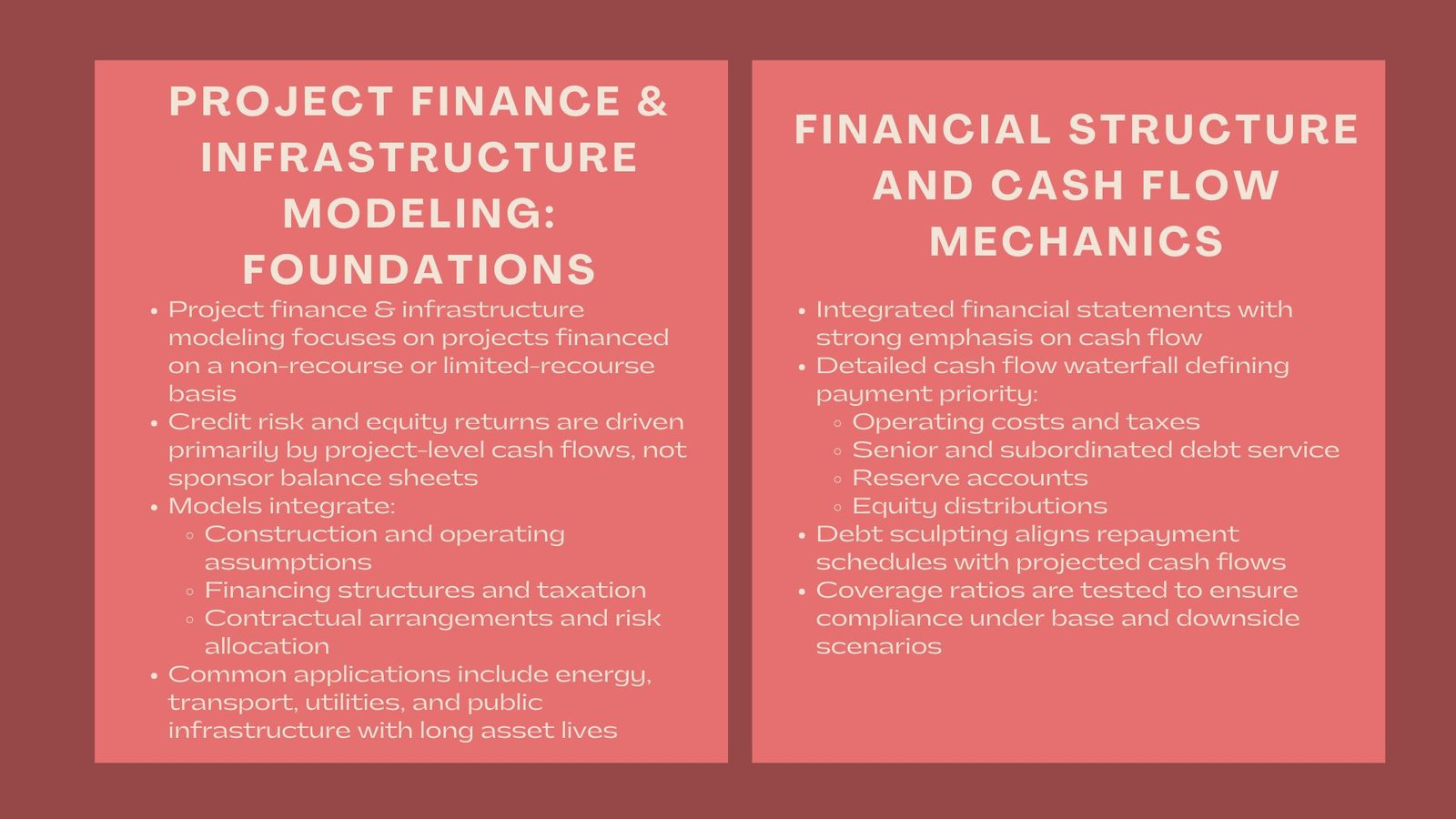

Core Principles and Structures of Project Finance

The main concept of project finance is the concept of non recourse or limited recourse financing. It implies that the lenders and the investors do not use the assets of the sponsoring company to repay the loans, but use the revenues of the given project. In case the project does not produce the promised cash flows the sponsors normally do not have an obligation to pay up the shortage above the down payments of equity they have committed. The financial framework involves active prior planning since all aspects of the project related to revenue generating factors, expenditure and control should be well articulated and binding.

The projects are typically established in the form of special purpose vehicles (SPVs), to act as the legal entity that would run the assets, liabilities and contractual obligations. Such separation helps lenders have a clear picture of the credit and security because they are in a position to directly follow the performance of the project without being embroiled in the overall financial operations of the company sponsoring the project. SPVs also facilitate clarity when it comes to the assignment of risks between various parties including sponsors, contractors, suppliers and off-takers.

The capitalization structure is normally a combination of mortgage and equity and debt can form a significant part of the capital stack. The heavy leverage on project finance projects implies that the project financial model should have greatest strength because the lenders would only invest in the project should the pro-forma cash flow be well rested with ease to meet the debt servicing obligations. Investors with equity, however, bear greater risk but can reap more in case of a good performance of the project. Such a balance of interests establishes a framework within which the project managers have to act efficiently in their operations and economically in financial terms.

Role of Project Managers in the Project Finance Process

Project managers have an unusual place in project finance ecosystem. They do not have direct roles to play in fundraising but their activities and judgments play a major role in the continuity of the project financially. Since the initiation of the initial project inception, project managers are considered to be involved in feasibility analysis, which plays a vital role in project schedule estimation, construction processes, and materials, and operating limits. These are used to provide inputs to the financial models through which viability of a project is determined.

Project managers are especially crucial during the detection and contracting stage where they negotiate and also outline contracts with contractors suppliers, and other service providers. The conditions of such contracts are long lasting in financial terms, especially where matters to be handled concern cost escalation clauses, delay penalties, and performance assurances. The project managers should make sure that the contracts should correlate with the assumptions made in the financial plan because any overruns in costs and delays will reduce the likelihood that the project will be able to satisfy its debt service.

Upon commencement of the work, the project manager is the key player in the success of a project implementation as planned. Project finance depends on on-time completion since down-time experiences could lead to cost overruns, financing interest penalty during the construction period and revenue delays. Such delays can cause a financial leakage in addition to violating financial covenants which may in turn cause the whole structure of finance to collapse. Project managers protect the financial health of the project by being highly controlling over the schedules, budgets and quality standards. For professionals aiming to strengthen these capabilities, pursuing Finance manager career development courses Singapore can provide essential skills to connect project execution with long-term financial sustainability.

Risk Management in Project Finance Projects

Risk distribution to more than one party is one of the characteristics of project finance. The risk is commonly broken down into risk related to construction, operational risk, market risk, political risk and environmental risk. All these are assigned to the party that is expected to manage or mitigate them best. As an instance, construction as a risk may be assumed by the engineering, procurement, and construction (EPC) contractor whereas market risk may be absorbed using long-term off-take contracts with financially sound consumers.

The risk allocation matrix is a concept identified in the financing agreements, and the project managers should be well acquainted with it. This information enables them to be proactive in risk management of the project being undertaken and also to check on whether they meet the contractual demands. They should track key performance indicators that may cause the insurance or fines so they should ensure that they work closely with legal, financial and advisory experts to clarify on the dispute that may arise or unscheduled situations.

In recent years, there has been an increasing level of environmental and social risk that has become a bigger factor and especially when a project needs funding through development banks or institutions that have very strict environmental, social and governance (ESG) policies. Project managers would find themselves in the role of having to carry out environmental impact assessments and to have mitigation measures put in place during the course of the project. Any non-compliance with these requirements may lead to denial of funding or withdrawal of such funding making the project extremely difficult to manage. Attending a Hands-on risk management workshop Singapore can provide project managers with the practical skills and insights needed to handle these complex risk scenarios effectively.

Financial Models and Their Impact on Project Execution

To an extent it can be said that the financial model in project finance is the core of the decision process. It shows an in-depth depiction of revenues, costs, debt service and returns on equity of the project that an investor is operating. The model will be used by lenders, investors and the sponsors to determine whether the project is financially viable and provide them with the optimal financing format. Even though project managers might not be required in the construction of the model, they need to understand the major drivers in the model.

The model will generally have assumptions regarding costs of the construction, costs of operations, inflation rates, interest rates, tax repercussions and revenue generators. Any of such assumptions changed during execution may cause rippling effects on the financial health of the project. As an illustration, the debt service coverage ratio (DSCR) might not be sufficient to the target level due to higher construction expenses in comparison with the projection, hence, the introduction of the increased amount of equity by lenders, or default clauses, respectively.

Financial outcomes can be influenced by project managers who will make sure that their actual performance reflects or surpasses anticipated performance levels in the model. This includes intense cost management, effective acquisition policies, persuasiveness in problem-solving, and keeping an open line of communication with the stakeholders. Project managers assist in aligning the parameters of the financial model to the execution of operations so as to make the project bankable in its life cycle.

The Strategic Value of Financial Awareness for Project Managers

Although the technical and operational side of the project management is also essential, financial awareness gives it a strategic advantage that may help an extraordinary project manager separate and rise above the rest. Knowledge of the mechanics of project finance can enable the project manager to understand how investors and lenders will approach their project, how to better communicate with the financial stakeholders, and more importantly how to make operational decisions that will advance the financial viability of the project in the long run.

An example would be that in a situation where there are delays that can virtually happen to any project, a financially conscious project manager can evaluate effects beyond its operational implications by examining the financial implication of the delays e.g. the cost of higher interest during construction or fines in case delivery is delayed. Such a comprehensive approach makes a more informed decision which is realistic in technical feasibility and financially sound.

Further, financial literacy increases the credibility of a project manager among the sponsors and financing parties. It portrays that they are aware of the wider picture within which the project is implemented and that they are dependable in protecting the interest of all. In any industry characterized by intense competition and where matters of trust and reliability are vital, this credibility may lead to bigger and more complex projects to be commissioned and more spaces to rise further in career.

Conclusion

Project finance is an effective method of financing large and mega projects in infrastructure and industry industries, which are supported by their own complexities and issues. To project managers, getting the basics of project finance right is imperative towards the successful delivery of the project. Ranging in knowing the modes of financing and distribution of risk to bridging operational implementation with the financial model, project managers must find their way in a universe where technical skills and financial understanding are two sides to one coin.

Project managers can improve their capacity to execute projects on schedule and at the aligned budget by building an excellent mastery of project finance, in addition to increasing financial robustness of the projects they manage. This act of a strategic combination of operating and financial skills will be what differentiates the best project managers in an age when capital is tight, and competition is intense.